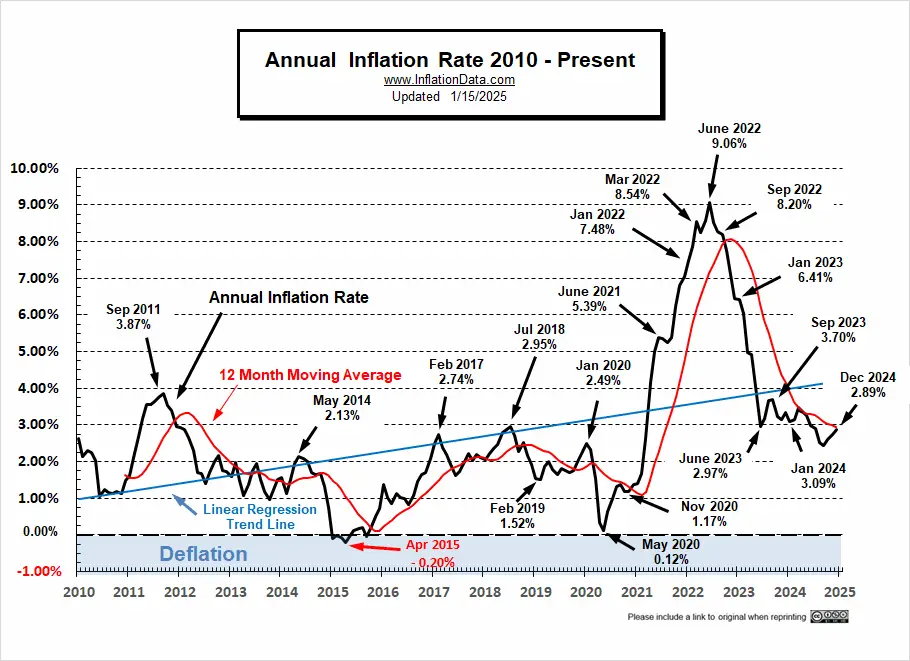

The U.S. Bureau of Labor Statistics released its December 2024 Inflation report on Wednesday January 15th 2025, showing Annual Inflation was up from 2.7% in November to 2.9% in December.

This looks like a 0.2% increase. (But since we calculate it to two digits, it was 2.75% in November and 2.89% in December, which means the actual increase was 0.14%.)

On a non-seasonally adjusted basis, monthly inflation was 0.04% in December but annual inflation rose because December 2023 was a negative -0.10%.

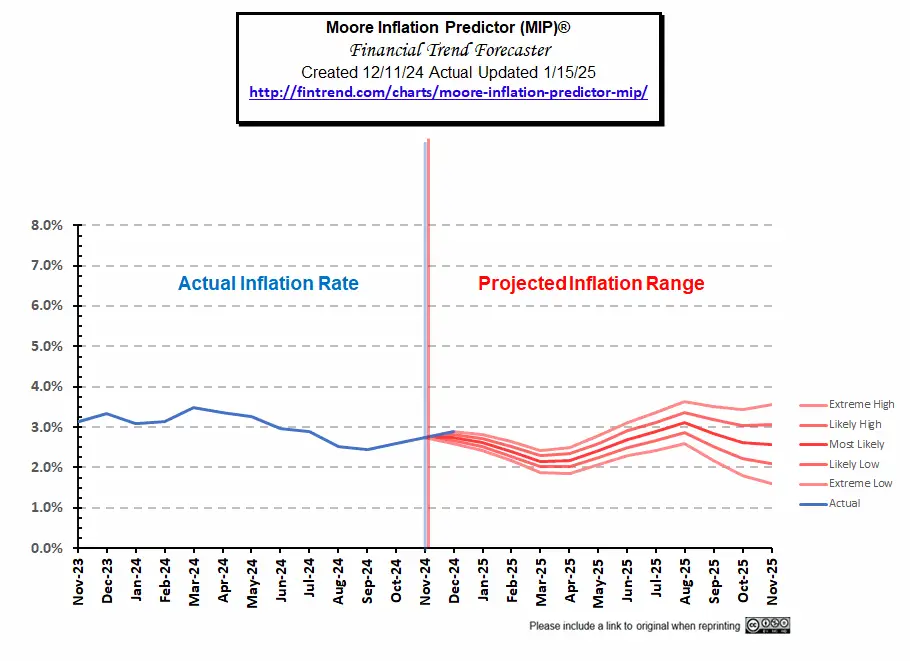

Inflation Prediction:

As you can see from our MIP projection from last month, December’s Annual inflation at 2.89% is just a hair below our predicted Extreme High of 2.90%.

See this month’s MIP prediction

Annual Inflation… 2.89% in December 2024

- Annual Inflation rose from 2.75% to 2.89%

- CPI Index rose from 315.493 to 315.605

- Monthly Inflation for December was 0.04%

- Next release February 12th, 2025

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sep | Oct | Nov | Dec | |

| 2022 | 7.48% | 7.87% | 8.54% | 8.26% | 8.58% | 9.06% | 8.52% | 8.26% | 8.20% | 7.75% | 7.11% | 6.45% |

| 2023 | 6.41% | 6.04% | 4.98% | 4.93% | 4.05% | 2.97% | 3.18% | 3.67% | 3.70% | 3.24% | 3.14% | 3.35% |

| 2024 | 3.09% | 3.15% | 3.48% | 3.36% | 3.27% | 2.97% | 2.89% | 2.53% | 2.44% | 2.60% | 2.75% | 2.89% |

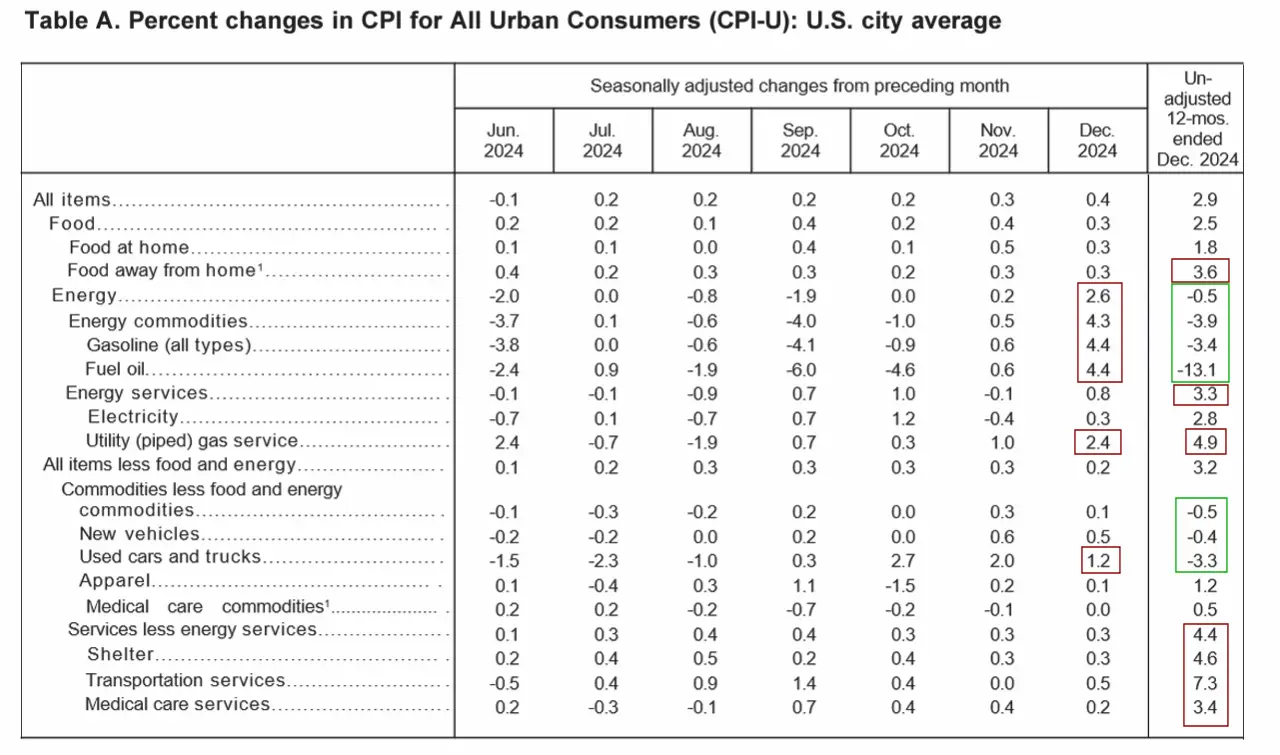

BLS Commentary:

The BLS Commissioner reported:

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent on a seasonally adjusted basis in December, after rising 0.3percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.

The index for energy rose 2.6 percent in December, accounting for over forty percent of the monthly all items increase. The gasoline index increased 4.4 percent over the month. The index for food also increased in December, rising 0.3 percent as both the index for food at home and the index for food away from home increased 0.3 percent each.

The index for all items less food and energy rose 0.2 percent in December, after increasing 0.3 percent in each of the previous 4 months. Indexes that increased in December include shelter, airline fares, used cars and trucks, new vehicles, motor vehicle insurance, and medical care. The indexes for personal care, communication, and alcoholic beverages were among the few major indexes that decreased over the month.

The all items index rose 2.9 percent for the 12 months ending December, after rising 2.7 percent over the 12 months ending November. The all items less food and energy index rose 3.2 percent over the last 12 months. The energy index decreased 0.5 percent for the 12 months ending December. The food index increased 2.5 percent over the last year.”

Individual Components:

Looking at table A below we can see that on an annual basis most of energy is still down but on a monthly basis it is up fairly significantly.

The biggest gainers on an annual basis were Services like Food away from home, Energy Services, Shelter, Transportation, and Medical Care Services.

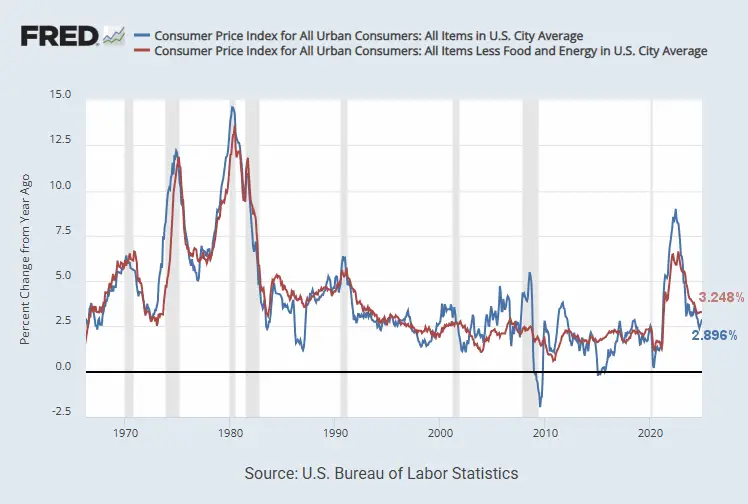

Although these “Seasonally Adjusted” numbers are slightly different than those typically presented by the BLS, the following chart from the Federal Reserve shows the gap between inflation with and without Food and Energy. So, we can see how much food and energy are contributing toward overall inflation.

Although these “Seasonally Adjusted” numbers are slightly different than those typically presented by the BLS, the following chart from the Federal Reserve shows the gap between inflation with and without Food and Energy. So, we can see how much food and energy are contributing toward overall inflation.

Over the last few months, energy prices have actually been pulling overall inflation down (i.e. blue line below the red line). Without food and energy, inflation would be 3.248%. But due to the downward pressure of Energy total inflation according to the FED is 2.896%.

Source: St. Louis FED

FED Monetary Policy

December 2024 Summary:

- FED Assets are Falling

- M2 Money supply is rising

- FED Funds Rates Fell to 4.48%

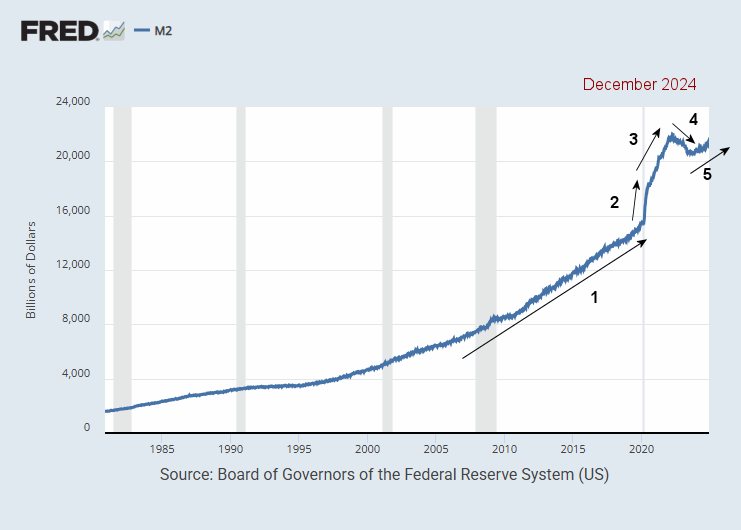

M2 Money Supply

Looking at the M2 money supply we get a slightly different picture. Here we see a steady growth of the money supply from 2009 through 2020 (#1), then a sharp spike as we saw with FED assets (#2), and then a slightly less sharp incline (#3) (but longer duration for QE 5) taking M2 to 22 Trillion dollars in 2022. From 2022 to 2023 (#4) we see the decline we would expect due to the reduction of FED assets…

More info about FED Monetary Policy and Inflation

Inflation Chart

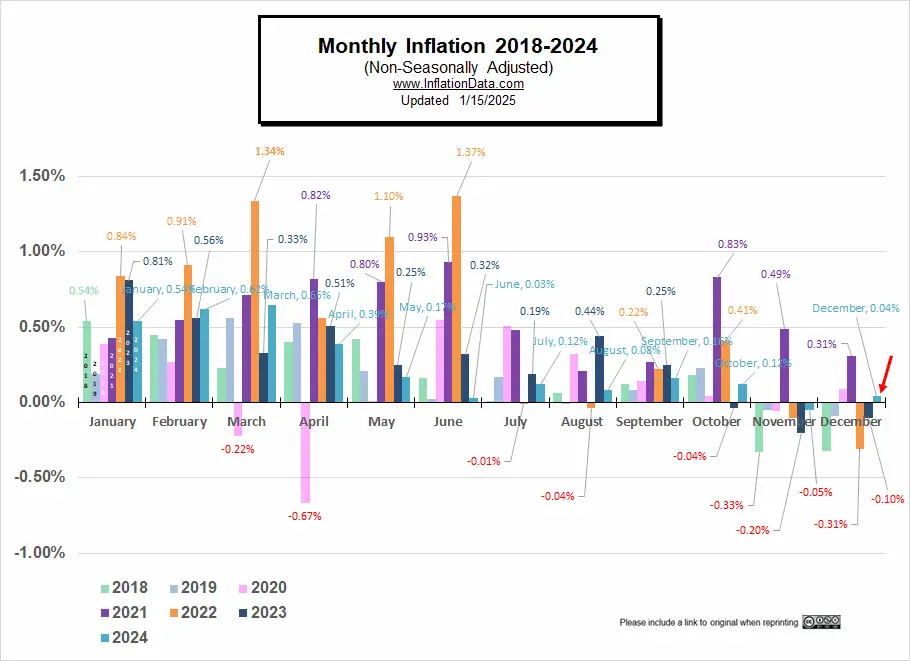

Monthly Inflation Compared to Previous Years:

The monthly inflation rate for December 2024 was 0.04%.

In the chart below, we can see how the UNADJUSTED monthly inflation compares between 2018 (light green), 2019 (light blue), 2020 (pink), 2021 (purple), 2022 (orange), 2023 (dark), 2024 (teal). Interestingly, January 2018 and January 2024 are identical. In 2024 monthly inflation started a bit higher than average at 0.54%, 0.62%, 0.65%, but April, May, and June 2024 came in significantly lower than 2023, which brought annual inflation down. November increased once again as 2023’s -0.20% was replaced by -0.05%. And then in December 0.04% replaced -0.10% once again causing Annual Inflation to rise.

Not Seasonally Adjusted Monthly Inflation Rates

Note: January 2022’s 0.84% was the highest January since 1990. June was the highest June since 1941 (although the first quarter of 1980 had some higher rates). Typically, the first quarter has the highest monthly inflation and the 4th quarter is the lowest (even negative).

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| 2016 | 0.17% | 0.08% | 0.43% | 0.47% | 0.41% | 0.33% | (0.16%) | 0.09% | 0.24% | 0.12% | (0.16%) | 0.03% |

| 2017 | 0.58% | 0.31% | 0.08% | 0.30% | 0.09% | 0.09% | (0.07%) | 0.30% | 0.53% | (0.06%) | 0.002% | (0.06%) |

| 2018 | 0.54% | 0.45% | 0.23% | 0.40% | 0.42% | 0.16% | 0.01% | 0.06% | 0.12% | 0.18% | (0.33%) | (0.32%) |

| 2019 | 0.19% | 0.42% | 0.56% | 0.53% | 0.21% | 0.02% | 0.17% | (0.01%) | 0.08% | 0.23% | (0.05%) | (0.09%) |

| 2020 | 0.39% | 0.27% | (0.22%) | (0.67%) | 0.002% | 0.55% | 0.51% | 0.32% | 0.14% | 0.04% | (0.06%) | 0.09% |

| 2021 | 0.43% | 0.55% | 0.71% | 0.82% | 0.80% | 0.93% | 0.48% | 0.21% | 0.27% | 0.83% | 0.49% | 0.31% |

| 2022 | 0.84% | 0.91% | 1.34% | 0.56% | 1.10% | 1.37% | (0.01%) | (0.04%) | 0.22% | 0.41% | (0.10%) | (0.34%) |

| 2023 | 0.80% | 0.56% | 0.33% | 0.51% | 0.25% | 0.32% | 0.19% | 0.44% | 0.25% | (0.04%) | (0.20%) | (0.10%) |

| 2024 | 0.54% | 0.62% | 0.65% | 0.39% | 0.17% | 0.03% | 0.12% | 0.08% | 0.16% | 0.12% | (0.05%) | 0.04% |

See: Monthly Inflation Rate for more information and a complete table of Unadjusted Monthly Rates.

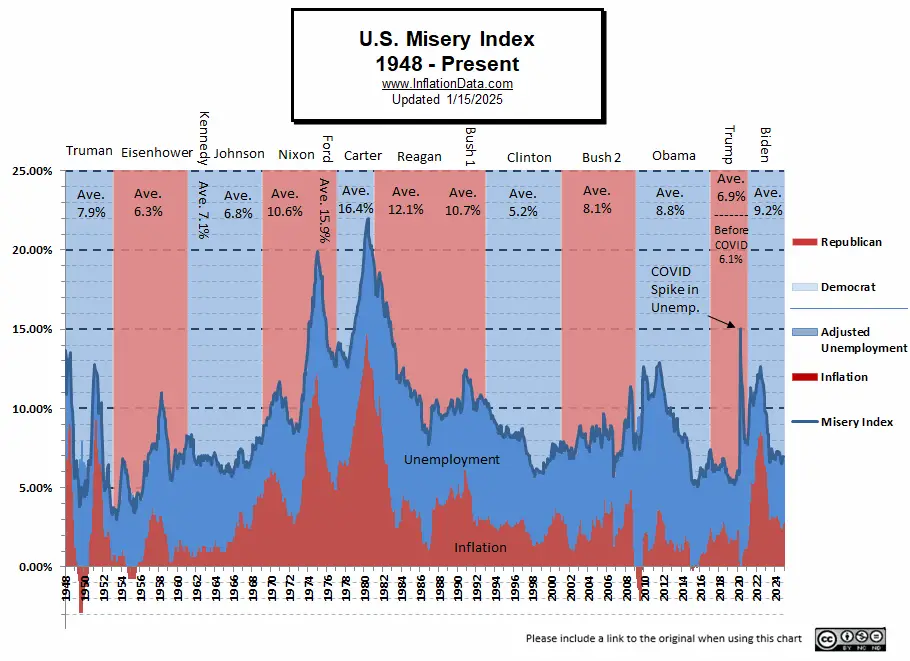

Misery Index

Current Misery Index:

Unemployment 4.1% + Inflation 2.89% = 6.99%

This month inflation is up but unemployment is down, so the misery index is up very slightly. For the first half of 2024 the Misery index hovered around 7% before falling to the high 6s. It finished the year at just below 7%.

[Read More on the Misery Index…]

[Read More on the Misery Index…]

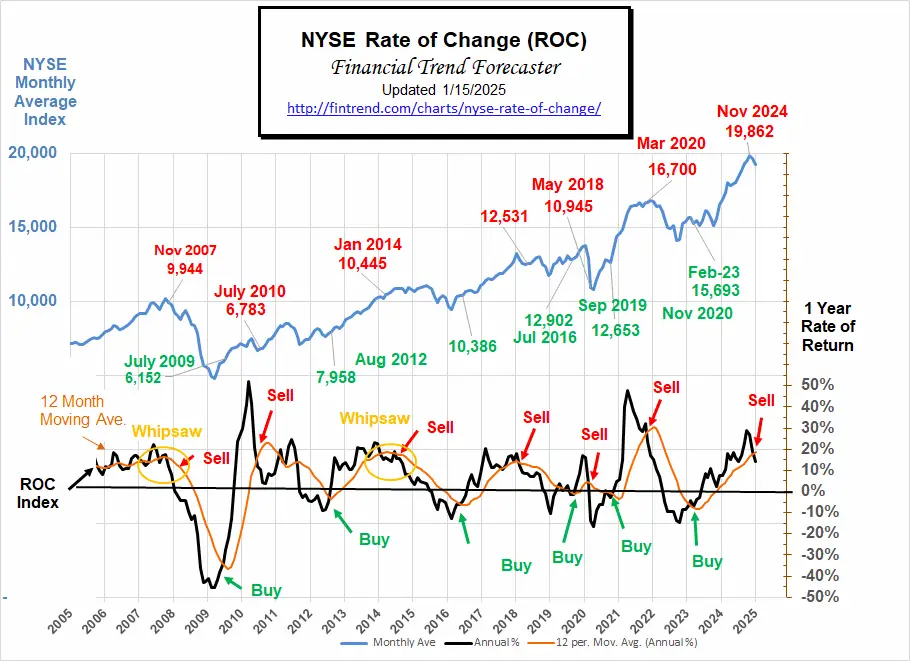

Rate of Change (ROC) Charts

The NYSE ROC issued a Sell Signal this month. But on the plus side AI/Robotics Company Symbotic (SYM) was Up 18% in a single day in part due to its relationship with Walmart. And in a recent interview, Elon Musk was extremely bullish on the medium term (i.e. 3-5 years).

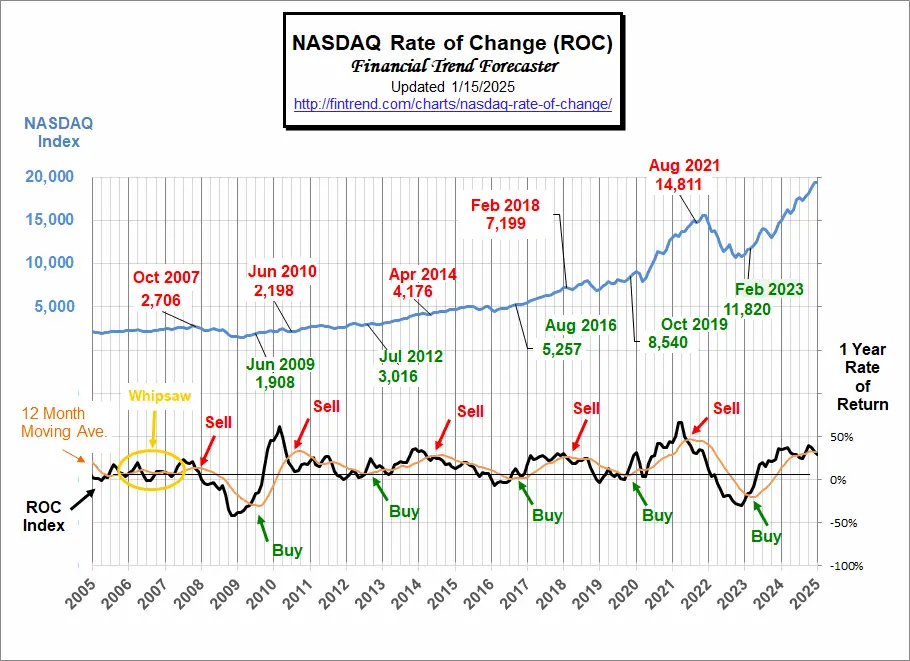

The NASDAQ ROC continues to flirt with its moving average, but now it is in Sell territory again. With both of the Index ROCs in Sell territory, we should be cautious.

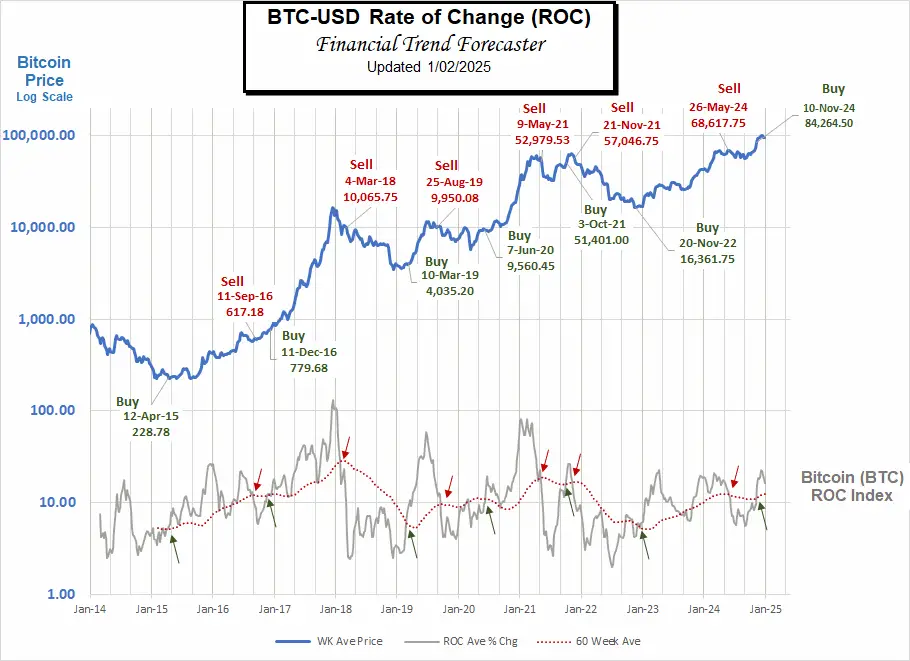

Bitcoin generated a buy signal in November and remains in Buy territory.

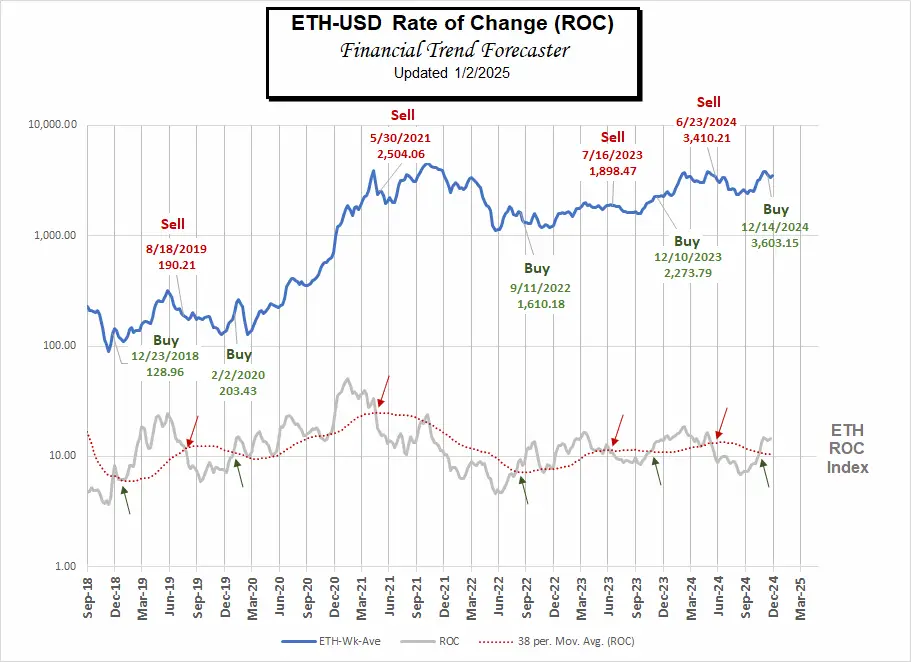

Ethereum on the other hand waited until December to issue its buy signal.

For more information, see NYSE Rate of Change (ROC) , NASDAQ ROC Chart, and Crypto ROC .

You Might Also Like:

From InflationData.com

- How Inflation Destroys Civilization

- November 2024 Inflation Up Slightly

- Inflation and Retirees

- 2025 Social Security COLA

- Inflation-Proofing Your Family Budget

- FED Interest Rates

From Financial Trend Forecaster

- NYSE ROC

- NASDAQ ROC

- Crypto ROC

- Ethereum Buy Signal

- Bitcoin ROC Buy Signal

- One American’s Experience with Socialized Medicine

- Bitcoin Breaks Out

- Is Trump Right About Tariffs?

- What Makes MicroStrategy Special

- China’s Monetary Bazooka

- How Much is the Money Supply Growing?

- Is Gold Overpriced?

- Are Some Forms of Taxation Worse Than Others for the Economy?

From UnemploymentData.com.

- December 2024 Unemployment Report

- November Unemployment Report

- October 2024 Employment / Unemployment Report

- Can We Trust the September Unemployment Numbers?

- September Jobs Report

- Have Wages Kept Up With Inflation?

From Elliott Wave University

- Five Benefits of Using the Elliott Wave Principle to Make Decisions

- Invest Like Warren Buffet

- Gold Prices: The calm before a record run

- This Trend Will Likely Soon Rock the U.S. Financial System

- Elliott Wave Analysis of Bitcoin

From OptioMoney

- Tips for Mastering the Art of Bargaining and Negotiation After Moving to a New Country

- Consumer Culture Contrasting Spending Habits in the US and Europe

- Financial Considerations When Moving to Florida

- Splitting Your Golden Years:

- Home-Buying Guide for Newlyweds

From Your Family Finances

- Maintaining Value in a High-Inflation World

- What Homeowners Need to Know about Florida’s Property Insurance Crisis

- How to Get Money Interest Free

- How to Financially Prepare for Hurricane Season

- Key Considerations for Smooth Wealth Transfer Planning

Leave a Reply