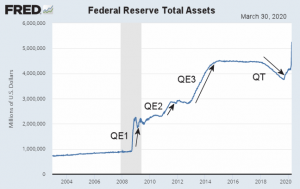

News from the FED’s December 2021 FOMC Meeting For nine months now, here at InflationData, we’ve been saying that inflation was becoming a problem. We’ve said this even though the FED denied it and initially said the problem was only “transitory”. The FED continued to massively increase the money supply via “Quantitative Easing” (QE) during that period. In our article Why Quantitative Easing is Inflationary… Sometimes, we showed that QE is inflationary when there aren’t counteractive deflationary forces. We also noted that QE had resulted in a massive increase in the money supply this time around. In his strangely named book Picnics on Vesuvius, former Financial Times Editor William … [Read more...]

Why Quantitative Easing is Inflationary… Sometimes

Quantitative Easing was initially considered inflationary but after its first usage, it didn't appear to be. Is this always the case? Is Quantitative Easing really inflationary? Will the Quantitative Easing of 2020-2021 result in more inflation? That is what we are going to look at here. ~Tim McMahon, editor At the height of the 2008 mortgage crisis the FED came up with a revolutionary idea to handle the crisis and that was called "Quantitative Easing (QE)". But before we delve into that let's look at what brought us to that point. Before Quantitative Easing Prior to the 2008 crisis, the housing market was on a tear (much like it is today). The banks were lending at a furious pace and … [Read more...]

Why is a Little Bit of Inflation Considered Good for the Economy?

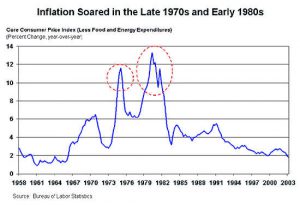

The short answer is because the U.S. Federal Reserve Board, i.e., the “FED,” says it is. The longer answer is much more complicated. To determine whether 2% is really best for you, we will have to look at a variety of different factors. First of all, it might surprise you to know that it wasn’t always that way. It wasn’t until January 25th, 2012, that U.S. Federal Reserve Chairman Ben Bernanke set a 2% target inflation rate. Before that, the FED didn’t have a specific inflation target but instead regularly set a target range. This range was often between 1.7% and 2%. But even that range is relatively new, and some economists still believe that Zero percent inflation is optimal. Prior … [Read more...]

FED Issues September 2021 Statement

On September 22, 2021, the Federal Reserve reported its current policy position. Currently, the FED is creating liquidity (i.e., printing money) through its Quantitative Easing (QE) program at the rate of $120 billion per month. The market has been fearing that the FED would begin tapering, i.e., cutting back on its liquidity creation. Rumor was that the FED would start reducing their QE by $10-$15 billion per month due to inflation concerns. The last time the FED embarked on a tapering plan back in 2017, they used a two-prong approach of raising the FED Funds rate and reducing the monthly printing by $10 Billion every three months (i.e., roughly $3.3 billion per month). The result of … [Read more...]

What are Central Banks?

History of Central Banking Like everyone, kings like to spend money, whether it is to wage war or to build palaces, but they often didn't have all the money they "needed", so they had to borrow it. To facilitate this large scale borrowing, they created a Central Bank to handle that function. In 1790, "Federalist" Alexander Hamilton advocated for a Central Bank in the United States. Democratic-Republicans, Thomas Jefferson and James Madison believed that the Constitution did not grant the Federal government the authority to create a bank, based on the 10th amendment i.e. that all powers not endowed to Congress are retained by the States (or the people). But Hamilton argued that although … [Read more...]

Inflation Expectations and the Massive Fed Stimulus

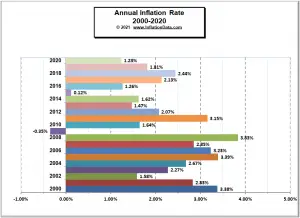

Inflation is loosely described as a general economic state of rising prices. In February 2020, the US inflation rate dipped from a high of 2.5% in January, to 2.3%. Assuming the standard of steadily increasing prices, driven largely by food, fuel, and living expenses, one can expect the inflation rate to tick higher. Forecasts for April 2020 are at 1.7%. Given that the major drivers of inflation are excess demand (demand-pull inflation), or cost-push inflation, current conditions based on Coronavirus quarantines have created a murky demand climate. Oil Prices and Inflationary Expectations All major US indices, including the Dow Jones Index, have plunged precipitously. Stock portfolios … [Read more...]

What is the Federal Funds Rate?

By law banks are required to maintain a certain percentage of their assets in reserves at any given time. This money is held at the Federal Reserve bank and is called the “Reserve Requirement”. Generally, this money does not earn any interest. But, any money over and above this minimum can be loaned to other banks to who might not have enough reserves. The rate that banks can charge each other is called the “Federal Funds rate” or “Fed Funds Rate”. The monetary policy-making body of the Federal Reserve System, is called the “Federal Open Market Committee” or “FOMC”. The FOMC meets eight times a year to discuss the economy and decide on any changes to monetary policy. One of the major … [Read more...]

Will the $2 Trillion Covid-19 Stimulus Cause Inflation?

The current round of massive Corona Virus easing began Monday March 16th, 2020, with the FED buying $40 billion in Treasuries and then buying another $50 billion in Treasuries on Tuesday. By Thursday morning, it had upped the plan to $75 billion PER DAY and added $10 billion in mortgage securities. By Friday morning, the Fed had decided to buy $107 billion worth of Treasuries and mortgage-backed securities. In its first week, the FED purchased $317 billion worth of assets, which is slightly faster than the Fed balance sheet grew at the height of the 2008-2009 financial crisis. Initially, the Federal Reserve estimated purchases of $500 billion but FED chief Jerome Powell said the initial … [Read more...]

Does the FED Control Mortgage Rates?

For new home buyers, anything that increases the cost of the purchase (like rising mortgage interest rates) can negatively impact your ability to be able to afford your home. That is why everyone is concerned when the Federal Reserve (i.e. the FED) raises interest rates. The following chart shows how the Fed Funds Rate has performed from January 2015 through July 2019. The FED lowered the FED Funds rate to near zero in response to the market crash in 2008-2009. It kept it there until January 2016 when it began gradually raising rates. However, at their July end meeting, they decided to lower interest rates, reducing the federal funds rate target by 25 basis points, to a range of 2% to 2.25%. … [Read more...]

What Impact Does Interest Rates and Inflation Targets Have on Stocks?

Why is The FED's Targeted Inflation Rate Important in the US? Since 2012, the Fed has targeted an inflation rate of 2%. They have deemed this a healthy rate of inflation, necessary for economic growth. According to the Board of Governors of the Federal Reserve System, since 1977, the Federal Reserve has operated under a mandate from Congress to "promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates" this is called a "dual mandate" in that it is supposed to balance a healthy economy with stable prices not just target low inflation. When the FOMC (Federal Open Market Committee) meets, their job is to fulfill this mandate. The Fed has … [Read more...]