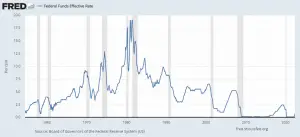

The Fed funds rate is, effectively, the price of money. When it changes, much like dropping a rock into the water, the impact ripples out in all directions.— Greg McBride, Bankrate Chief Financial Analyst On Wednesday, September 18th, the FED reduced interest rates for the first time in four years. Mr. Market has been anticipating this cut all year and it finally happened. Last month FED Chairman Powell hinted at a rate cut at this FOMC meeting and at the time most experts believed that the cut would only be 25 basis points or ¼%. But, once lower-than-expected August inflation numbers were released on September 11th, the market began clamoring for a 50 basis point cut, or even a 75 basis … [Read more...]

Can the FED Engineer a “Soft Landing”?

The ultimate dream of the Federal Reserve and those who believe in the FED's omniscience is for them to engineer a soft landing, i.e., curbing inflation without sending the economy into a deep recession. The idea is that if they raise rates just enough, but not too much, they can find the "Goldilocks" middle ground that will magically cool inflation just enough. In today's article, Mihai Macovei explains why that is more of a fairytale than Goldilocks herself. ~Tim McMahon, editor. There Is No Fed Magic Trick to Achieve a Soft Landing Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first … [Read more...]

When Can We Expect Lower FED Rates?

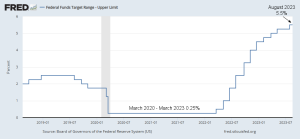

Why Has The FED Been Raising Interest Rates? The Federal Reserve (Fed) started raising interest rates in March 2022 in an effort to combat inflation. As of the end of July 2023, the Fed's target rate limit is 5.5%, the highest level in 15 years. There are a few reasons why the Fed is raising interest rates so aggressively. First, inflation was at a 40-year high. In June 2022, the Consumer Price Index (CPI) rose 9.06% year-over-year, the fastest pace since December 1981. This means that the cost of goods and services was rising rapidly, which was eroding the purchasing power of consumers and businesses. Second, the economy is still strong. The unemployment rate posted a 50-year … [Read more...]

No Surprise… FED Raised Rate by 1/4%

The market was predicting a 1/4% raise in the FED Funds rate with 99% certainty and that is exactly what they got. We were wondering if because of last month's drop in annual inflation (due primarily to a mathematical anomaly) the FED would not raise rates this month. But apparently their previous pause was sufficient under the circumstances. By applying the slight rate increase at this point, it should present the impression to the general public that they are on top of things, when the 1/3% rebound in inflation that we expect for July shows up. FED Chairman, Jerome Powell has left the door open for further increases (or not) with his comment, “Looking ahead, we will continue to take … [Read more...]

Central Banks Respond Differently to the Banking Crisis

Central bankers don't like surprises, so they tend to communicate among themselves in order to coordinate their response to every new crisis. And this week there was a wave of responses to the combination banking crisis and still high inflation. The Cause Raising interest rates from near zero to over 4.5% in a short period of time puts stress on banks' liquidity as it causes an "inverted yield curve", i.e., short-term interest rates are higher than the locked-in long-term rates. Thus banks are paying out more (on short-term deposits) than they are receiving (on long-term mortgages). The Effect So you would think the Central Bankers would be prepared to deal with the … [Read more...]

Is The Fed Flashing Signs It’s Done Raising Rates?

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 4.75 percent, an increase of 25 basis points. With this latest increase, the target has increased by 4.5 percent since February 2022, although this latest increase of 25 basis points is the smallest increase since March of last year. Indeed, the FOMC has slowed its rate of increase over the past three months. After four 75 basis point increases in 2022, the committee approved a 50-point increase in December, followed by the 25-point increase this week. In other words, the FOMC has been slowed down in its monetary tightening. The committee was … [Read more...]

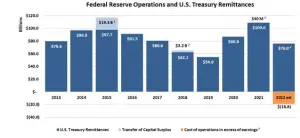

Why the Fed Is Bankrupt and Why That Means More Inflation

In 2011, the Federal Reserve invented new accounting methods for itself so that it could never legally go bankrupt. As explained by Robert Murphy, the Federal Reserve redefined its losses so as to ensure its balance sheet never shows insolvency. As Bank of America’s Priya Misra put it at the time: As a result, any future losses the Fed may incur will now show up as a negative liability (negative interest due to Treasury) as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible. That was twelve years ago, and it was all academic at the time. But in 2023, the Fed really is insolvent, although its fake post-2011 account doesn’t show this. … [Read more...]

November FED Announcement Rocks Stock Market

The FED Giveth and the FED Taketh Away On Wednesday, November 2nd, the FED held its "Federal Open Market Committee meeting" and made the announcement the market has been breathlessly awaiting. As expected, Chairman Jerome Powell announced a hike of 75 basis points in the fed funds rate. Along with the announcement, the market was hoping for some indication of a "pivot", i.e., that the FED would give some indication that it was going to be slackening off on its rapid rate increases. And in this respect, the November FED Announcement did throw the market a bone. It added the new phrase “Cumulative Tightening” to the standard announcement. So, going forward, the FED will take the fact … [Read more...]

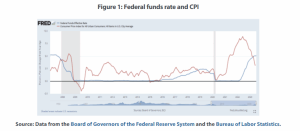

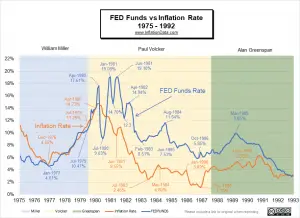

Jerome Powell “Channels” His Inner Paul Volcker

Federal Reserve Chairman Jerome Powell is sounding more and more like former FED Chairman Paul Volcker, who served as the chairman of the Federal Reserve from August 1979 to August 1987. Volcker is best known for his historic fight to vanquish inflation in the early 1980s. Before Volcker took over as the head of the FED, Inflation had risen from a low of 4.65% in December 1976 to 11.26% in July 1979. During that time, FED chairman William Miller raised the FED funds rate from 4.61% to 10.47% in July of 1979. During Miller's time, the FED funds rate pretty much tracked the inflation rate, with a couple of month lag. Prior to Volcker, the prevailing monetary theory was that the FED … [Read more...]

Surprise, Surprise, The FED Raises Rates by .75%

At its June 15th meeting, the FED announced that it will be raising rates by ¾%. Up until last week, this would have been a big shock to the market. But despite the imposed FED silent period leading up to their Wednesday meeting "somehow" journalists from all the major financial publications published remarkably similar articles predicting a 0.75% increase in the FED funds rate. Prior to this leaked guidance, the consensus was that the FED would increase rates by ½% but last week's higher-than-expected inflation report threw a wrench into the works. Everyone is making a big deal out of the fact that this is the first raise of that magnitude since 1994. And that it will double the FED … [Read more...]