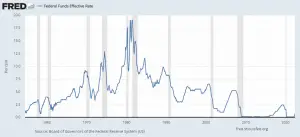

At its June 15th meeting, the FED announced that it will be raising rates by ¾%. Up until last week, this would have been a big shock to the market. But despite the imposed FED silent period leading up to their Wednesday meeting "somehow" journalists from all the major financial publications published remarkably similar articles predicting a 0.75% increase in the FED funds rate. Prior to this leaked guidance, the consensus was that the FED would increase rates by ½% but last week's higher-than-expected inflation report threw a wrench into the works. Everyone is making a big deal out of the fact that this is the first raise of that magnitude since 1994. And that it will double the FED … [Read more...]

Inflation Takes a Bite Out of Your Food Budget

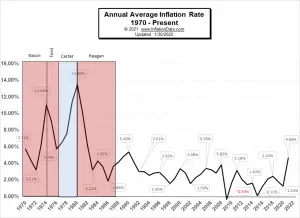

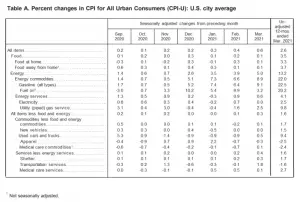

The Bureau of Labor Statistics reported that in May 2022, Annual Inflation Rose. May Food Inflation Breaks Record: The combined food index (at home and away) increased 10.1 percent for the 12-months ending May, the first annual increase of 10 percent or more since the period ending March 1981. Food at home rose even more... 11.9% over the last 12 months... while food away from home "only" rose 7.4% over the last year. All six major grocery store food group indexes rose in May. The index for dairy and related products rose 2.9 percent, its largest monthly increase since July 2007. The index for nonalcoholic beverages increased 1.7 percent, and the index for other food at home rose … [Read more...]

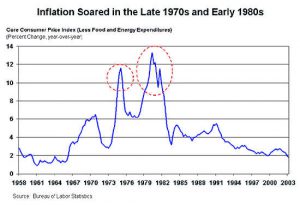

How Quickly Can The FED Get Inflation Under Control?

This is an interesting question. How long DOES it take to get inflation under control? I've often said that the economy is like a cruise ship; it doesn't turn on a dime. A cruise ship can't just come barreling into the harbor at full speed and slam on the brakes when it's near the dock. If it tried that, it would end up destroying half the town. Typically, it takes AT LEAST 9 months for the economy to see the effects of the FED's actions. In order to control inflation, a successful FED has to anticipate where the economy will be nine months to a year down the road and then take measured steps to correct it before we get there. We haven't seen that this time. What we have seen is a FED in … [Read more...]

Spoiler: The FED Guaranteed To Fight Inflation… Sooner Or Later

News from the FED’s December 2021 FOMC Meeting For nine months now, here at InflationData, we’ve been saying that inflation was becoming a problem. We’ve said this even though the FED denied it and initially said the problem was only “transitory”. The FED continued to massively increase the money supply via “Quantitative Easing” (QE) during that period. In our article Why Quantitative Easing is Inflationary… Sometimes, we showed that QE is inflationary when there aren’t counteractive deflationary forces. We also noted that QE had resulted in a massive increase in the money supply this time around. In his strangely named book Picnics on Vesuvius, former Financial Times Editor William … [Read more...]

Why Quantitative Easing is Inflationary… Sometimes

Quantitative Easing was initially considered inflationary but after its first usage, it didn't appear to be. Is this always the case? Is Quantitative Easing really inflationary? Will the Quantitative Easing of 2020-2021 result in more inflation? That is what we are going to look at here. ~Tim McMahon, editor At the height of the 2008 mortgage crisis the FED came up with a revolutionary idea to handle the crisis and that was called "Quantitative Easing (QE)". But before we delve into that let's look at what brought us to that point. Before Quantitative Easing Prior to the 2008 crisis, the housing market was on a tear (much like it is today). The banks were lending at a furious pace and … [Read more...]

Why is a Little Bit of Inflation Considered Good for the Economy?

The short answer is because the U.S. Federal Reserve Board, i.e., the “FED,” says it is. The longer answer is much more complicated. To determine whether 2% is really best for you, we will have to look at a variety of different factors. First of all, it might surprise you to know that it wasn’t always that way. It wasn’t until January 25th, 2012, that U.S. Federal Reserve Chairman Ben Bernanke set a 2% target inflation rate. Before that, the FED didn’t have a specific inflation target but instead regularly set a target range. This range was often between 1.7% and 2%. But even that range is relatively new, and some economists still believe that Zero percent inflation is optimal. Prior … [Read more...]

FED Issues September 2021 Statement

On September 22, 2021, the Federal Reserve reported its current policy position. Currently, the FED is creating liquidity (i.e., printing money) through its Quantitative Easing (QE) program at the rate of $120 billion per month. The market has been fearing that the FED would begin tapering, i.e., cutting back on its liquidity creation. Rumor was that the FED would start reducing their QE by $10-$15 billion per month due to inflation concerns. The last time the FED embarked on a tapering plan back in 2017, they used a two-prong approach of raising the FED Funds rate and reducing the monthly printing by $10 Billion every three months (i.e., roughly $3.3 billion per month). The result of … [Read more...]

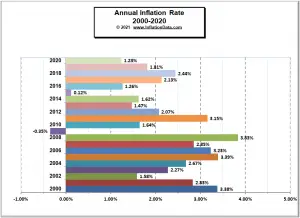

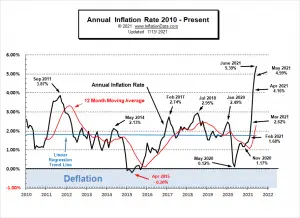

June 2021: Highest Annual Inflation since 2008

Inflation Summary: Annual Inflation up sharply to 5.39% CPI Index rose from 269.195 in May to 271.696 in June. Monthly Inflation for March 0.71%, April 0.82%, May 0.80%, and June was 0.93% . Next release August 11th Inflation for the 12 months ending in June was 5.39% for the Largest Annual Increase since July 2008's 5.60% Last month's 4.99% was the largest increase since August 2008's 5.37% but at 5.39% June 2021 was actually slightly higher than that. (Although the BLS reported them both as 5.4%). If inflation tops the 5.6% of July 2008, we have to go all the way back to the 6.29% of October 1990 to find a higher peak. We have been predicting Annual Inflation would … [Read more...]

March Inflation Skyrockets

Inflation Summary: Annual Inflation up from 1.68% in February to 2.62% in March. CPI Index rose slightly from 263.014 in February to 264.877 in March. Monthly Inflation for February was 0.55% and March was 0.71%. Next release May 12th Annual inflation for the 12 months ending in March was 2.62% We have been predicting Annual Inflation would shoot up in March due to higher gas prices and negative numbers falling out of the annual calculation. Further increases to come in April and May. Since the BLS rounds their numbers to 1 decimal place they reported February as 1.7% and March as 2.6% for a monthly increase of 9/10ths of 1% taking inflation well above the FED's 2% … [Read more...]

Why Hasn’t the U.S. Dollar Experienced Hyperinflation?

I recently answered this question on Quora and thought I'd share the answer here as well. Why hasn't the U.S. dollar experienced hyperinflation? That is an excellent question. As we can see from the chart the FED has engaged in 4 major phases of Quantitative Easing (QE) where they drastically increased their “assets” and one phase of Quantitative Tightening (QT) where they tried to decrease their assets. FED assets is sort of a euphemism for money printing. Basically, it involves creating money out of thin air and then buying something. That “something” becomes an asset on the FED’s books. Prior to 2008, the primary thing the FED bought was U.S. Treasury debt i.e. Treasury Bills, Bonds, … [Read more...]