Quantitative Easing was initially considered inflationary but after its first usage, it didn't appear to be. Is this always the case? Is Quantitative Easing really inflationary? Will the Quantitative Easing of 2020-2021 result in more inflation? That is what we are going to look at here. ~Tim McMahon, editor At the height of the 2008 mortgage crisis the FED came up with a revolutionary idea to handle the crisis and that was called "Quantitative Easing (QE)". But before we delve into that let's look at what brought us to that point. Before Quantitative Easing Prior to the 2008 crisis, the housing market was on a tear (much like it is today). The banks were lending at a furious pace and … [Read more...]

Why Hasn’t the U.S. Dollar Experienced Hyperinflation?

I recently answered this question on Quora and thought I'd share the answer here as well. Why hasn't the U.S. dollar experienced hyperinflation? That is an excellent question. As we can see from the chart the FED has engaged in 4 major phases of Quantitative Easing (QE) where they drastically increased their “assets” and one phase of Quantitative Tightening (QT) where they tried to decrease their assets. FED assets is sort of a euphemism for money printing. Basically, it involves creating money out of thin air and then buying something. That “something” becomes an asset on the FED’s books. Prior to 2008, the primary thing the FED bought was U.S. Treasury debt i.e. Treasury Bills, Bonds, … [Read more...]

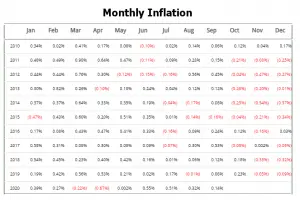

September Inflation Virtually Unchanged

Annual Inflation Increased Very Slightly Annual Inflation rose from 1.31% in August to 1.37% in September. CPI Index rose from 259.918 in August to 260.280 in September. Monthly Inflation for August was 0.32%, for September it was 0.14. The FED holds steady on Assets and FED Funds Rates. Next release November 12th Annual inflation for the 12 months ending in September was 1.37% The CPI index itself was up from 259.918 in August to 260.280. Resulting in a monthly inflation rate of 0.14%. Annual inflation for the 12 months ending in September was up almost imperceptibly from 1.31% to 1.37%. This is a rebound from an astonishingly … [Read more...]

How the FED Controls the Money Supply

When the government spends more money than it receives in taxes it has a “deficit” situation. In order to deal with this deficit, it engages in some fancy bookkeeping. The government is made up of a variety of agencies, so the other agencies request money from the Treasury Department. If it doesn’t have enough money the Treasury Department issues an IOU (called a Government Bond). The Treasury gives the Bond to the Federal Reserve (which is theoretically not part of the government). The FED writes a check to the Treasury for the bond. It then breaks up the bond into smaller bonds and sells them to individual banks. The banks then sell them to individual investors and groups of … [Read more...]

Is the Federal Reserve Right About Inflation?

The Federal Reserve The Federal Reserve serves as the Central Bank of the United States, and whether you realize it or not, it plays an active role in the lives of every American. It makes decisions about monetary policy and interest rates that have a direct impact on the market and an indirect impact on everyone. The FED uses inflation targets to determine how much they can devalue (inflate) the currency. Many people believe that they created a massive money printing scheme cryptically called "Quantitative Easing"since QE1 converted almost worthless mortgage backed securities into currency. The Fed regularly issues statements about how inflation isn't really as bad as everyone says it … [Read more...]

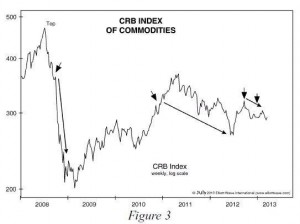

Commodity Prices Falling Despite QE

Traditional wisdom tells us that when the money supply expands the price of commodities rises. Today Robert Prechter takes a look at what has actually happened to commodity prices since 2008 during a period when theoretically the FED has been pumping up the money supply. ~Tim McMahon, editor Commodities Falling Despite QE: What Does That Mean? Robert Prechter: "Charts tell the truth. Let's look at some charts." By Elliott Wave International During QE3, the latest round of the Fed's quantitative easing, the stock market rose. We all know that. But did you also know that commodities fell? That's right: QE3 had zero effect on commodities -- or maybe even a negative effect. In … [Read more...]

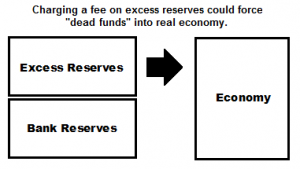

How “Excess Reserves” and the Money Multiplier Could Trigger Inflation

Banks have $2.5 trillion parked in "excess reserves". This is money on deposit with the FED. The FED pays a miniscule amount of interest on these reserves but the banks are willing to loan it to the FED because it is easy no risk income. But it is also the reason that the money multiplier is falling! And when the money multiplier is falling the FED has a very hard time increasing the money supply. So if the FED really wants to increase the money supply all it has to do is decrease the interest rate it pays on excess reserves and the banks will find some place else to deploy it. Which could trigger massive inflation. ~Tim McMahon,editor A Fed Policy Change That Will Increase the Gold … [Read more...]

FED Looks for New Ways to Crank Up Money Supply

With all the talk about "Tapering" you'd think the FED was actually considering reducing it's money pumping. But in actuality that is not it at all. The FED is afraid that it is creating a a bubble in the stock market so it is looking for ways to continue its pumping but shift it enough so that the money goes somewhere besides just to the stock market. In other words, it is still worried about the economy and realizes that it is doing more harm than good but feels trapped, so it is looking for new ways that might work better. If the FED can figure out how to free up the log jam of "excess reserves" held by the banks, liquidity could be sloshing around the economy before you know it and … [Read more...]

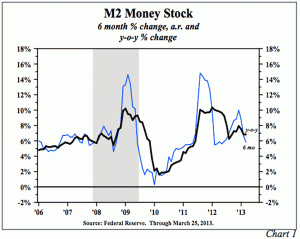

Is Ben Bernanke “Shooting Blanks”?

Summary: Lacy Hunt and Van Hoisington launch into their first-quarter "Review and Outlook," this week with a statement that some may find eye-opening: "The Federal Reserve (Fed) is not, and has not been, 'printing money'…" But given the facts of life about how money is really created (and destroyed), they are of course right: it's all about the acceleration – or deceleration – in the M2 money supply. Van and Lacy say, "A review of post-war economic history would lead to a logical assumption that the money supply (M2) would respond upward to [the Fed's] massive infusion of reserves into the banking system. Mystery Math- Monetary Base up 350%, M2 Up 35%? And yet, the Fed's 3.5x … [Read more...]

Why Money Printing Makes You Poorer

Here is an excellent article by Bill Bonner on the announcement that Japan made that they are going to crank up the printing press and eliminate the deflation that has been plaguing their economy over the last twenty years. In it he explains the effects of money printing both short term and longer term. He also debunks the idea of where demand actually comes from. He says, "People always want stuff. Demand is infinite. Government doesn't have to stimulate it. What really matters is buying power."~Tim McMahon, editor Why Money Printing Makes You Poorer Last week, Japan announced that it would undertake a bold and radical experiment. After 23 years of on-again, off-again deflation, the new … [Read more...]