Planning for retirement is an essential part of couples’ financial management. As life expectancy increases and healthcare costs rise, ensuring that you have sufficient funds to maintain your lifestyle during retirement has become more critical than ever.

Planning for retirement is an essential part of couples’ financial management. As life expectancy increases and healthcare costs rise, ensuring that you have sufficient funds to maintain your lifestyle during retirement has become more critical than ever.

Two major factors that can significantly impact retirement income are Social Security tax and inflation. Many people don’t realize that Social Security income can be taxable, (which doesn’t seem right since Social Security was a “tax” from your income to start with). Understanding how these elements affect your financial future can help you make more informed decisions and better prepare for the years ahead.

What is Social Security Tax?

Social Security tax is a payroll tax that funds the Social Security program, which provides benefits for retirees, disabled individuals, and survivors of deceased workers. Employees and employers each pay 6.2% of wages up to a certain limit ($168,600 in 2024), while self-employed individuals pay the full 12.4%. These contributions are crucial for the sustainability of the Social Security program, but they also impact the amount of take-home pay available for saving and investing in retirement accounts.

One important aspect to consider is the taxability of Social Security benefits. Many people are unaware that their Social Security benefits may be subject to federal income tax if their combined income exceeds certain fairly low thresholds.

For married couples filing jointly, the thresholds are higher than for single filers, but understanding when is social security taxable for married couples is essential for effective retirement planning. According to the IRS, if your combined income as a couple exceeds $32,000, up to 50% of your Social Security benefits may be taxable, and if it exceeds $44,000, up to 85% of your benefits may be taxable. The IRS has a calculator to help you determine how much of your Social Security Benefits are taxable.

The Role of Inflation in Retirement Planning

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. Over time, inflation can significantly diminish the value of your savings, making it crucial to account for inflation when planning for retirement. Historical inflation rates have varied, but even modest inflation can have a substantial impact over the long term.

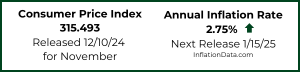

For instance, the average U.S. inflation rate in the decade from 2010-2020 was around 2% per year. However, the current decade has seen higher inflation rates, with the Consumer Price Index (CPI) rising by 3.4% in April 2024 after peaking at 9.1 in June 2022.

These increases highlight the importance of incorporating inflation protection into your retirement strategy to ensure that your savings maintain their purchasing power over time.

The Intersection of Social Security Tax and Inflation

Social Security tax and inflation are two powerful forces that can significantly influence retirement savings. When combined, their effects can be even more pronounced, affecting both the amount of money available for retirement and the purchasing power of those savings.

Interaction and Influence

Social Security benefits are adjusted for inflation through Cost-of-Living Adjustments (COLAs). These adjustments are intended to help beneficiaries maintain their purchasing power as prices rise.

However, the increase in benefits due to COLAs may also lead to higher taxable income, potentially pushing retirees into higher tax brackets. For instance, if inflation causes a substantial increase in Social Security benefits, it might result in a greater portion of those benefits being taxable, especially for married couples whose combined income exceeds the tax thresholds.

Consider a married couple with a combined income of $40,000, including Social Security benefits. With moderate inflation, their benefits might increase, pushing their combined income above the $44,000 threshold.

Consequently, up to 85% of their Social Security benefits could become taxable, reducing their net income. This scenario demonstrates how inflation can inadvertently increase the tax burden on retirees.

Strategies for Couples to Mitigate These Effects

Navigating the combined challenges of Social Security tax and inflation requires a proactive and informed approach. By implementing specific strategies, couples can better manage their retirement savings and ensure a more secure financial future.

Managing Social Security Tax

- Strategic Timing of Benefits: Delaying Social Security benefits can increase the monthly amount received and potentially reduce the tax burden. For instance, waiting until age 70 to claim benefits can maximize the monthly payout.

- Income Management: Keeping track of combined income and understanding the thresholds for Social Security taxation can help couples manage their taxable income. Minimizing withdrawals from retirement accounts in high-income years can also help.

Protecting Savings from Inflation

- Inflation-Protected Investments: Investing in Treasury Inflation-Protected Securities (TIPS) or Series I Savings Bonds can help safeguard savings from inflation. These securities adjust with inflation, ensuring that the value of the investment is maintained.

- Diversification: A well-diversified investment portfolio can provide a hedge against inflation. Including a mix of stocks, bonds, real estate, and other assets can help mitigate the risk of inflation eroding purchasing power.

- Regular Review and Adjustment: Regularly reviewing and adjusting the retirement plan to account for inflation and changes in income can ensure that the strategy remains effective over time.

Importance of Diversified Investments

Diversified investments spread the risk across various asset classes, reducing the impact of market volatility and inflation. By not putting all their eggs in one basket, couples can better protect their retirement savings from the uncertainties of economic fluctuations.

Social Security tax and inflation are critical factors that couples must consider in their retirement planning. By staying informed and proactive, couples can better ensure a financially secure retirement.

You Might Also Like:

- How to Calculate the Social Security Cost of Living Adjustment

- Comparing the Cost of Living When Retiring (or Moving)

- Tax Deferred Retirement- 401k, IRAs and More

- Retirees Working for Good

Image created by Meta AI.

Leave a Reply