In today's article, Charles A. Smith explains how bankers and bureaucrats conspire to consistently rob the common person through inflation. We have become conditioned to believe that 2% inflation is the norm, and not only that, but it is even desirable and beneficial. Charles argues that, quite to the contrary, productivity improvements should create lower consumer prices, i.e., deflation. The reason that doesn't happen is because "Inflation makes bankers’ and bureaucrats’ lives easier and keeps them in power". ~Tim McMahon, editor. Inflation Is a Giant "Skim" on the American People The price of a McDonald’s hamburger in the United States has inflated 3.75 percent annually over the … [Read more...]

Do Private Corporations Cause Inflation?

We often hear the cry that those greedy corporations are raising prices and causing inflation. If they would only bite the bullet and stop raising prices all would be well. They even have a name for it "greedflation". As recently as April 27th 2023, Bloomberg published an article entitled ECB (The European Central Bank) Wakes Up to Greedflation as Key Culprit in Price Struggle. The article tells us that French politician and President of the European Central Bank Christine Lagarde blames "corporate margins" for inflation. Today's article looks at the problems with that view. ~Tim McMahon, editor Private Corporations Don't Cause Price Inflation. Governments Do. By Daniel … [Read more...]

Default by Inflation

As long as I can remember, the "boogeyman" of government debt has always been default. This is not an insignificant concern. Over the years, governments HAVE defaulted on their sovereign debt. In the 1700s, corporate debt was seen as more likely to be repaid than government debt. As recently as a year ago, Russia was facing the prospect of default on Eurobonds maturing in 2023 and 2043. According to the following chart by Reuters, 34 governments have defaulted on at least some of their sovereign debt since 1989. The largest defaults were Congo in 2012 and Ukraine in 2015, but there was also Ecuador, Nicaragua, Argentina, Venezuela, Russia, and Pakistan, along with many others. But … [Read more...]

Is There an Optimum Growth Rate of Money?

It is widely held that a growing economy requires a growing money stock because economic growth increases demand for money. Many economists also believe that failing to accommodate the increase in the demand for money leads to a decline in consumer prices. This could destabilize the economy and produce an economic recession or even a depression. Some economists who follow Milton Friedman—also known as monetarists—want the central bank to target the money supply growth rate to a fixed percentage. They hold that if this percentage is maintained over a prolonged period, it will create economic stability. The idea that money must grow to support economic growth implies that money sustains … [Read more...]

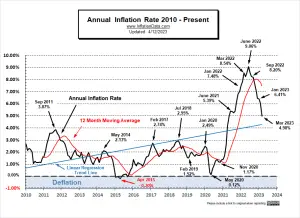

Inflation Less Than Experts Predict in March

Annual inflation PLUNGED in March according to the Bureau of Labor Statistics CPI report released on April 12th. Monthly inflation was 0.33% for March 2023, compared to 1.34% in March 2022. This resulted in a 1% drop in Annual inflation. But despite the significant drop in inflation, the stock market did not rally. Instead, the NYSE lost a few points, and the NASDAQ lost just over 100 points. March 2023 Inflation Summary: Annual Inflation fell from 6.04% to 4.98% CPI Index rose from 300.840 to 301.836 Monthly Inflation for March was 0.33% Next release May … [Read more...]

Food and Shelter Prices Keep Climbing as CPI Growth Hits a Three-Month High

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data today, [i.e., February 14th], and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in sixteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.4 percent year over year in January before seasonal adjustment. That’s down very slightly from December’s year-over-year increase of 6.5 percent, and January is the twenty-third month in a row with inflation above the Fed’s arbitrary 2 percent inflation target. Price inflation has now been above 6.0 percent for sixteen months in a row. [Editor's note: … [Read more...]

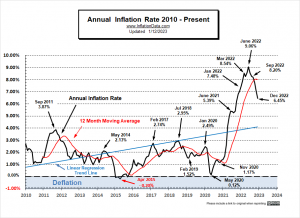

Inflation Falls Again in December

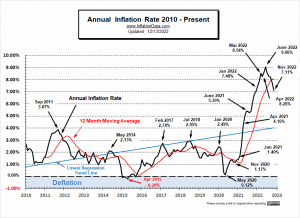

The Bureau of Labor Statistics reported that Annual Inflation fell from 7.11% in November to 6.45% in December 2022. This was down from a peak of 9.06% in June 2022. Monthly inflation was negative (Disinflation) for November at -0.10% and December at -0.31%. This is fairly typical for the fourth quarter, which is traditionally negative. Monthly inflation for 2022 was lower than in November 2021, so December Annual inflation fell. It is important to remember that although the inflation RATE is falling... prices are still going up, i.e., prices are still 6.5% higher than they were a year ago. A decline from 7.5% to 6.5% is similar to a car going from 75 mph to 65 mph... it is still … [Read more...]

Inflation Down in November

The Bureau of Labor Statistics reported that Annual Inflation fell from 7.75% in October to 7.11% in November 2022. This was down from a peak of 9.06% in June 2022. Monthly inflation was negative (Disinflation) for November at -0.10%. This is fairly typical for the fourth quarter, which is traditionally negative. Monthly inflation for 2022 was lower than in November 2021 so Annual inflation fell. It is important to remember that although the inflation RATE is falling... prices are still going up, i.e., prices are still 7% higher than they were a year ago. A decline from 7.75% to 7.11% is similar to a car going from 77 mph to 71 mph... it is still speeding forward just not quite as … [Read more...]

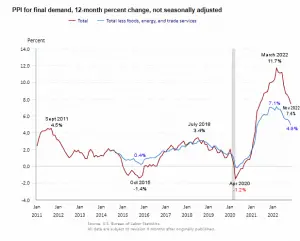

November Producer Price Index Declines from 2021 to 2022

Typically when we think of inflation, we look at the Consumer Price Index (CPI), which measures prices affecting Consumers. Today we are going to look at the November Producer Price index. According to the U.S. Bureau of Labor Statistics (BLS), "the Producer Price Index (PPI) measures the average change over time in the prices domestic producers receive for their output. It is a measure of inflation at the wholesale level that is compiled from thousands of indexes measuring producer prices by industry and product category." The index is published monthly, but unlike the CPI, the PPI is subject to adjusting/correcting over the following four months after publication. The CPI is considered … [Read more...]

Can Businesses Really Set Any Price They Want?

There is a common belief that a company can arbitrarily pick any price it wants for its products and then make obscene profits. And while it is true that a company is certainly free to set its prices, that doesn’t mean that consumers have to pay them. There are a variety of other factors at play. Does the company have a monopoly? How long would it take for the competition to gear up and start producing a competing product? How much demand is there for this product? How desperately does the consumer want/need this product? How expensive is it for the competition to get started? Is the monopoly due to a patent, government fiat, or temporary supply disruption? And many others. In the … [Read more...]