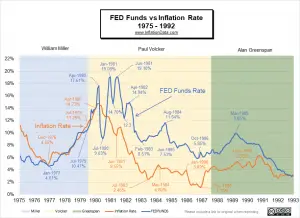

Federal Reserve Chairman Jerome Powell is sounding more and more like former FED Chairman Paul Volcker, who served as the chairman of the Federal Reserve from August 1979 to August 1987. Volcker is best known for his historic fight to vanquish inflation in the early 1980s. Before Volcker took over as the head of the FED, Inflation had risen from a low of 4.65% in December 1976 to 11.26% in July 1979. During that time, FED chairman William Miller raised the FED funds rate from 4.61% to 10.47% in July of 1979. During Miller's time, the FED funds rate pretty much tracked the inflation rate, with a couple of month lag. Prior to Volcker, the prevailing monetary theory was that the FED … [Read more...]

Surprise, Surprise, The FED Raises Rates by .75%

At its June 15th meeting, the FED announced that it will be raising rates by ¾%. Up until last week, this would have been a big shock to the market. But despite the imposed FED silent period leading up to their Wednesday meeting "somehow" journalists from all the major financial publications published remarkably similar articles predicting a 0.75% increase in the FED funds rate. Prior to this leaked guidance, the consensus was that the FED would increase rates by ½% but last week's higher-than-expected inflation report threw a wrench into the works. Everyone is making a big deal out of the fact that this is the first raise of that magnitude since 1994. And that it will double the FED … [Read more...]

FED Issues September 2021 Statement

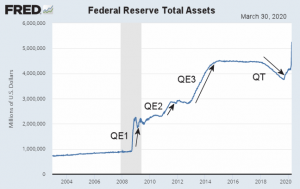

On September 22, 2021, the Federal Reserve reported its current policy position. Currently, the FED is creating liquidity (i.e., printing money) through its Quantitative Easing (QE) program at the rate of $120 billion per month. The market has been fearing that the FED would begin tapering, i.e., cutting back on its liquidity creation. Rumor was that the FED would start reducing their QE by $10-$15 billion per month due to inflation concerns. The last time the FED embarked on a tapering plan back in 2017, they used a two-prong approach of raising the FED Funds rate and reducing the monthly printing by $10 Billion every three months (i.e., roughly $3.3 billion per month). The result of … [Read more...]

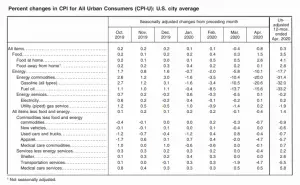

April Inflation Near Zero

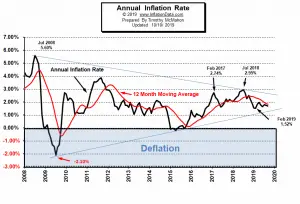

The U.S. Bureau of Labor Statistics (BLS) released its April Inflation report on May 12th, 2020, for the 12 months through the end of April 2020. Annual Inflation Down Sharply... Again! Inflation fell sharply to 0.33% in April from 1.54% in March, 2.33% in February and 2.49% in January. CPI Index in 258.115 in March fell to 256.389 in April. Monthly Inflation for April was -0.67%, March was -0.22%, February was 0.27% typically January through May are highly inflationary so this is VERY unusual. The FED has massively cranked up the "printing presses" using "Quantitative Easing" in an effort to stimulate the economy in the wake of COVID-19. FED Funds Rate down to near … [Read more...]

What are Central Banks?

History of Central Banking Like everyone, kings like to spend money, whether it is to wage war or to build palaces, but they often didn't have all the money they "needed", so they had to borrow it. To facilitate this large scale borrowing, they created a Central Bank to handle that function. In 1790, "Federalist" Alexander Hamilton advocated for a Central Bank in the United States. Democratic-Republicans, Thomas Jefferson and James Madison believed that the Constitution did not grant the Federal government the authority to create a bank, based on the 10th amendment i.e. that all powers not endowed to Congress are retained by the States (or the people). But Hamilton argued that although … [Read more...]

Will the $2 Trillion Covid-19 Stimulus Cause Inflation?

The current round of massive Corona Virus easing began Monday March 16th, 2020, with the FED buying $40 billion in Treasuries and then buying another $50 billion in Treasuries on Tuesday. By Thursday morning, it had upped the plan to $75 billion PER DAY and added $10 billion in mortgage securities. By Friday morning, the Fed had decided to buy $107 billion worth of Treasuries and mortgage-backed securities. In its first week, the FED purchased $317 billion worth of assets, which is slightly faster than the Fed balance sheet grew at the height of the 2008-2009 financial crisis. Initially, the Federal Reserve estimated purchases of $500 billion but FED chief Jerome Powell said the initial … [Read more...]

Does the FED Control Mortgage Rates?

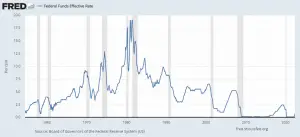

For new home buyers, anything that increases the cost of the purchase (like rising mortgage interest rates) can negatively impact your ability to be able to afford your home. That is why everyone is concerned when the Federal Reserve (i.e. the FED) raises interest rates. The following chart shows how the Fed Funds Rate has performed from January 2015 through July 2019. The FED lowered the FED Funds rate to near zero in response to the market crash in 2008-2009. It kept it there until January 2016 when it began gradually raising rates. However, at their July end meeting, they decided to lower interest rates, reducing the federal funds rate target by 25 basis points, to a range of 2% to 2.25%. … [Read more...]

How the FED Controls the Money Supply

When the government spends more money than it receives in taxes it has a “deficit” situation. In order to deal with this deficit, it engages in some fancy bookkeeping. The government is made up of a variety of agencies, so the other agencies request money from the Treasury Department. If it doesn’t have enough money the Treasury Department issues an IOU (called a Government Bond). The Treasury gives the Bond to the Federal Reserve (which is theoretically not part of the government). The FED writes a check to the Treasury for the bond. It then breaks up the bond into smaller bonds and sells them to individual banks. The banks then sell them to individual investors and groups of … [Read more...]

September Inflation Virtually Unchanged

The U.S. Bureau of Labor Statistics (BLS) released its September Inflation report on October 10th, 2019, for the 12 months through the end of September 2019. Annual Inflation is Down Very Slightly Annual inflation in September was 1.71% virtually unchanged from August's 1.75%. Inflation has been in a narrow range throughout 2019. 1.79% in May, 1.81% in July, 1.65% in June, peaking at 2.00% in April. Inflation peaked at 2.95% in July 2018. The CPI-U index in September was 256.759 up from 256.558 in August. Monthly Inflation for September was 0.08%, August was -0.01%, July was 0.17%, June was virtually zero at 0.02%, May was 0.21%, April was 0.53%, March was 0.56%. … [Read more...]

Gold Price and Its Relationship with Inflation

Inflation is the increase in the price you pay for goods and services, which affects the purchasing power of your money. This is more accurately called "price inflation" as compared to "monetary inflation". As inflation increases, the value of your money decreases. There are many different causes of inflation, but the most important cause is an increase in a country’s money supply. When the government decides to print money or implement a quantitative easing program, the money supply is increased (i.e. monetary inflation), thus affecting the general level of prices. As we can see in the following chart, the Federal Reserve engaged in three phases of quantitative easing i.e. QE1, QE2, … [Read more...]