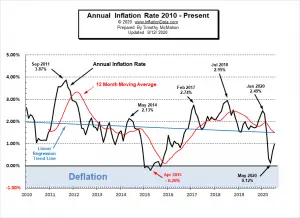

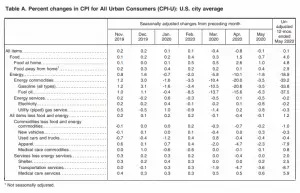

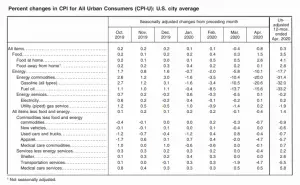

Annual Inflation Still Below 1% Annual Inflation rose from 0.65% in June to 0.99% in July. CPI Index rose to 259.101 in July. Monthly Inflation for July was 0.51%, June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. The FED may be slowing its "Quantitative Easing" in an effort to prevent hyperinflation. FED Funds Rate up slightly but still remains near Zero. Next release September 11th Annual inflation for the 12 months ending in July was 0.99%, June was 0.65%, May was 0.12%, April was 0.33%, March was 1.54% down sharply from February's 2.33% and January's 2.49%. The CPI index itself was up from 257.797 in June to 259.101 in … [Read more...]

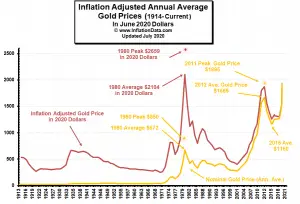

3 Factors Causing the Current Gold Rally

A variety of factors affect the price of gold. Currently, many of them are combining to drive the price of gold to all-time record highs. Let's look at a few of the factors that affect the price of gold. 1) Uncertainty- Gold is a Crisis Hedge We have said this many times over the years but it bears repeating again gold is more of a crisis hedge than an inflation hedge. When uncertainty rears its ugly head... gold does well. That uncertainty can take many forms and one of them is "monetary uncertainty". So if people don't know what the value of their money is going to be in the future (i.e. inflation) they will shift some of their assets to gold (driving up the price of gold). So as far as … [Read more...]

Inflation Quintuples… Still Below 1%

Annual Inflation Rebounds Annual Inflation rose to 0.65%. CPI Index rose from 256.394 in May to 257.797 in June. Monthly Inflation for June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. The FED may be slowing its "Quantitative Easing" in an effort to prevent hyperinflation. FED Funds Rate up slightly but still remains near Zero. Next release August 12th The Bureau of Labor Statistics Released the Inflation Data for the 12 months ending in June on July 14th. Monthly Inflation SOARS to 0.55%. Annual inflation for the 12 months ending in June was 0.65%, May was 0.12%, April was 0.33%, March was 1.54% down sharply from February's … [Read more...]

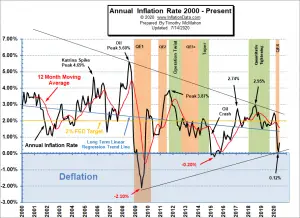

Is the FED Tightening or Is Hyperinflation on the Horizon?

Recently a prophecy has been trending on YouTube. In it, the possibility of major upheaval in November is mentioned, combined with the possibility of hyperinflation. As I've mentioned before, beginning in March 2020, the FED created massive amounts of liquidity through Quantitative Easing in an effort to combat the monetary effects of shutting the country down due to the virus. If that is combined with a reduction in the quantity of goods and services created due to the virus or riots shutting down the means of production we could see hyperinflation. So that would play into fulfilling that prophesy. Back on April 1st, I wrote an article entitled Will the $2 Trillion Covid-19 Stimulus … [Read more...]

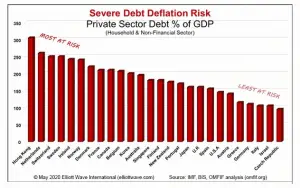

5 Countries Most at Risk for Deflation

People often confuse Deflation and Depression perhaps because in the 1930s the U.S. experienced a lot of both of them at the same time. This combined with the similarity in the sound of the words tends to compound the confusion. But they are not synonymous, it is quite possible to have an inflationary depression as the Hyperinflation in Weimar Germany from 1919-1923 shows. Just as inflation is more than just rising prices, deflation is more than just "falling prices". In both cases, the terms "inflation" and "deflation" actually refer to the macro "cause" while the change in prices is simply the "effect". Unfortunately, lazy speech tends to confuse the "cause" with the "effect". So when … [Read more...]

May Inflation “Astonishingly Low”

The Bureau of Labor Statistics Released the Inflation Data for the 12 months ending in May on June 10th. Inflation is virtually ZERO at 0.12%. Annual Inflation Retreats Annual Inflation fell again to 0.12% in May from 0.33% in April. CPI Index rose marginally from 256.389 in April to 256.394 (virtually identical). Monthly Inflation for May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%... typically January through May are highly inflationary so this is VERY unusual. The FED continues to crank up the "printing presses" using "Quantitative Easing" in an effort to stimulate the economy in the wake of COVID-19. FED Funds Rate remains near Zero. Next … [Read more...]

Why Inflation Affects Various Individuals Differently

The cause and effect are both commonly called "inflation" which can cause some confusion. Typically, "Inflation" is defined as "an increase in the cost of a basket of goods over time". Technically this should be called "Price Inflation" which is often the result of "Monetary Inflation". As we have discussed in "What is Inflation", monetary inflation can also be referred to simply as "inflation." Inflation is a common phenomenon that affects millions of households every year. Let's look at how it affects various types of individuals. Inflation and Income A fixed income combined with rising prices decreases the ability of people to purchase the same number of goods. As inflation … [Read more...]

April Inflation Near Zero

The U.S. Bureau of Labor Statistics (BLS) released its April Inflation report on May 12th, 2020, for the 12 months through the end of April 2020. Annual Inflation Down Sharply... Again! Inflation fell sharply to 0.33% in April from 1.54% in March, 2.33% in February and 2.49% in January. CPI Index in 258.115 in March fell to 256.389 in April. Monthly Inflation for April was -0.67%, March was -0.22%, February was 0.27% typically January through May are highly inflationary so this is VERY unusual. The FED has massively cranked up the "printing presses" using "Quantitative Easing" in an effort to stimulate the economy in the wake of COVID-19. FED Funds Rate down to near … [Read more...]

What Causes Inflation? Rising Prices Explained

Economists say that there are 3 major causes of inflation. They are: Cost-Push Inflation Demand-Pull Inflation An increase in the Money Supply https://youtu.be/UMAELCrJxt0 What is Cost-Push inflation? As the cost of raw materials or wages increases it causes producers to be forced to increase the cost of their products in order to be able to cover their costs of production and a reasonable profit. This results in a “snowball effect” as these new products raise the prices of other products. But that leads us to the “chicken or the egg” question. What caused the cost of raw materials or wages to rise in the first place? It is possible for foodstuffs to be in short supply due … [Read more...]

The 2008 Financial Crisis

Approximately every 50 to 80 years the world experiences an economic meltdown of catastrophic proportions. The one most people think of is the “Great Depression” of the 1930s. But the more recent example is the 2008 Financial Crisis. This crisis had the potential to be as bad as the Great Depression but Government action i.e. Unemployment Insurance and massive liquidity pumping was able to mitigate the effects somewhat. However, even with those actions, U-3 unemployment reached 10.6% and U-6 unemployment which is more like the measurement used in the 1930s reached 18%. What Caused the 2008 Crisis? The 2008 crisis is the culmination of a series of missteps and failed legislation. … [Read more...]