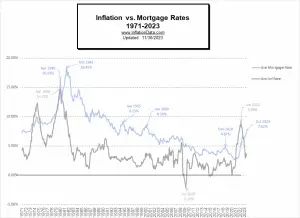

The interesting thing about borrowing money long-term is that inflation actually helps you repay the loan with cheaper money... At 7% inflation, prices double roughly every 10 years, which is only 1/3rd of the way through your 30-year mortgage. So, if your budget was stretched initially to make your mortgage payment, after 10 years (assuming your salary kept up with inflation) that same mortgage would only have half the impact on your budget. Thus, to get the true impact of mortgage rates, we need to adjust them for inflation. It has been a while since we addressed the issue of “Inflation Adjusted Mortgage Rates,” primarily because inflation and mortgage rates have been at historically … [Read more...]

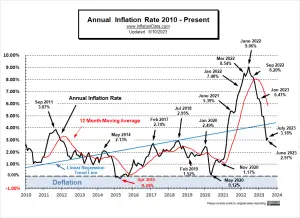

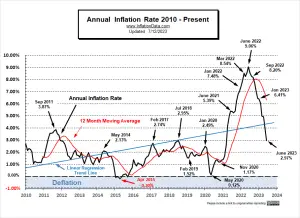

September Inflation Virtually Unchanged

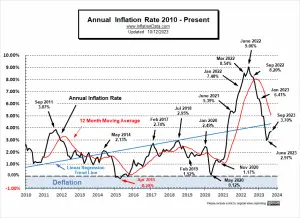

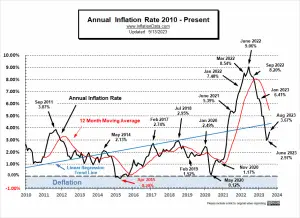

According to the Bureau of Labor Statistics CPI report released on October 12th, Annual Inflation was unchanged at 3.7% in September. (but since we calculate it to two digits, it was actually up from 3.67% to 3.70%.) Monthly inflation went from 0.44% in August to 0.25% in September. But, even though monthly inflation was lower than last month, Annual inflation increased. This is because monthly inflation in September 2023 was slightly higher than monthly inflation in 2022. Thus, as the 2022 number fell out of the calculation, it was replaced by a slightly higher monthly number, thus increasing the Annual Inflation number. September 2023 Inflation Summary: Annual Inflation rose … [Read more...]

How Germany is Fudging Their Inflation Numbers

Playing with Official Inflation Statistics: An Example from Germany By Karl-Friedrich Israel The Harmonized Index of Consumer Prices (HICP) consists of 12 subindices, which are weighted according to their shares in total household expenditures. If, for example, food and non-alcoholic beverages (subindex 1) account for 15% of expenditures, they should also be given a weight of 15% in the overall index. In this way, each expenditure category would be given the importance it has for an average household. This is the claim of official statistics. But here, too, as so often, aspiration and reality diverge. In Germany, the traditionally largest subindex covers housing, water, electricity, … [Read more...]

Increasing Inflation Now Shifting Insurance Rates

Inflation is making everything more expensive, and insurance is no exception. As prices rise for goods and services, insurance companies have to adjust as well. They factor in a variety of elements, including the average cost per claim made and the rising costs involved in repairing cars or homes. When these costs go up, insurance companies must pass it on by raising the price of premiums. Understanding Insurance Inflation Insurance inflation means the cost of your car, home, health, or life insurance is going up. What’s driving these increases? For starters, healthcare expenses are rising, so health insurance gets more expensive. Natural disasters like floods and fires can also make home … [Read more...]

August 2023 Inflation Up Sharply

According to the Bureau of Labor Statistics CPI report released on September 13th, Annual Inflation increased from 3.2% in July to 3.7% in August. (but more precisely, it was from 3.18% to 3.67%.) Monthly inflation went from 0.19% in July to 0.44% in August. August 2023 Inflation Summary: Annual Inflation rose from 3.18% to 3.67% CPI Index rose from 305.691 to 307.026 Monthly Inflation for August was 0.44%, July was 0.19% and June was 0.32%. Next release October … [Read more...]

Inflation Is a Huge Wealth Redistribution Scheme

In today's article, Charles A. Smith explains how bankers and bureaucrats conspire to consistently rob the common person through inflation. We have become conditioned to believe that 2% inflation is the norm, and not only that, but it is even desirable and beneficial. Charles argues that, quite to the contrary, productivity improvements should create lower consumer prices, i.e., deflation. The reason that doesn't happen is because "Inflation makes bankers’ and bureaucrats’ lives easier and keeps them in power". ~Tim McMahon, editor. Inflation Is a Giant "Skim" on the American People The price of a McDonald’s hamburger in the United States has inflated 3.75 percent annually over the … [Read more...]

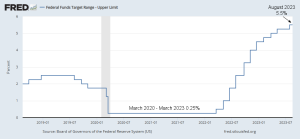

When Can We Expect Lower FED Rates?

Why Has The FED Been Raising Interest Rates? The Federal Reserve (Fed) started raising interest rates in March 2022 in an effort to combat inflation. As of the end of July 2023, the Fed's target rate limit is 5.5%, the highest level in 15 years. There are a few reasons why the Fed is raising interest rates so aggressively. First, inflation was at a 40-year high. In June 2022, the Consumer Price Index (CPI) rose 9.06% year-over-year, the fastest pace since December 1981. This means that the cost of goods and services was rising rapidly, which was eroding the purchasing power of consumers and businesses. Second, the economy is still strong. The unemployment rate posted a 50-year … [Read more...]

July Annual Inflation- Up Slightly

According to the Bureau of Labor Statistics CPI report released on August 10th, Annual Inflation increased from 3% in June to 3.2% in July. (but more precisely, it was from 2.97% to 3.18%.) Monthly inflation was 0.25% for May 2023, 0.32% in June, and 0.19% in July. July 2023 Inflation Summary: Annual Inflation rose from 2.97% to 3.18% CPI Index rose from 305.109 to 305.691 Monthly Inflation for July was 0.19%, down from 0.32% in June Next release is September … [Read more...]

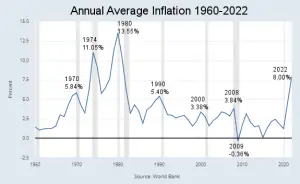

How Inflation Impacts Merchants

Just like the old joke, "How do you eat an elephant? ...one bite at a time", inflation is constantly "eating" away at your purchasing power. Some years your purchasing power might decline by 1%, and other years, it might decline by 5% or even 10%. As we can see from the chart above, back in 1980, purchasing power declined by an average of 13.55% over the whole year. But from April 1979 to April 1980, prices increased (and thus purchasing power declined) by a whopping 14.76%. And that was on top of 10.09% from April 1978 to April 1979. So, in just two years, from April 1978 to April 1980, prices increased significantly. How much? Well, due to compounding, you can't simply add 14.76% and … [Read more...]

June 2023- Inflation Falls to 3%

According to the Bureau of Labor Statistics CPI report released on June 13th, Annual Inflation declined from 4.0% in May to 3% in June. (but more precisely, it was from 4.05% to 2.97%.) Monthly inflation was 0.25% for May 2023, and 0.32% in June. June 2023 Inflation Summary: Annual Inflation fell from 4.05% to 2.97% CPI Index rose from 304.127 to 305.109 Monthly Inflation for June was 0.32% Next release August 10th 2023 Jan Feb Mar Apr May June July Aug Sep Oct Nov Dec 2022 7.48% 7.87% 8.54% 8.26% 8.58% 9.06% 8.52% 8.26% 8.20% 7.75% 7.11% 6.45% 2023 6.41% 6.04% 4.98% 4.93% 4.05% 2.97% What … [Read more...]