Since financial stocks make up 14% of the S&P 500 Index, it is difficult to sustain a rally without strength in banks and financial services firms. With the Fed and ECB opening up the liquidity fire hydrant in late December 2011, bank stocks experienced another in a series of monster bailout rallies. As outlined below, the Financials Select Sector ETF (XLF) may be poised to give back some gains over the coming sessions based on numerous factors including reduced odds of QE3. Unfortunately in the debt-saddled world we live in, central banks may be the most important driver of asset prices. Dallas Fed President Richard Fisher told reporters after a speech Wednesday: There will be no … [Read more...]

Exploring the Not-So-Altruistic Aspects of the “Buffett Rule”

By Robert Ross, Casey Research This week, President Obama released his $3.8-trillion budget for fiscal year 2013. The plan calls for new taxes on the wealthy, a restructuring of the tax code, and short-term infrastructure spending aimed at boosting the economy (albeit artificially). Also included in the budget are limitations on subsidies for oil and gas companies, an end to the Bush tax cuts, and a proposal to raise taxes on dividends, which could be as high as 39.6% for households making over $250,000 per year. Although Senate Minority Leader Mitch McConnell (R-KY) dismissed the proposal as "a campaign document," the White House claims the measure would generate $206 billion in … [Read more...]

The Fed Resumes Printing

By Bud Conrad, Casey Research The Federal Reserve recently announced important policy changes after its Federal Open Market Committee (FOMC) meeting. Here are the three most important takeaways, in its own words: The Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions – including low rates of resource utilization and a subdued outlook for inflation over the medium run – are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for … [Read more...]

How Does the Value of the U.S. Dollar Fit Into the Big Picture for the Economy?

Robert Prechter discusses his views on the credit crisis and the U.S. dollar More credit is denominated in U.S. dollars than any other currency. What does this mean for the value of the dollar as the credit crisis continues its strangle-hold on the world economies? Enjoy this video clip of Bob Prechter from an October interview with The Mind of Money host Douglass Lodmell, in which Bob discusses the debt implosion and the value of the U.S. dollar. You can watch Prechter's full 45-minute interview here -- no sign up required! Watch the full 45-minute interview FREEGet even more valuable insights as Mind of Money host Douglass Lodmell interviews Elliott Wave … [Read more...]

How Inflation Affects Personal Debt Consolidation

What is the effect of inflation? As a result of inflation, the value of tomorrow’s money decreases with regards to today’s money. In other words, you can purchase less with the same amount of money. This is commonly seen as prices having increased. This can make the situation appear more appealing for borrowers because they can buy today and pay back with less valuable dollars. But lenders and creditors don't appreciate receiving less valuable dollars. So, in order to offset the declining value lenders and creditors increase the interest rates they charge. Thus inflation in general results in increased financial problems all around. It not only results in rising commodity prices but … [Read more...]

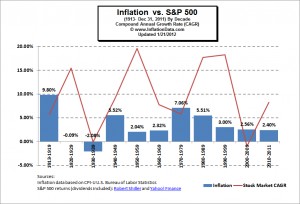

Is There a Correlation Between Inflation and the Stock Market

When inflation is high and commodity prices are rising on what seems like an almost daily basis, have you ever wondered how that might affect the price of stocks? Recently I received the following question: "In the years leading up to the great depression and the great recession, the DJIA nearly quadrupled. My question is... what the cost of living did in these time periods and if there is a correlation between the stock market and the cost of living? John Kelsch" ************ John, Great question! You would think that if all commodities are going up stocks would probably go up as well, since companies produce commodities. But that isn't always the case. Often high … [Read more...]

Fed To ‘Hold Off’ On QE 3

We noted extreme levels of optimism earlier today. What could possibly trigger a correction in stocks and commodities? If the Fed fails to signal and/or announce another round of quantitative easing (QE), it would undoubtedly leave the markets disappointed. The Fed uses the Wall Street Journal (WSJ) as a medium to communicate with the markets. It is possible someone at the Fed picked up the phone and said, “We need to temper short-term expectations for another round of QE. Can you help us out?” Friday’s WSJ has an article titled “Fed Holds Off For Now on Bond Buys”. Notice the word “may” is not included. Here is the first paragraph of the article: Federal Reserve officials are waiting … [Read more...]

The US Government Is Bankrupt

By Doug Casey, Casey Research Everyone knows that the US government is bankrupt and has been for many years. But I thought it might be instructive to see what its current cash-flow situation actually is. At least insofar as it's possible to get a clear picture. As you know, the so-called Super Committee recently tried to come up with a plan to cut the deficit by $1.5 trillion and failed completely. To anyone who understands the nature of the political process, the failure was, of course, as predictable as it was shameful. What's even more shameful, though, is that the sought-after $1.5 trillion cut wasn't meant to apply to the annual budget but to the total budget of the next 10 years … [Read more...]

How Global Financial Developments are Affecting the Price of Gold

Let’s face it. With the US economy facing the bitter consequences of extravagance and unscrupulous spending, it has become quite difficult for the US to manage both its public and private debts now. In this phase of post recession hangover and economic meltdown, the U.S. federal government has bumped up against its permitted borrowing limit. According to Alison Fraser, director of the Roe Institute for Economic Policy Studies, America’s debt just crossed $15 trillion, which means presently, the amount owed by the United States government to the world, is equivalent to the amount produced by the American economy per year. All these factors lead to higher prices and intensifying inflation … [Read more...]

Preparing Your Finances for 2012

Looking ahead to a new year and planning for the future It's hard to believe that 2011 has passed so quickly and that 2012 will soon be here. Now is a good time to look back over the past year and assess your finances. Did your choices this year put you in better or worse circumstances? Do you have the information needed to make wise decisions in the next year? Are you prepared to protect your financial future? The following excerpt from Conquer the Crash explains the importance of preparing and taking action now so that you'll be ready for what's ahead. You can read 8 more chapters from Conquer the Crash -- 42 pages of critical information, including a list of imperative "dos and … [Read more...]