Inflation in the U.S. has reached levels not seen since the 1980s. That means that millennials have never seen inflation this high. Consequently, they are probably unaware of not only how devasting inflation can be, but also about the best ways to hedge against surging inflation. Simply stated, inflation ravages purchasing power, and the higher the inflation rate, the quicker purchasing power is destroyed. Even if you receive a cost of living (CoL) raise it is usually "too little too late" just like the FED's recent attempts to fight inflation. The reason a CoL raise doesn't help much is because it is a lagging entity. In other words, even if you get a raise equal to the actual level of … [Read more...]

How Foreign Currencies Act as an Inflation Hedge

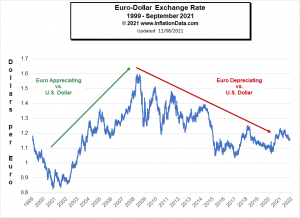

One method investors can use to hedge against inflation is investing in a variety of foreign currencies. The key of course is which currencies you choose as an inflation hedge. You need to invest in those countries' currencies, which will provide you with better protection from exchange rate changes to be successful at hedging against inflation. Inflation in the United States has been relatively tame since the 1980s but it is currently at risk due to massive money creation by the FED via Quantitative Easing. However, inflation risk can be mitigated with the help of investment diversification. One method investors who are looking to protect their money against inflation would use is to … [Read more...]

A Reader Question About IRAs and Gold Stocks

I recently got an excellent question from a longtime reader named Bob and I thought I would pass along some of what I told him. Bob has invested a good portion of his IRA in shares of Randgold Resources. The NASDAQ symbol is GOLD. Randgold Resources is a gold mining business based primarily in Mali. Its headquarters are in Jersey, the Channel Islands, it is listed on the London and the NASDAQ stock exchanges. Bob has been accumulating shares of Randgold because he feels that as a mining company it is a productive asset rather than physical gold (or paper derivatives of gold) which earns no interest (or dividends). Randgold peaked at around $127 back in October 2012 and has been trending … [Read more...]