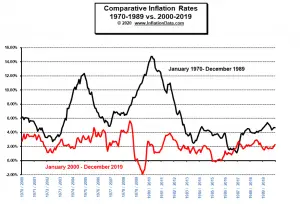

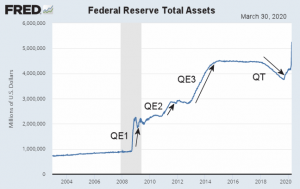

COVID-19 has brought the global economy to its knees and in response, the governments of the world have opened the money printing spigots. The U.S. FED for instance has bought roughly 3 TRILLION in assets this year (labeled "Quantitative Easing 4" on this chart). Many fear that this much "money printing" will result in massive inflation or even hyperinflation. As you can see from the chart below, high inflation rates were the bane of the 1970s and early 1980s when the inflation rate rarely dipped below 4%. By contrast, the period beginning with the new millennium has rarely seen inflation go above 4%. Inflation in the 1970s caused much suffering and business disruption, … [Read more...]

May Inflation “Astonishingly Low”

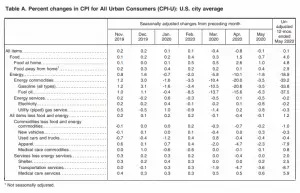

The Bureau of Labor Statistics Released the Inflation Data for the 12 months ending in May on June 10th. Inflation is virtually ZERO at 0.12%. Annual Inflation Retreats Annual Inflation fell again to 0.12% in May from 0.33% in April. CPI Index rose marginally from 256.389 in April to 256.394 (virtually identical). Monthly Inflation for May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%... typically January through May are highly inflationary so this is VERY unusual. The FED continues to crank up the "printing presses" using "Quantitative Easing" in an effort to stimulate the economy in the wake of COVID-19. FED Funds Rate remains near Zero. Next … [Read more...]

Inflation Expectations and the Massive Fed Stimulus

Inflation is loosely described as a general economic state of rising prices. In February 2020, the US inflation rate dipped from a high of 2.5% in January, to 2.3%. Assuming the standard of steadily increasing prices, driven largely by food, fuel, and living expenses, one can expect the inflation rate to tick higher. Forecasts for April 2020 are at 1.7%. Given that the major drivers of inflation are excess demand (demand-pull inflation), or cost-push inflation, current conditions based on Coronavirus quarantines have created a murky demand climate. Oil Prices and Inflationary Expectations All major US indices, including the Dow Jones Index, have plunged precipitously. Stock portfolios … [Read more...]

Will the $2 Trillion Covid-19 Stimulus Cause Inflation?

The current round of massive Corona Virus easing began Monday March 16th, 2020, with the FED buying $40 billion in Treasuries and then buying another $50 billion in Treasuries on Tuesday. By Thursday morning, it had upped the plan to $75 billion PER DAY and added $10 billion in mortgage securities. By Friday morning, the Fed had decided to buy $107 billion worth of Treasuries and mortgage-backed securities. In its first week, the FED purchased $317 billion worth of assets, which is slightly faster than the Fed balance sheet grew at the height of the 2008-2009 financial crisis. Initially, the Federal Reserve estimated purchases of $500 billion but FED chief Jerome Powell said the initial … [Read more...]