By Dr. Ron Paul When I talk to many teenagers and grade schoolers, they seem to have no problem comprehending the fact that if you just create a lot of money, it'll be like Monopoly money and it won't have value. Governments do that for all kinds of reasons, especially to enhance political power to fight wars we shouldn't be fighting or to pass welfare programs that aren't deserved. When you print that money, the value of that dollar has to go down, and then one of the consequences of inflating the money will be higher prices. But there are a lot of other problems, too, with inflating. It causes a business cycle, it causes financial bubbles and it causes a lot of … [Read more...]

Experimental (Reckless) Monetary Policy

In the following article Bill Bonner makes some excellent points about the problem with the current monetary policy. The first is that it is totally ludicrous to try to buy real goods with fake money. It has to cause distortions in the overall economy. "People make different decisions when they can borrow for practically nothing... " Secondly, once it gets started, without some form of real recovery it will be impossible to stop. Kind of like a drug addict. The withdrawal will be painful and won't happen until something forces the FED's hand. And thirdly also just like drug addicts and unsuccessful people the world over the FED is taking a short term view. It is a proven fact that the most … [Read more...]

Why Inflation is U.S. Hottest Export

Last week, we went to São Paulo, Brazil. There, too, we found taxi drivers who knew a lot more about monetary crises than the typical US economist. Said one: I remember. I was just a kid. But my father would call and tell us to run to the grocery store. He had just been paid. We'd dash for the grocery story, meet him there and buy everything we could. We spent every cent in just a few minutes. Our friend was recalling what it was like in the late 1980s in Brazil. The government had caused inflation... then hyperinflation. Prices rose so fast that as soon as people got some cash they ran to the grocery store to spend it. Later, there was no point. In 1990, hyperinflation in … [Read more...]

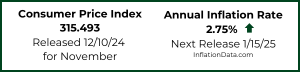

Stimulate the Economy? Please Don’t!

Personally, I would love to see the inflation rate stay between 1 and 2% or better yet between 0% and 1%. Why? In the long run low inflation rates benefit everyone, as people can accurately judge their future costs and make sound business (or family management) decisions. In addition to making planning easier it also promotes saving because people know that the money they put away will be worth the same amount (plus interest) as that which they saved in the first place. High savings results in stability in times of need, and it provides capital for industry which generates wealth as new things are produced. But why save if the value of the money you are putting away is eroding? In a … [Read more...]

Why Money Printing Makes You Poorer

Here is an excellent article by Bill Bonner on the announcement that Japan made that they are going to crank up the printing press and eliminate the deflation that has been plaguing their economy over the last twenty years. In it he explains the effects of money printing both short term and longer term. He also debunks the idea of where demand actually comes from. He says, "People always want stuff. Demand is infinite. Government doesn't have to stimulate it. What really matters is buying power."~Tim McMahon, editor Why Money Printing Makes You Poorer Last week, Japan announced that it would undertake a bold and radical experiment. After 23 years of on-again, off-again deflation, the new … [Read more...]

What are “Foreign Exchange Reserves”?

Will the U.S. Dollar Be Replaced as the World's Reserve Currency? Foreign Exchange Reserves are foreign money held by International banks for use in international trade and in an effort to diversify their holdings and hedge against the inflation of their own currency. The most common items bought and sold with their foreign exchange reserves are oil and gold. Up until 1944 the asset of choice was gold and it was used as the medium of exchange between countries to settle their debts. But in July 1944, delegates from the 44 Allied nations gathered in Bretton Woods, New Hampshire., and made the U.S. dollar the reserve currency of the world. At that time, the dollar was pegged at $35 per ounce … [Read more...]

Civil Liberties Rest Upon Sound Money

Sound Money = Freedom Over the years I have written many times about the necessity of sound money to base our economy on and the results of wanton reckless money creation that will alway result in inflation and a worthless currency either sooner or later. I've told you about how inflation affects you, and how the Money Supply affects Inflation and Who Inflation Hurts the Most. I also spoken at length about the value of gold as the Timeless Inflation Hedge and how Gold is Still Money. Today, Wendy McElroy, author of The Art of Being Free shares a deep and fascinating research on all the main issues we face: the loss of security in the name of security, the state's role in strangling … [Read more...]

Will Greece Follow Iceland or Weimar Germany?

In Iceland the bankers were told to stuff it. In Weimar Germany they resorted to the printing press. Which model will modern day Greece follow?It seems that the words Weimar Germany and Hyperinflation are almost synonymous. The Weimar Republic (Das Weimarer Republik in German) is the name of the democratic government which was established in 1919 when Germany was defeated in WWI and Emperor Wilhelm II abdicated the throne. The problem came from the War repairations that were foisted upon Germany by the winners and the growing internal unrest which was allowing the Nazi's to gain a foothold. In an effort to pay their debts, promote full employment, and fight back against growing competitive … [Read more...]

What is the Significance of the Fiat Currency?

Last month in an article entitled What Is Fiat Currency? we told you that "Fiat currency is a term that is used to describe a currency which is created by “fiat” or “arbitrary order or decree” of the government." This month we would like to talk a little about the significance of Fiat currency. ~ Tim McMahon, editor. Fiat Currency Currency that is declared by a government to be a legal tender is referred to as a ‘Fiat Currency’. This type of currency owes its value strictly to the government’s acceptance of it for paying taxes and requiring its acceptance for "all debts public and private". It is not backed by reserves or any physical commodity and is defined as nonconvertible paper money … [Read more...]

What You Need to Know About the Federal Reserve System

The Federal Reserve System If you saw the HBO movie “Too Big to Fail,” you may have the notion that the Federal Reserve System, commonly known as The Fed, deals with high level banking issues that have worldwide implications. And you would be right. But The Fed also regulates banking functions that affect individual Americans, ranging from regulating debit card overdraft fees and limiting gift card fees to issuing U.S. Treasury savings bonds. History of the Federal Reserve The Founding Fathers were cautious about establishing a central bank, thinking that it would encourage irresponsible borrowing by the government. As a result, America functioned without a central bank throughout the … [Read more...]