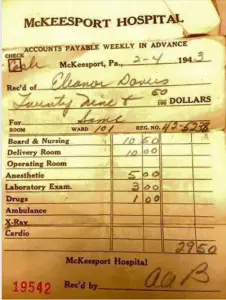

Healthcare spending in the U.S. is higher than in any other nation. As of this writing hospital services have increased 7.2% over the last 12 months. In 2022, healthcare costs reached $4.5 trillion, with individuals spending an average of $13,493 annually. With soaring prescription drug prices, higher deductibles, and premium increases, costs are getting out of hand. According to Price Waterhouse, "The cost of treating patients is on the rise. The healthcare industry is under pressure from high inflation, rising wages, and other costs, which are only compounded by clinical workforce shortages. Health payers are negotiating pricing with hospitals while provider profit margins continue to … [Read more...]

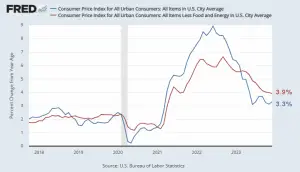

Have Wages Kept Up with Inflation in 2023?

There seems to be a perennial debate about whether wages are keeping up with inflation. The media in particular loves to stoke this particular divide. We delved into this a bit in our article Not All Prices Have Inflated Since 1964 in which we showed that although wages in nominal terms haven't kept up for the "median" worker, but the "average" worker is doing better. This indicates that many workers are better off than in 1964, but not all (on a purely inflation-adjusted basis). Despite the numbers, purchasing power in many technology sectors has multiplied so many times and quality has increased so drastically that even though overall prices multiplied ten-fold, things like Televisions … [Read more...]

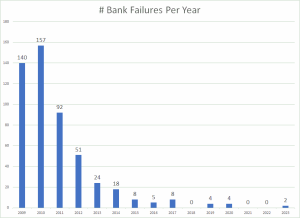

The 3 Major Causes of Bank Problems

There are three major categories of problems that can cause bank instability. In his article "A Tale of Two Crises" Bloomberg's John Authers tells us that they are: a liquidity crisis- When customers pull their money out. a solvency crisis- When borrowers can fail to repay their loans. a confidence crisis- When shareholders sell the bank's stock, sending their shares down making it harder to raise money. And beyond true crises, changes in economic and financial conditions can attack their profits — which is bad for shareholders and ultimately might tend to imperil everyone connected to the bank. Understanding a Liquidity Crisis One of the primary causes of a Liquidity … [Read more...]

InflationData Ranked Number 1 Inflation Blog

We just received notification that InflationData was Ranked the Number 1 Inflation Blog according to Feedspot Inflation Blogs: Their commentary says: "We’ve carefully selected these websites because they are actively working to educate, inspire, and empower their readers with frequent updates and high-quality information." #1 InflationData- That's us. But I thought you might find it interesting to see who else ranked in the top 10 so here they are: … [Read more...]

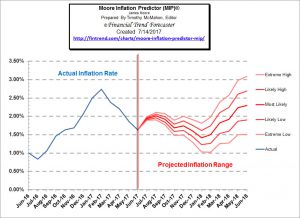

Inflation 1.63% in June

The U.S. Bureau of Labor Statistics released the Annual Inflation Rate data for the year ending in June on July 14th 2017. Annual inflation was 1.63% in June - down from 1.87% in May, 2.20% in April, 2.38% in March, 2.74% in February, and 2.50% in January. June CPI-U 244.955-- May CPI-U 244.733 Monthly Inflation for June 0.09%, May 0.09%, April was 0.30%, March was 0.08%, February was 0.31% and 0.58% in January. Next release August 11th Annual Inflation Chart Annual inflation for the 12 months ending in June 2017 was 1.63% down from 1.87% in May, 2.20% in April, 2.38% in March, 2.74% in February and 2.50% in January. The annual cyclical low was 0.84% in July 2016. The … [Read more...]

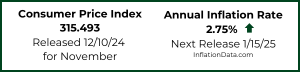

Inflation Rate Falls for April

The U.S. Bureau of Labor Statistics (BLS) released the monthly and annual Inflation numbers for April 2017. Annual inflation was 2.20% down from 2.38% in March, 2.74% in February, and 2.50% in January but above the 2.07% in December. Consumer Price Index (CPI-U) 244.524 up from 243.801 in March Monthly Inflation for April was 0.30% very close to February's 0.31% and similar to the average between March's 0.08% and January's 0.58%. Next release June 14th With Inflation falling almost 2/10ths of a percent and unemployment down one-tenth of a percent the Misery Index is down 3/10ths of a percent. The misery index helps … [Read more...]

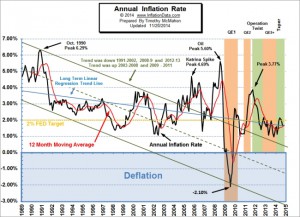

Inflation Flat for October

The Bureau of Labor Statistics released the Inflation rate for the month of October today. Annual inflation remained steady at 1.66% even though prices fell from the month previous (i.e. monthly inflation was -0.25%). However, since monthly inflation was -0.26% in October 2013 annual inflation rates remained virtually identical as October 2013 was replaced by October 2014 in the calculations. The FED has stated that it's goal is to maintain inflation at a steady 2%. But as we can see from the chart they have rarely achieved that goal. If the goal was to remain below 2% we could say they have done very well since 2012 however during that time-period the FED has been fearing deflation … [Read more...]

Australian Banks Rated As Low Risk

Australian Banks and Economic Environment Positive In a world analysis Australian banks have been found to pose a low degree of risk to the global financial system. According to Dr Robert Engle, the 2003 winner of the Nobel Prize in Economics and a professor of finance at Stern School of Business at New York University, the Australian banking system is robust and capitalized enough to endure another financial crisis. He said the economic environment was positive from an Australian perspective and that the liquidity measures that had been implemented were proving to be effective. The comments were made as part of Dr Engle’s presentation on systemic risk within the worldwide financial … [Read more...]

Recruiters Cost Cutting Strategies

Australian Job Market According to a recent report published by News.com.au, the Australian job market, albeit relatively secure for the time being, does have its sore spots. There are numerous types of employment, which, due to the altering economic landscape and shifts caused by the global recession, globalization and the spread of outsourcing and offshoring, are simply not safe anymore. Read on to learn what those unsafe job sectors are, to figure out what recruiters are looking for, in these trying times and to find out about possible strategies employed by companies which are recruiting on a tight budget. Travel. Travel has come to be regarded as a luxury, during a time when the … [Read more...]

The Doom of Wired Telecom

Advances in technology bring many changes to the business world, and certain industries that were once considered viable are now industries that should be avoided at all costs. One industry that is expected to shrink the most dramatically is the wired telecommunications carrier industry. This industry has been rapidly shrinking in response to the increasing widespread use of cell phones and online forms of communication. The need for wired communications has become so low that 25 percent of all households do not even own a land line phone. Some even predict that by 2025, land line phones will completely disappear. … [Read more...]