Small Business Big Profits Recession is a word that strikes fear into the heart of many small business owners and investors, and for good reason. Reports indicate that the number of failing small businesses drastically increased during the recent recession, and many are still in the process of recovering from insolvency due to the economic backlash. Although a recession certainly decreases the overall demand for products because consumers have less money to spend, there are certain companies in almost every industry that find a way to not only survive but thrive during these harsh financial times. Creatively Outdo Competitors to Increase Profits When people have less money to spend they … [Read more...]

Why Buy Gold?

Gold has been one of the best investments over the last decade going from a low of $252 to a high of $1889. If you're looking for a way to protect against the effects of inflation, currency collapse or economic instability, here are a few things to consider about why gold should be in your portfolio. Return to the Gold Standard If you've been paying attention to what is going on in the world these days, you know that the financial markets have been in turmoil. Much of this relates to the basic underpinnings of the economic system. In the United States, the Federal Reserve is in charge of the money supply and interest rates. Nothing is backing the paper money that is printed, other than the … [Read more...]

Why is the US Federal Government Afraid of Deflation?

Deflation: Harry Dent "Understanding Demographics Is Vital to Success" In this segment from one of his talks at the Casey Research Recovery Reality Check Summit, economics expert and author Harry Dent explains how shifting demographic trends lead to economic cycles and why the current US federal government is so afraid of deflation. https://youtu.be/d3EZlY-29Ss Harry's complete presentation – as well as the speeches of 30 other economic and investment luminaries from this Summit – is available to you in MP3 or CD format. Listen to experts like David Stockman, Harry Dent, Lacy Hunt, James Rickards, John Hathaway, Chuck Butler – their assessment of what investors should expect and … [Read more...]

Prepare for your financial future

Position Yourself for the Rest of "Conquer the Crash" The earlier you prepare, the better To this day, I wonder why Robert Prechter's book Conquer the Crash has not been more widely recognized. It described in advance much of what happened in the 2008 financial crisis. Published in 2002, the book provided detailed descriptions of then-future economic scenarios. They were detailed vs. general. Prechter was specific in a way that would prove right or wrong; there was no gray. This is from the book: There are five major conditions in place at many banks that pose a danger: (1) low liquidity levels, (2) dangerous exposure to leveraged derivatives, (3) the optimistic safety ratings of … [Read more...]

What is Quantitative Easing?

Is Quantitative Easing Money Printing? Quantitative Easing is often referred to as "money printing" or a way for the government to increase the money supply. According to Wikipedia, quantitative easing is different from the typical method whereby governments buy treasury debt to increase the money supply. In QE1 when the market was panicked, and banks didn't want to buy government bonds, the central bank implemented "quantitative easing" by purchasing relatively worthless financial assets (like mortgage backed securities) from banks and giving them new electronically created money. So this is straight forward money printing compared to the more round about traditional method. Thus … [Read more...]

Global Debt Market: Biggest Bubble of All Time?

The Global Debt Market -- The Biggest Bubble of All: This One Has Yet to Deflate (Are You Ready?) History shows that once a financial bubble bursts, it can take a long time to bounce back. Recent history offers an example: Real estate prices topped in 2006-2007 -- then came the worst part of the sub-prime mortgage crisis in 2008. Yet instead of recovering with the passage of time, real estate prices just keep getting worse: Home prices dropped for the fifth consecutive month in January, reaching their lowest point since the end of 2002. -- CNNMoney, March 27 As values sink and desperation grows, the number of owners giving their timeshares away for $1 -- or less -- has doubled in … [Read more...]

How to Speculate your Way to Success

Everybody Forced to Speculate? According to an interview with Doug Casey, "Everybody is going to be almost forced to be a speculator to try to stay in the same place. Speculating means capitalizing on politically caused distortions in the marketplace." ~editorHow to Speculate your Way to Success Source: JT Long of The Gold Report (4/20/12) So far, 2012 has been a banner year for the stock market, which recently closed the books on its best first quarter in 14 years. But Casey Research Chairman Doug Casey insists that time is running out on the ticking time bombs. Next week when Casey Research's spring summit gets underway, Casey will open the first general session addressing the … [Read more...]

Why Deficits Are Politically Convenient

Terry Coxon of Casey Research discusses the effects of deficits on the economy and politics. ~editor Deficits: How Far to the Wall? By Terry Coxon, Casey Research Decades of manipulation by the Federal Reserve (through its creation of paper money) and by Congress (through its taxing and spending) have pushed the US economy into a circumstance that can't be sustained but from which there is no graceful exit. With few exceptions, all of the noble souls who chose a career in "public service" and who've advanced to be voting members of Congress are committed to chronic deficits, though they deny it. For political purposes, deficits work. The people whose wishes come true through the … [Read more...]

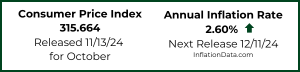

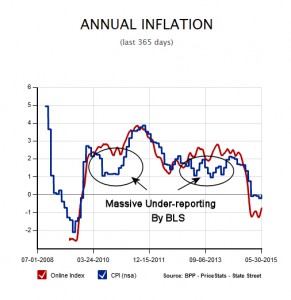

Can We Trust Government Inflation Numbers?

Independent Inflation Tracking Numbers Updated February 19, 2016 For some reason people don't seem to trust the government. I can't understand why. Surely the government only has our best interests at heart and wants to take care of us like good parents, and they are just protecting us from ourselves. And of course all politicians are honest, selfless, hard-working civil servants. Right? Well, Okay maybe they don't always have our best interests at heart. And maybe it would benefit the budget if they didn't have to pay so much for cost of living increases but surely they aren't fudging the Consumer Price Index are they? I frequently get emails, and occasionally phone calls, asking … [Read more...]

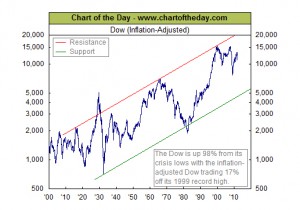

Inflation Adjusted Stock Prices

Adjusted Stock Price Financial advisors will often tell us of the steady increases available only through the stock market and present us with beautiful charts showing the relentless march of the the stockmarket ever higher and to the right. But what about inflation? How does the stock market perform when inflation is taken into consideration? After we take the loss of purchasing power into account have all the gains disappeared? When adjusting stock prices for inflation we typically use the US Bureau of Labor Statistics Consumer Price Index CPI-U. Prices are then calculated in "real" dollars. That means that the price is adjusted so that we can see what it would have cost if prices … [Read more...]