It is widely held that a growing economy requires a growing money stock because economic growth increases demand for money. Many economists also believe that failing to accommodate the increase in the demand for money leads to a decline in consumer prices. This could destabilize the economy and produce an economic recession or even a depression. Some economists who follow Milton Friedman—also known as monetarists—want the central bank to target the money supply growth rate to a fixed percentage. They hold that if this percentage is maintained over a prolonged period, it will create economic stability. The idea that money must grow to support economic growth implies that money sustains … [Read more...]

Is the FED Tightening or Is Hyperinflation on the Horizon?

Recently a prophecy has been trending on YouTube. In it, the possibility of major upheaval in November is mentioned, combined with the possibility of hyperinflation. As I've mentioned before, beginning in March 2020, the FED created massive amounts of liquidity through Quantitative Easing in an effort to combat the monetary effects of shutting the country down due to the virus. If that is combined with a reduction in the quantity of goods and services created due to the virus or riots shutting down the means of production we could see hyperinflation. So that would play into fulfilling that prophesy. Back on April 1st, I wrote an article entitled Will the $2 Trillion Covid-19 Stimulus … [Read more...]

How Does Inflation Affect Foreign Exchange Rates

Inflation affects every consumer, business person and investor in some way or other. Inflation is one of the key factors that affect consumer prices, financial markets including Stocks, Bonds and Forex. As such, it is important for consumers, investors and traders to get a deeper understanding of what is inflation and what causes it. What is Inflation? Understanding inflation is often complicated by the fact that the cause and the effect are often muddled together in people's minds due to the lazy way we often refer to inflation. The effect of inflation is what people see when they go shopping and see increases in the general price of goods and services. When the individual prices of just … [Read more...]

The Quantity Theory of Money

We have written quite extensively on the cause of inflation in articles like: How does the Money Supply affect our Inflation Rate? in What is Inflation? and Inflation Cause and Effects. One of the keys to understanding inflation is the Money Multiplier. Because of the "Fractional Reserve system banks are only required to keep a small fraction of the money on deposit as "reserves" against potential withdrawals the bank can loan out the majority of the money on deposit to earn interest. This results in a multiplication effect increasing the money supply by vast multiples. This "leverage" can work in either direction. In April 2010, I wrote an article explaining how this can result in … [Read more...]

Living in a Free-Lunch World

It seems that every once in a while, we awake from a deep sleep with what appears to us to be a brilliant revelation. Unfortunately, if we don't write them down they are usually forgotten by morning. Sometimes in the light of day they turn out to be totally ridiculous... but occasionally they actually do turn out to be a flash of inspiration. I had one such experience a few weeks ago. Of late I have been increasingly disturbed by the growing gulf between Liberals and Conservatives. It seems that they can't find any common ground and for all intents and purposes might be living on entirely different worlds. My revelation, although perhaps not earth-shattering, was to me at least … [Read more...]

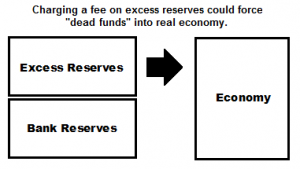

How “Excess Reserves” and the Money Multiplier Could Trigger Inflation

Banks have $2.5 trillion parked in "excess reserves". This is money on deposit with the FED. The FED pays a miniscule amount of interest on these reserves but the banks are willing to loan it to the FED because it is easy no risk income. But it is also the reason that the money multiplier is falling! And when the money multiplier is falling the FED has a very hard time increasing the money supply. So if the FED really wants to increase the money supply all it has to do is decrease the interest rate it pays on excess reserves and the banks will find some place else to deploy it. Which could trigger massive inflation. ~Tim McMahon,editor A Fed Policy Change That Will Increase the Gold … [Read more...]

FED Looks for New Ways to Crank Up Money Supply

With all the talk about "Tapering" you'd think the FED was actually considering reducing it's money pumping. But in actuality that is not it at all. The FED is afraid that it is creating a a bubble in the stock market so it is looking for ways to continue its pumping but shift it enough so that the money goes somewhere besides just to the stock market. In other words, it is still worried about the economy and realizes that it is doing more harm than good but feels trapped, so it is looking for new ways that might work better. If the FED can figure out how to free up the log jam of "excess reserves" held by the banks, liquidity could be sloshing around the economy before you know it and … [Read more...]

Experimental (Reckless) Monetary Policy

In the following article Bill Bonner makes some excellent points about the problem with the current monetary policy. The first is that it is totally ludicrous to try to buy real goods with fake money. It has to cause distortions in the overall economy. "People make different decisions when they can borrow for practically nothing... " Secondly, once it gets started, without some form of real recovery it will be impossible to stop. Kind of like a drug addict. The withdrawal will be painful and won't happen until something forces the FED's hand. And thirdly also just like drug addicts and unsuccessful people the world over the FED is taking a short term view. It is a proven fact that the most … [Read more...]

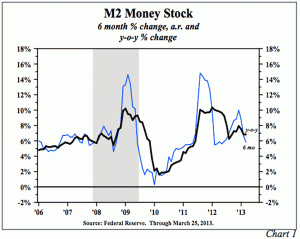

Is Ben Bernanke “Shooting Blanks”?

Summary: Lacy Hunt and Van Hoisington launch into their first-quarter "Review and Outlook," this week with a statement that some may find eye-opening: "The Federal Reserve (Fed) is not, and has not been, 'printing money'…" But given the facts of life about how money is really created (and destroyed), they are of course right: it's all about the acceleration – or deceleration – in the M2 money supply. Van and Lacy say, "A review of post-war economic history would lead to a logical assumption that the money supply (M2) would respond upward to [the Fed's] massive infusion of reserves into the banking system. Mystery Math- Monetary Base up 350%, M2 Up 35%? And yet, the Fed's 3.5x … [Read more...]

Stimulate the Economy? Please Don’t!

Personally, I would love to see the inflation rate stay between 1 and 2% or better yet between 0% and 1%. Why? In the long run low inflation rates benefit everyone, as people can accurately judge their future costs and make sound business (or family management) decisions. In addition to making planning easier it also promotes saving because people know that the money they put away will be worth the same amount (plus interest) as that which they saved in the first place. High savings results in stability in times of need, and it provides capital for industry which generates wealth as new things are produced. But why save if the value of the money you are putting away is eroding? In a … [Read more...]