I recently received the following question about unemployment from a gentleman in Tanzania and I thought it was a good question and I would share the answer with you. What Causes Unemployment? I have been thinking on that situation of unemployment. Why does the rate of unemployment increase day after day? Does it mean that people have decreased the rate of thinking on creating jobs or there is any other reason? ~ Lioba from Dar-es-Salaam Tanzania. Here is my Response: Lioba, That is a very good question. Unemployment is a function of how efficient the marketplace is. In a purely agricultural economy, there is no unemployment, everyone has to work, if they don't work they don't eat. … [Read more...]

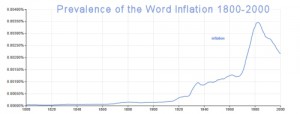

The Language of Inflation

Just the other day I was thinking about language and how it molds our thought processes. In some aboriginal tribes they don't have words for past, present and future tense. They would just say "I go home" this could mean "I went home", "I am going home" or "I will go home". It has been proven that in societies like this the concept of time is very muddled if almost non-existent. How can you plan for your future if you don't understand the concept of time? Lest we English speakers get all smug about the superiority of our language, ancient Greek was more precise than English in many aspects such as the word Love with at least three different words that we translate as "Love". And Eskimos are … [Read more...]

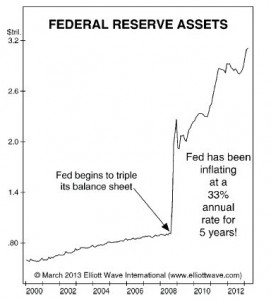

Deflationary Forces Overpower FED

Despite Bernanke's famous helicopter speech the FED's powers really are not unlimited. There is only so much they can do to stimulate the economy. After all they can't force people who are concerned about their future to borrow money. Just like a turtle people naturally recoil and pull back when times are uncertain. And even if they wanted to borrow bankers are reluctant to lend in uncertain times. This results in a phenomenon called Pushing on a String where no matter how hard the FED tries very little force is exerted on the economy. Robert Prechter believes that this is exactly what has been happening over the last few years where the FED has been trying to stimulate the economy but the … [Read more...]

Inflation and Your Retirement Nest Egg

Inflation has a big effect on the future value of our nest egg. As we begin to think about retirement we dream of our "magic number" that amount of money that we will need to retire comfortably. But with the rate of inflation constantly changing in is like trying to take aim at a moving target. To make matters worse it's not just the value of the money that is changing it is also the amount of interest you can earn on that money. With the FED actively working to keep interest rates low your savings often earn virtually "Nil" in the way of interest and to make matters even worse once inflation and taxes take their bite your nest egg might actually be shrinking. In today's article Dennis … [Read more...]

Pushing on a String, Velocity of Money and Money Multiplier Conspire Against the FED

Under certain circumstances such as high national indebtedness, fear of bad economic times or when interest rates approach zero, monetary policy becomes ineffective in enticing consumers into spending more money. Economists refer to this as "Pushing on a String" because if the basic demand doesn't exist to induce people to spend money, it can't be forced through monetary policy. Prime examples of this are during the Great Depression in the United States and in Japan since the 1990s. And as Lacy Hunt explains we are once again facing this problem in the United States since 2008. ~Tim McMahon, editor Federal Reserve Policy Failures Are Mounting By Lacy H. Hunt, Ph.D., Economist The Fed's … [Read more...]

BLS Recovering From Shutdown

The government shutdown is over and the U.S. Bureau of Labor Statistics is recovering from their unscheduled vacation. The United States federal government shutdown of 2013, lasted from October 1 to 17, 2013. Unemployment data for the month of September was due to be released on October 4th i.e. four working days into the shutdown. So the employment data is now scheduled for release on October 22nd. And the Consumer Price Index which is used to calculate the September inflation rate, which was scheduled for release on October 16th is now scheduled for release on October 30th. Although the shutdown inconvenienced vacationers wanting to see National Monuments and the National Zoo, did it … [Read more...]

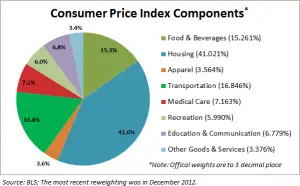

Consumer Price Index Definition

What is the Consumer Price Index? The Consumer Price Index is simply a basket of goods that is used by the Bureau of Labor Statistics to gauge how much price inflation the economy is experiencing. It is "weighted" based on how much of each good the average family uses. Therefore if 41% of your expenses are related to the housing category and 3.6% of your expenses are related to the apparel category and Apparel goes down by 1% and housing goes up by 1% your overall expenses will still be going up. In other words, if you spend $820 on rent a month and $72 on clothes a 1% increase in your rent would add $8.20 to your monthly rent expenses while a -1% would only save you $0.72 on … [Read more...]

What’s So Bad about Shutting the Government Down?

It all seems a bit silly. On Monday the National Park Service declared that the open-air Veterans Memorial would be closed during the shutdown. After all they have to prove there is some "pain" involved in shutting down the government. But a bunch of 80-90 year old veterans would have none of it and they tore down the blockades. So the park service made a 180-degree turn and declared their visits now constitute protected “First Amendment activity” . Basically they had no choice, what were they going to do? Shoot the old war heroes? Put them all in jail? It's like a bit of a joke. No their backs are against the wall, somehow they must impress on us common rabble how important the … [Read more...]

Taper Caper: The Consequences of Institutionalizing Q.E.

By Ben Hunt, Ph.D. Previously, we discussed the Bureaucratic Capture of the FED and the institutionalizing of QE. QE is adrenaline delivered via IV drip ... a therapeutic, constant effort to maintain a certain quality of economic life. This may or may not be a positive development for Wall Street, depending on where you sit. I would argue that it’s a negative development for most individual and institutional investors. But it is music to the ears of every institutional political interest in Washington, regardless of party, and that’s what ultimately grants QE bureaucratic immortality. It is impossible to overestimate the political inertia that exists within and around these massive … [Read more...]

Taper Caper: Has the FED Been “Politicized” or “Captured”?

By Ben Hunt, Ph.D. Two things happened this week with the FOMC announcement and subsequent press conferences by Bernanke, Bullard, etc. – one procedural and one structural. The procedural event was the intentional injection of ambiguity into Fed communications. As I’ll describe below, this is an even greater policy mistake than the initial June FOMC meeting when “tapering” first entered our collective vocabulary. The structural event ... which is far more important, far more long-lasting, and just plain sad ... is the culmination of the bureaucratic capture of the Federal Reserve, not by the banking industry which it regulates, but by academic economists and acolytes of government … [Read more...]