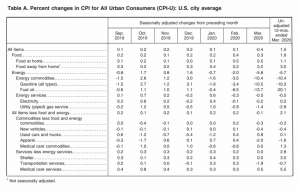

The U.S. Bureau of Labor Statistics (BLS) released its March Inflation report on April 10th, 2020, for the 12 months through the end of March 2020. Annual Inflation Down Sharply Inflation fell sharply to 1.54% in March from 2.33% in February and 2.49% in January. CPI Index in February was 258.679 and fell to 258.115 in March. Monthly Inflation for March was -0.22%, February was 0.27% typically January through May are highly inflationary so this was VERY unusual. The FED has massively cranked up the "printing presses" using "Quantitative Easing" in an effort to stimulate the economy in the wake of COVID-19. FED Funds Rate down sharply. Next release May 12th Annual … [Read more...]

Inflation Expectations and the FED

As inflation expectations rise the FED has less and less "wiggle room" to stimulate the economy. But how do you measure "inflation expectations"? In today's article, Chris Ciovacco will show us. ~Tim McMahon, editor Low Inflation Leaves Fed’s No Taper Door Open Fed Lost Control In 2008 In early December, we used Japan as an extreme example of why central banks are terrified of allowing their respective economies to slip into a deflationary spiral. Do the same concepts apply to the United States? They do. The federal government offers standard Treasury bonds (IEF) and Treasuries that provide some protection against inflation (TIP). The law of supply and demand tells us that when demand … [Read more...]

Deflationary Forces Overpower FED

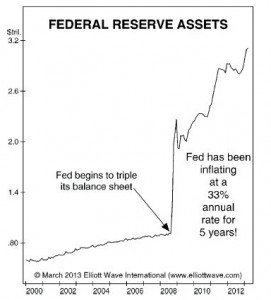

Despite Bernanke's famous helicopter speech the FED's powers really are not unlimited. There is only so much they can do to stimulate the economy. After all they can't force people who are concerned about their future to borrow money. Just like a turtle people naturally recoil and pull back when times are uncertain. And even if they wanted to borrow bankers are reluctant to lend in uncertain times. This results in a phenomenon called Pushing on a String where no matter how hard the FED tries very little force is exerted on the economy. Robert Prechter believes that this is exactly what has been happening over the last few years where the FED has been trying to stimulate the economy but the … [Read more...]

What are “Foreign Exchange Reserves”?

Will the U.S. Dollar Be Replaced as the World's Reserve Currency? Foreign Exchange Reserves are foreign money held by International banks for use in international trade and in an effort to diversify their holdings and hedge against the inflation of their own currency. The most common items bought and sold with their foreign exchange reserves are oil and gold. Up until 1944 the asset of choice was gold and it was used as the medium of exchange between countries to settle their debts. But in July 1944, delegates from the 44 Allied nations gathered in Bretton Woods, New Hampshire., and made the U.S. dollar the reserve currency of the world. At that time, the dollar was pegged at $35 per ounce … [Read more...]

Gold and the Federal Reserve

Gold-US Dollar Link by Chris Vermeulen The $1800 per ounce level continues to be a major technical resistance area for gold. After hovering near $1800 recently, gold moved sharply away from that level last week to close at $1735 an ounce. Despite that, more fund managers and analysts continue to point to a bright long-term future for gold prices. John Hathaway of the Tocqueville Gold Fund says gold will reach new highs within a year. He based his forecast, like many others, on the fact that negative real interest rates look likely to persist as Ben Bernanke and the Federal Reserve continue to print money. Believe it or not, some mainstream analysts are also touting gold’s … [Read more...]

What is the Real Purpose of the Federal Reserve?

The Federal Reserve- Is the Federal Reserve really doing such a bad job… or does it actually do exactly what it's supposed to do, but the average American is in the dark about what that is? The Federal Reserve is merely a "Cartel" of Bankers whose primary purpose is to promote their own interests and not the interests of the American public. "They create money out of nothing, move it around a bit and then collect interest on it." If your or I tried to do that we'd be arrested. “The Fed’s sole purpose: keeping the banks afloat” – G. Edward Griffin In this explosive video, Casey Summit speaker G. Edward Griffin, author of The Creature from Jekyll Island, talks about the Fed's real role … [Read more...]

What is Quantitative Easing?

Is Quantitative Easing Money Printing? Quantitative Easing is often referred to as "money printing" or a way for the government to increase the money supply. According to Wikipedia, quantitative easing is different from the typical method whereby governments buy treasury debt to increase the money supply. In QE1 when the market was panicked, and banks didn't want to buy government bonds, the central bank implemented "quantitative easing" by purchasing relatively worthless financial assets (like mortgage backed securities) from banks and giving them new electronically created money. So this is straight forward money printing compared to the more round about traditional method. Thus … [Read more...]

The Fed Resumes Printing

By Bud Conrad, Casey Research The Federal Reserve recently announced important policy changes after its Federal Open Market Committee (FOMC) meeting. Here are the three most important takeaways, in its own words: The Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions – including low rates of resource utilization and a subdued outlook for inflation over the medium run – are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for … [Read more...]

Has the Fed Started QE3?

By Bud Conrad, Casey Research The Fed surprised the market by extending its policy of 0 to 0.25% Fed funds rate to mid-2013. The way the Fed manages to drive rates lower is to buy Treasuries with newly created money – driving the price up and the rates down. The big question is whether the policy will have a sizeable effect on markets. The chart below shows the historical jump in the Fed’s combined policy tools that were used to lower rates and bail out financial institutions through a variety of programs. These include the big purchase of mortgage-backed securities (MBS) called QE1 and the large purchase of Treasuries called QE2. The point of the extrapolation in the chart is just to … [Read more...]

Bernanke Is Making the Crisis Worse

By Bud Conrad, Chief Economist, Casey Research The Fed is a corrupt and powerful institution, and Chairman Bernanke is making the global crisis worse. His new speech given last week in Europe was terribly misguided and will upset markets as the Chinese and Germans won't ignore his challenges. Bernanke’s interpretations of the markets have been wrong since before he was appointed to head the Fed, and his actions are doing nothing but aggravating the situation. In this seminal speech, titled “Rebalancing the Global Recovery,” Bernanke not only defended QE II as the right policy, but also attacked the monetary policy of China, the biggest holder of U.S. debt, an action that must be … [Read more...]