I grew up reading the works of Hans Sennholz, one of the leading thinkers of the Austrian Economics movement. The following article although originally published in 2005 is as timely now as it was then. He was the author and co-author of many books including Money and Freedom, Gold, Freedom, and Free Markets, The Politics of Unemployment, and Man Must Work (an idea that is certainly out of fashion now). Many of his works are out of print and difficult to locate now like Age of Inflation and Debts and Deficits. In 1972, the Congressional Record recorded his wild projection of the federal debt reaching $4 trillion by 1993, when the federal debt was less than $450 billion. The actual figure … [Read more...]

July 4th Cookout Will Cost You 17% More in 2022

Whether you call it a "cookout", "grilling", or a "barbeque", cooking over an outside fire with family and friends on Independence Day is an American tradition. Every year the American Farm Bureau tracks how much the July 4th Cookout family gettogether is going to cost and it's no surprise that the cost is up this year. But what may be a surprise is how much it is up! According to the U.S. Bureau of Labor Statistics (BLS), annual inflation is 8.6%. But according to the Farm Bureau survey the cost of your July 4th Cookout will cost you 17% more in 2022. It is always nice when we can get some independent data on prices. Every year Farm Bureau enlists volunteers from around the country to … [Read more...]

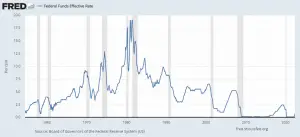

Surprise, Surprise, The FED Raises Rates by .75%

At its June 15th meeting, the FED announced that it will be raising rates by ¾%. Up until last week, this would have been a big shock to the market. But despite the imposed FED silent period leading up to their Wednesday meeting "somehow" journalists from all the major financial publications published remarkably similar articles predicting a 0.75% increase in the FED funds rate. Prior to this leaked guidance, the consensus was that the FED would increase rates by ½% but last week's higher-than-expected inflation report threw a wrench into the works. Everyone is making a big deal out of the fact that this is the first raise of that magnitude since 1994. And that it will double the FED … [Read more...]

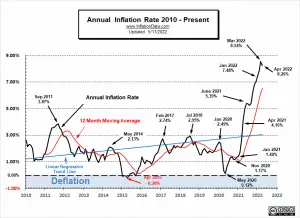

Inflation Takes a Bite Out of Your Food Budget

The Bureau of Labor Statistics reported that in May 2022, Annual Inflation Rose. May Food Inflation Breaks Record: The combined food index (at home and away) increased 10.1 percent for the 12-months ending May, the first annual increase of 10 percent or more since the period ending March 1981. Food at home rose even more... 11.9% over the last 12 months... while food away from home "only" rose 7.4% over the last year. All six major grocery store food group indexes rose in May. The index for dairy and related products rose 2.9 percent, its largest monthly increase since July 2007. The index for nonalcoholic beverages increased 1.7 percent, and the index for other food at home rose … [Read more...]

Inflation Adjusted Gasoline Hits New High

June 10, 2022 Update: AAA says the national average is now almost $5.00 a gallon (and much higher in places like California). That moves the blue dot on the chart below up and prices are now well above inflation-adjusted peaks! June 2, 2022 It's no secret that gasoline prices are skyrocketing. However, a couple of months ago we said that although gas prices were high and rising, they still weren't at record levels when looked at in inflation-adjusted terms. But all that has changed now as gasoline prices continue to climb upward. Today the AAA reported the highest national gas prices they have recorded. Although this is a significant development, all sorts of … [Read more...]

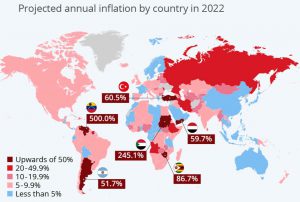

Worldwide Inflation by Country 2022

Click for Larger Image It's not just the United States that is suffering from high inflation, countries worldwide are experiencing higher than average inflation. This is partially due to the global pandemic but even more the result of the actions taken by central banks in response to the pandemic. In this article, we will look at global inflation rates by country and inflation around the world. The World Inflation Rate The average inflation rate around the world is 7.4%. The global inflation rate surged from 4.35% in 2021, and 3.18% in 2020. Jump to: Countries with the Highest Inflation Rates Countries with Hyperinflation Russian Inflation Inflation in Europe EU … [Read more...]

Analyzing 5 Ways You Can Hedge Against Surging Inflation

Inflation in the U.S. has reached levels not seen since the 1980s. That means that millennials have never seen inflation this high. Consequently, they are probably unaware of not only how devasting inflation can be, but also about the best ways to hedge against surging inflation. Simply stated, inflation ravages purchasing power, and the higher the inflation rate, the quicker purchasing power is destroyed. Even if you receive a cost of living (CoL) raise it is usually "too little too late" just like the FED's recent attempts to fight inflation. The reason a CoL raise doesn't help much is because it is a lagging entity. In other words, even if you get a raise equal to the actual level of … [Read more...]

April Inflation Down, But…

The Bureau of Labor Statistics reported that in April 2022, Inflation fell to 8.3% Inflation Summary: Annual Inflation Declined from 8.54% in March to 8.26% in April CPI Index rose from 287.504 to 289.109 Monthly Inflation for April was 0.56%, down from 1.34% in March The next release is on June 10th April 2022 Annual Inflation was 8.26%. Jan. 2021 -- 1.40% ** Jan. 2022 -- 7.48% ** Feb. 2022 -- 7.87% ** March 8.54% Gasoline prices were artificially lower due to a massive release from the Strategic Petroleum Reserves (SPR), which temporarily pushed inflation down in April. The International Energy Agency was not happy that the Biden administration didn't warn them that it … [Read more...]

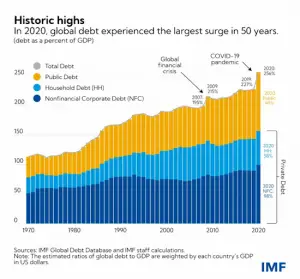

Roots of Our Current Inflation

The government and the FED have been making lots of excuses for the current wave of price inflation but it hasn't occurred by accident, because of oil shocks, or Russian invasions. The foundation for the current wave of rising prices was laid brick by brick over a long period of time. And because of this foundation of debt, a severe financial crisis looms not far ahead. The following article by Antony P. Mueller was reprinted by Creative Commons Permission. ~Tim McMahon, editor 05/02/2022 A Deeply Flawed Monetary System A monetary system that allows the creation of money out of thin air is vulnerable to the fits of credit expansion and credit contraction. Periods of credit expansion … [Read more...]

How Families Are Adjusting To The Crazy Inflation Rates

On April 12th of, 2022, the U.S. Bureau of Labor Statistics (BLS) announced that the annual US inflation rate had reached a record high of 8.5%, a level not seen since December 1981. This level of rapid price increase is being felt all over the nation and even in Europe. Those with low incomes are having the hardest time adjusting to the rapidly increasing cost of living, as is often the case. But working families across the nation are also being forced to adapt and change in order to cope with rising prices. This has impacted every corner of our society, from gas to prices at the grocery store. Adjusting to this level of inflation hasn’t been easy, and here is how some families are looking … [Read more...]