Inflation in the U.S. has reached levels not seen since the 1980s. That means that millennials have never seen inflation this high. Consequently, they are probably unaware of not only how devasting inflation can be, but also about the best ways to hedge against surging inflation. Simply stated, inflation ravages purchasing power, and the higher the inflation rate, the quicker purchasing power is destroyed. Even if you receive a cost of living (CoL) raise it is usually "too little too late" just like the FED's recent attempts to fight inflation. The reason a CoL raise doesn't help much is because it is a lagging entity. In other words, even if you get a raise equal to the actual level of … [Read more...]

How to Prepare for Inflation

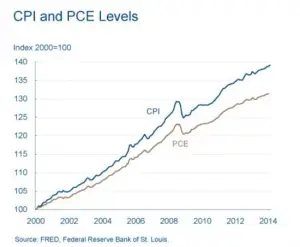

With inflation reaching heights not seen in many years, people are wondering... How to prepare for inflation? And What effects will inflation have on our investments? Between 2020 and 2021, inflation steadily increased from a minuscule 0.12% in May of 2020 to just under 5.4% in June and July of 2021. Although 5+% may not seem like much, it means that prices are 5% higher than they were a year ago. If inflation stays at 5%, you might think it has stabilized, but unfortunately, inflation compounds. So if the inflation rate is still at 5%, next year's prices are now more than 10% higher than last year. So, for instance, after 1 year at 5% inflation, a $100 item now costs $105, but after another … [Read more...]

Safe-Haven Investments that Protect Your Capital From Rising Inflation

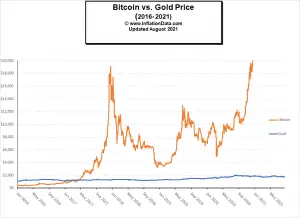

How the Pandemic Created Inflation Given the current state of affairs and how the Covid-19 pandemic has impacted the global economic outlook, an unconventional recession has emerged, prompting many governments to inflate the money supply to counteract the artificially suppressed economic activity. In many countries, this inflated money supply has resulted in consumer price inflation and resulted in investors seeking a safe haven investment. When there's a high level of inflation, economic uncertainty, or financial markets are in turmoil investors flock to safe-haven assets. The rationale is that in times of crisis when most traditional investments are losing value, safe-haven assets tend … [Read more...]

A Stock Pickers Guide To Thinking About Inflation

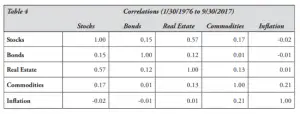

Stock investors sitting on cash and watching the stock market soar to new highs shouldn’t be faulted for missing out on above-average historical returns in 2020. Inflation, along with increasing signs of a market bubble, is a growing area of concern so the prospect of investing in tech giants valued at more than $1 trillion isn’t as appealing as it once was. But investors know that sitting on a portfolio near 100% in cash will see their net worth suffer as a result of inflation. To protect against inflation, investors should consider some of the most popular stocks as of April 2021 as some of them double as a hedge against inflation. Commodity Stocks Offer A Hedge… And A … [Read more...]

Using Risk to Combat Inflation

Inflation is a fact of life that everyone must deal with. Even when inflation is "low", it gradually takes its toll on your assets. The result of low inflation is that your purchasing power gradually erodes even though you might have the same amount of money. In order to combat this, you have to earn more or increase the rate of return on your investments. Often a simple savings account won't even pay enough interest to cover the losses due to creeping inflation. In that case, the only way to beat inflation is to take on additional risk to increase your rate of return. Taking on additional risk, however, means that you could suffer other types of losses. So, in order to properly manage … [Read more...]

Should You Buy an Annuity?

For many cash strapped seniors an annuity sounds like the perfect solution. And it can be if you think you’ll outlive your mortality date. The only trouble is that the insurance companies offering annuities have perfected estimating your mortality date based on factors like gender, birth year, where you live, where you were born, the age your parents died, and your health (or unhealthy) habits. One disadvantage of an annuity is that when you die there is nothing left for your heirs. On the other hand, with an insurance policy you (or your heirs actually) come out ahead if you live less than your mortality date. So in addition to Dennis Miller's advice in the following article you might … [Read more...]

How to Save Your Money And Your Life

Editor's Note: There is only one real way to create wealth and that is to build something. If you take $50,000 worth of lumber, metal and glass and combine it with $50,000 worth of skilled labor you can come up with a $150,000 house. You have in effect created $50,000 out of thin air. Or by machining a $2.00 lump of metal you can create a $20.00 gear or a $200 watch. It all depends on the skillful application of technology to raw materials. Everything else is just rearranging deck chairs on the Titanic. In the short term, rearranging deck chairs can be very profitable for an individual but it doesn't "create wealth" it simply transfers it from one person to another. The rapid pace of … [Read more...]

Using Forex to Hedge against Inflation

Forex Hedge According to Wikipedia-A foreign exchange hedge (FOREX hedge) is typically used by companies to eliminate or hedge foreign exchange risk resulting from transactions in foreign currencies. In other words, if a company in based in one country most of its expenses are denominated in the currency of that country. So if a company is based in the U.S. most of its expenses are in dollars. But if it sells a significant portion of its products in another country like Mexico then a portion of its income will be in Pesos. If the Peso depreciates against the Dollar the value of their income could cause them to lose significantly even though they thought they were selling at a profit. This … [Read more...]