When Inflation heats up it can ravage your cash holdings and so of course that is why a portion of your portfolio needs to be in inflation hedges. But a side effect of inflationary forces is the added volatility it adds to markets. Navigating this added volatility involves having flexibility in your portfolio and flexibility comes from cash or cash equivalents. Unfortunately, cash equivalents are big losers during periods of high inflation. So what do you do? Fortunately, there is a solution that will provide liquidity and prevent the major part of the purchasing power erosion due to inflation. Plus provide good returns in the mean time. In today's report the author of "Keep What You … [Read more...]

April Inflation Up in OECD Countries

OECD annual inflation continues rising to 2.9% in April 2011 The Organisation for Economic Co-operation and Development (OECD) released the April inflation numbers for its member countries today. Although we have known the U.S. inflation numbers for a couple of weeks now it is interesting to see how they compare to other developed countries around the world. Some of the biggest gainers were the United Kingdom (to 4.5% in April, up from 4.0% in March) and the United States (to 3.2%, up from 2.7%). Inflation also accelerated in Germany (to 2.4% up from 2.1%), Italy (to 2.6%, up from 2.5%), France (to 2.1%, up from 2.0%) and Japan (to 0.3%, after four consecutive months at 0.0%). Average … [Read more...]

Raw Materials Price Inflation Skyrockets– Manufacturing Collapses

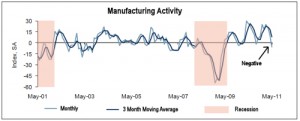

According to the May report of the Richmond FED-- the index of manufacturing activity fell 16 points from a positive level of 10 in April to a declining (negative level) of -6 in May thus indicating that manufacturing actually contracted during the time period. During this same time the cost of raw goods required to manufacture goods increased dramatically. Inflation was the monthly equivalent of an average annual rate of 6.12% in May the highest monthly reading since December 1993 up 27% from April's equivalent of 4.81%. As I've said many times 5% annual inflation will stifle the economy 6% is pretty devastating. Manufacturing activity in negative territory is a sign of a recession … [Read more...]

Does the Consumer Price Index (CPI) Include Taxes?

Question: I have heard over the years that the CPI does not include taxes as one of its components. In other words, an increase or decrease in a tax rate is not considered a change in consumer prices/costs. Is this true? If so, how is this omission justified? Thank you, James Schmidt … [Read more...]

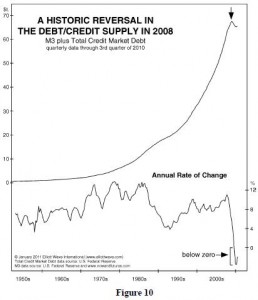

Why Quantitative Easing Has NOT Brought Back Inflation

When the FED began quantitative easing to halt the deflationary crash of 2008, almost everyone was convinced that it would result in massive inflation. The lone voice proclaiming that it wouldn't stop the deflationary express train wreck was Robert Prechter. In the following article Prechter explains why inflation never materialized. It is an excerpt from Prechter's, Independent Investor eBook 2011. I hope you enjoy this short excerpt. See below for details on how to get the eBook in its entirety for free. ~ Tim McMahon, editor … [Read more...]

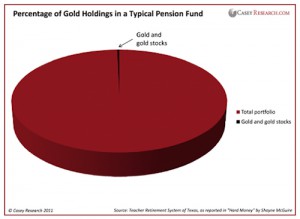

Why $5,000 Gold May Be Too Low

Jeff Clark, BIG GOLD You already know the basic reasons for owning gold – currency protection, inflation hedge, store of value, calamity insurance – many of which are becoming clichés even in mainstream articles. Throw in the supply and demand imbalance, and you’ve got the basic arguments for why one should hold gold for the foreseeable future. All of these factors remain very bullish, in spite of gold’s 450% rise over the past 10 years. No, it’s not too late to buy, especially if you don’t own a meaningful amount; and yes, I’m convinced the price is headed much higher, regardless of the corrections we’ll inevitably see. Each of the aforementioned catalysts will force gold’s price … [Read more...]

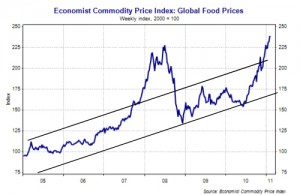

Agflation- What is it?

Agflation, is a relatively new term coined by analysts at Merrill Lynch in 2007. Back then rising demand for agricultural products started driving up prices. Agflation is simply a combining of the words agriculture as in "agricultural commodities" and the word inflation. Inflation is commonly used to mean an increase in prices (although it originally meant an increase in the money supply which eventually resulted in an increase in prices). So agflation is simply an increase in the prices of agricultural products. But agflation is not the result of an increase in the money supply like typical inflation, but rather it is simply a result of supply and demand factors. In 2000, the world wide … [Read more...]

Understanding the Federal Reserve Bank

What's a greater threat to the U.S. economy -- inflation or deflation? To decide that... it helps to understand what role the U.S. Federal Reserve plays. Despite so much focus on the policies of the Fed, its operations remain somewhat of a mystery to most investors -- in no smaller measure, due to their complexity. Here's an excerpt of a 35-page report that explains the Fed, its goals and, very importantly, its limitations in layman's terms. … [Read more...]

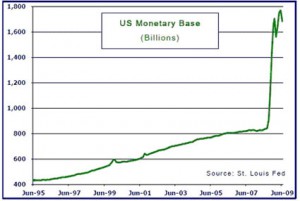

Inflation and Velocity of Money

How do you define inflation? In some ways it's a slippery thing, like trying to nail Jell-O to a tree. One common definition amounts to "a general and sustained rise in the price of goods and services." Another is "a persistent decline in the purchasing power of money." Others argue that inflation is directly tied to the money supply. That is to say, they believe a substantial rise in the money supply is the same thing as inflation. (This is one small step removed from Milton Friedman’s old assertion: "Inflation is always and everywhere a monetary phenomenon.") Why is the debate important? Because of the infamous chart you see below (courtesy of hedge fund QB Partners and the St. Louis … [Read more...]

Education Inflation Way Above Consumer Price Index

Every year the College Board surveys 3,500 colleges across the country to determine college cost increases and trends. Then in October it releases its "Trends in College Pricing" report. Here are highlights from its latest report: In-State tuition up 7.9% Out-of State Tuition up 6% Private University Tuition up 4.5% … [Read more...]