Recently a prophecy has been trending on YouTube. In it, the possibility of major upheaval in November is mentioned, combined with the possibility of hyperinflation. As I've mentioned before, beginning in March 2020, the FED created massive amounts of liquidity through Quantitative Easing in an effort to combat the monetary effects of shutting the country down due to the virus. If that is combined with a reduction in the quantity of goods and services created due to the virus or riots shutting down the means of production we could see hyperinflation. So that would play into fulfilling that prophesy. Back on April 1st, I wrote an article entitled Will the $2 Trillion Covid-19 Stimulus … [Read more...]

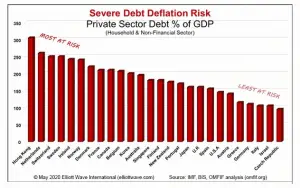

5 Countries Most at Risk for Deflation

People often confuse Deflation and Depression perhaps because in the 1930s the U.S. experienced a lot of both of them at the same time. This combined with the similarity in the sound of the words tends to compound the confusion. But they are not synonymous, it is quite possible to have an inflationary depression as the Hyperinflation in Weimar Germany from 1919-1923 shows. Just as inflation is more than just rising prices, deflation is more than just "falling prices". In both cases, the terms "inflation" and "deflation" actually refer to the macro "cause" while the change in prices is simply the "effect". Unfortunately, lazy speech tends to confuse the "cause" with the "effect". So when … [Read more...]

Why Inflation Affects Various Individuals Differently

The cause and effect are both commonly called "inflation" which can cause some confusion. Typically, "Inflation" is defined as "an increase in the cost of a basket of goods over time". Technically this should be called "Price Inflation" which is often the result of "Monetary Inflation". As we have discussed in "What is Inflation", monetary inflation can also be referred to simply as "inflation." Inflation is a common phenomenon that affects millions of households every year. Let's look at how it affects various types of individuals. Inflation and Income A fixed income combined with rising prices decreases the ability of people to purchase the same number of goods. As inflation … [Read more...]

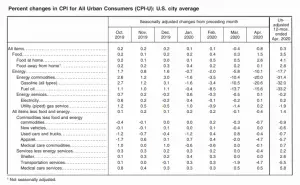

April Inflation Near Zero

The U.S. Bureau of Labor Statistics (BLS) released its April Inflation report on May 12th, 2020, for the 12 months through the end of April 2020. Annual Inflation Down Sharply... Again! Inflation fell sharply to 0.33% in April from 1.54% in March, 2.33% in February and 2.49% in January. CPI Index in 258.115 in March fell to 256.389 in April. Monthly Inflation for April was -0.67%, March was -0.22%, February was 0.27% typically January through May are highly inflationary so this is VERY unusual. The FED has massively cranked up the "printing presses" using "Quantitative Easing" in an effort to stimulate the economy in the wake of COVID-19. FED Funds Rate down to near … [Read more...]

What Causes Inflation? Rising Prices Explained

Economists say that there are 3 major causes of inflation. They are: Cost-Push Inflation Demand-Pull Inflation An increase in the Money Supply https://youtu.be/UMAELCrJxt0 What is Cost-Push inflation? As the cost of raw materials or wages increases it causes producers to be forced to increase the cost of their products in order to be able to cover their costs of production and a reasonable profit. This results in a “snowball effect” as these new products raise the prices of other products. But that leads us to the “chicken or the egg” question. What caused the cost of raw materials or wages to rise in the first place? It is possible for foodstuffs to be in short supply due … [Read more...]

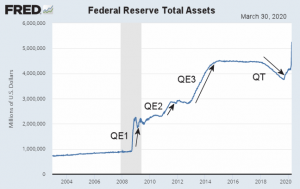

Will the $2 Trillion Covid-19 Stimulus Cause Inflation?

The current round of massive Corona Virus easing began Monday March 16th, 2020, with the FED buying $40 billion in Treasuries and then buying another $50 billion in Treasuries on Tuesday. By Thursday morning, it had upped the plan to $75 billion PER DAY and added $10 billion in mortgage securities. By Friday morning, the Fed had decided to buy $107 billion worth of Treasuries and mortgage-backed securities. In its first week, the FED purchased $317 billion worth of assets, which is slightly faster than the Fed balance sheet grew at the height of the 2008-2009 financial crisis. Initially, the Federal Reserve estimated purchases of $500 billion but FED chief Jerome Powell said the initial … [Read more...]

Inflation: The Hidden Tax

The media and the Central Bank (i.e. The U.S. Federal Reserve aka. the "FED") tells us that a little bit of inflation is a good thing. Inflation gets the ball rolling, greases the wheels of commerce, and stimulates the economy. The FED sets as a goal 2% inflation, so inflation must be good for us, right? Two Forms of Inflation Well, it is good for someone but not necessarily for you i.e. the consumer. The first problem comes because there are two different types of “inflation” and by interchanging them we end up with a form of Orwellian “double-speak”. The first kind of inflation is “monetary inflation” i.e. an increase in the overall money supply. This is accomplished by a complex process … [Read more...]

November Annual Inflation Jumps Up But…

The U.S. Bureau of Labor Statistics (BLS) released its November Inflation report on December 11th, 2019, for the 12 months through the end of November 2019. November Inflation is Up Annual inflation in November was 2.05% up from October's 1.76%. The last time inflation was this high was in April. Inflation has been in a narrow range through much of 2019. 1.79% in May, 1.81% in July, 1.65% in June, with a high of 2.00% in April. Inflation peaked at 2.95% in July 2018. The CPI-U index in November was 257.208 down from 257.346 Monthly Inflation for November was -0.05% much higher than -0.33% in November 2018. Next release January 14th The CPI index itself actually … [Read more...]

Modern Monetary Theory

Recently Freshman Congresswoman Alexandria Ocasio-Cortez (AOC) thrust Modern Monetary Theory (MMT) into the popular limelight by suggesting that MMT was how the U.S. could pay for her "Green New Deal". What is MMT and how is it different from good old "Money Printing"? History is rife with examples of countries that tried to print money without any “governor” on the quantity of money printed. Recent examples include Argentina, North Korea, Zimbabwe, and Venezuela. See: 27 examples of hyperinflation from ancient Egypt through modern-days. In today's article Charles Hugh Smith of Daily Reckoning looks at why Modern Monetary Theory Won't Work. We've reprinted the following article by … [Read more...]

Investing to Fight Inflation

While inflation has been low in most developed countries over the last decade, there are places where it is starting to pick back up, with stronger growth outlooks for several major economies. As we can see from the chart below the OECD is projecting massive inflation in 2020 for both Turkey and Argentina at 12.6% and 22.7% respectively. The average of all OECD countries is a low 2.4%. The OECD Inflation projection for the European Union (EU) is also surprisingly low. Who would have thought that countries like Italy, Spain and Portugal could maintain such low inflation rates, with the highest being Hungary at 3.8%. Back in June 2019, the Telegraph published an article about how the … [Read more...]