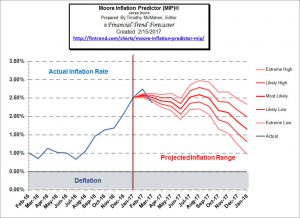

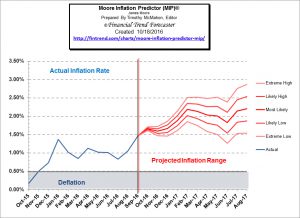

Back in February (based on January data) our Moore Inflation Predictor (MIP) forecast that March's inflation rate would be between 2.41% and 2.63% and today the Bureau of Labor Statistics said that March's annual inflation rate was 2.38%. So we were pretty close but how we got here is another matter entirely. In this case, two wrongs actually did make a right. As you can see from the chart below (we added a reality line to show what actually happened) first the inflation rate shot way above our projection and then it shot slightly below like some sort of drunk driver over-compensating while trying desperately to stay on the road. You can see what our MIP is projecting now … [Read more...]

Inflation Reaches Highest Level in 5 Years

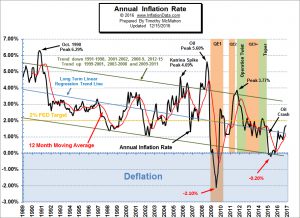

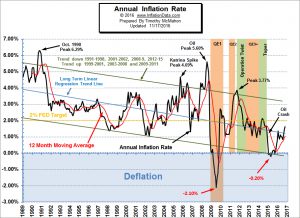

On Wednesday March 15th the U.S. Bureau of Labor Statistics (BLS) released their monthly Inflation report for the 12 months ending February 28th . The Consumer Price Index (CPI-U) came in at 243.603 up from 242.839 in January. This resulted in a 0.31% monthly inflation and 2.74% annual inflation. The last time the annual inflation rate was this high was in February of 2012 when it was 2.87%. After a deflationary period from March through October 2009, massive quantitative easing, caused a 2 month flirtation with inflation nearing 3% but then inflation promptly fell and by June 2010 inflation was 1.05% again. The inflation rate spent the next several months bouncing around between 1% and … [Read more...]

How Much Has Inflation Affected Mortgage Rates in the Last 5 Years?

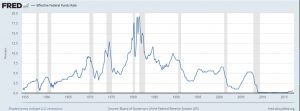

In some ways, mortgage rates are a reflection of the overall health of the American economy. As we can see in the chart below from "FreddieMac", often both mortgage rates and inflation rates peak during recessions and tend to fall or are stable during better times. How has inflation impacted mortgage rates recently? The FED Rate According to the St. Louis FED website: "The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with … [Read more...]

Inflation is Officially Back

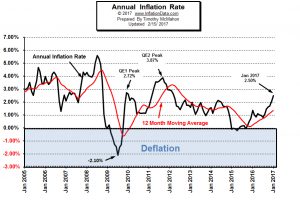

January 2017 saw a 0.6 percent hike in the Consumer Price Index, which pushed the annual inflation rate to 2.5 percent. This is the highest inflation rate in five years. The rate is higher than what many economists had anticipated. After several years of economists worrying that prices might fall, inflation has officially come back for the first time since the peak created by the massive second round of "Quantitative Easing" i.e. QE2 in 2011. QE 1 and QE 2 The first round of Quantitative Easing (QE1) resulted in an inflation rate of 2.72% in 2010 but as soon as the monetary spigot was turned off, the inflation rate fell, so the FED instituted QE2 which then resulted in an inflation rate … [Read more...]

Inflation Skyrockets to 2.5% In January

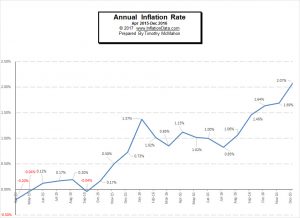

Annual Inflation is up from 2.07% in December to 2.5% in January. January itself racked up a whopping 0.58% monthly inflation rate. The Bureau of Labor Statistics released the newest inflation numbers on for January on February 15th 2017. Their Consumer Price Index (CPI-U) for all Urban Consumers was 242.839 up from 241.432 in December. Annual Inflation Chart Annual inflation is up from the annual cyclical low of 0.84% in July 2016, August was 1.06%, September rose to 1.46% and October was 1.64%. This is also up from the longer term cyclical low of -0.20% in April of 2015. Although this may look like the beginning of a longer upward trend it is still possible that it is simply a … [Read more...]

December Inflation Rate Finally Tops 2%

For quite some time, I've been saying, that "annual inflation throughout 2016 would remain well below the official FED target of 2% but we are getting closer and it is possible that December could tip the scale above 2%." And that is exactly what happened... annual inflation finished the year at 2.07%! The Bureau of Labor Statistics (BLS) released the data for the month of December on January 18th. They also adjusted four months of data from May through August 2016 due to some faulty data relating to Prescription drug prices but it had no visible effect on the published inflation rates and was only visible if you extended the calculation out to 3 decimal places. Annual Inflation … [Read more...]

November Inflation Up Slightly

The U.S. Bureau of Labor Statistics (BLS) released the monthly and annual inflation rate data for November 2016 on December 15th. The next data release is scheduled for January 15th. The current annual inflation rate is 1.69% up from 1.64% in October. Monthly inflation was actually negative for November but "less negative" than in 2015 causing the Annual Inflation rate to rise. Inflation for the month of November 2016 was -0.16%, while November 2015 was -0.21%. The CPI index was 241.353 in November 2016 down from 241.729 in October. Current Annual Inflation Chart Annual inflation for the 12 months ending in November 2016 was 1.69% up from a cyclical low of 0.84% in July. August was … [Read more...]

Inflation Climbs Again in October

The U.S. Bureau of Labor Statistics (BLS) released the monthly and annual inflation rate data for October 2016 on November 17th. The current annual inflation rate is 1.64% up from 1.46% in September. Monthly inflation was 0.12% for the month of October 2016, while October 2015 was -0.14%. meaning that as the negative number fell out of the calculation and was replaced by a positive one, annual inflation jumped up. Historically, the 4th quarter, i.e. October, November and December have been negative inflation months i.e. disinflationary. So having positive inflation for the month of October is a bit unusual and could indicate a trend toward rising inflation or it could simply be the … [Read more...]

Investing in Gold

Throughout history, people have been attracted to gold. It is considered one of the most precious metals. In ancient times it was primarily used as jewelry or for fabricating religious items. Often gold was the only money so there was no such thing as "Investing in Gold" since holding gold coins was simply considered "saving". Today however, since our money is not based on anything but "the good faith and credit" of the government, investing in gold is not only possible but also advisable. But for all its history, there isn't really that much gold around. If you collected all the gold ever mined, from every corner of the Earth and put it into a single pile it would only fill a 5-story … [Read more...]

Inflation Up Almost 38% in September

The U.S. Bureau of Labor Statistics released their monthly inflation data on Tuesday, October 18th and revealed an almost 38% increase in Annual Inflation in September. The annual inflation rate was 1.06% in August and increased 37.7% to 1.46% in September as a result of the Consumer Price Index (CPI-U) increasing from 240.854 to 241.428. For the year meat poultry and fish were down -6.3%, energy was down -2.9%, while Fuel Oil was down a whopping -8.5% and used cars and trucks were down -4.1%. However, Medical care services was up 4.8%, Transportation Services was up 3.0%, Shelter was up 3.4%, and Medical Care Services was up 5.1%. … [Read more...]