As inflation expectations rise the FED has less and less "wiggle room" to stimulate the economy. But how do you measure "inflation expectations"? In today's article, Chris Ciovacco will show us. ~Tim McMahon, editor Low Inflation Leaves Fed’s No Taper Door Open Fed Lost Control In 2008 In early December, we used Japan as an extreme example of why central banks are terrified of allowing their respective economies to slip into a deflationary spiral. Do the same concepts apply to the United States? They do. The federal government offers standard Treasury bonds (IEF) and Treasuries that provide some protection against inflation (TIP). The law of supply and demand tells us that when demand … [Read more...]

Understanding Inflation and What to Do About It

Inflation erodes our purchasing power causing manufacturers to have to raise prices or reduce quantities in order to make the same profit margin. Neither consumers nor manufacturers benefit, so who does? Why is inflation so prevalent? Yes, the level of inflation will vary and may recede briefly but the erosion continues. To say that low inflation is better than high inflation is like saying a death of a 1000 cuts is preferable to beheading. Either way you are dead, one just takes longer. With low inflation however you may not notice the cuts since they are so small. Unfortunately, just because the government says the cuts are small doesn't mean that they actually are. See Can We Trust … [Read more...]

What Causes Unemployment?

I recently received the following question about unemployment from a gentleman in Tanzania and I thought it was a good question and I would share the answer with you. What Causes Unemployment? I have been thinking on that situation of unemployment. Why does the rate of unemployment increase day after day? Does it mean that people have decreased the rate of thinking on creating jobs or there is any other reason? ~ Lioba from Dar-es-Salaam Tanzania. Here is my Response: Lioba, That is a very good question. Unemployment is a function of how efficient the marketplace is. In a purely agricultural economy, there is no unemployment, everyone has to work, if they don't work they don't eat. … [Read more...]

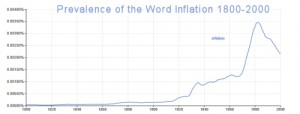

The Language of Inflation

Just the other day I was thinking about language and how it molds our thought processes. In some aboriginal tribes they don't have words for past, present and future tense. They would just say "I go home" this could mean "I went home", "I am going home" or "I will go home". It has been proven that in societies like this the concept of time is very muddled if almost non-existent. How can you plan for your future if you don't understand the concept of time? Lest we English speakers get all smug about the superiority of our language, ancient Greek was more precise than English in many aspects such as the word Love with at least three different words that we translate as "Love". And Eskimos are … [Read more...]

A Monetary Master Explains Inflation

Today we'd like to host a discussion between Terry Coxon, a senior editor of The Casey Report and David Galland, a partner in a research firm employing about 40 analysts. David says... Terry is my go-to guy. He cut his teeth working side by side for years with the late Harry Browne, the economist and prolific author of a number of groundbreaking books, including the 1970 classic, How You Can Profit from the Coming Devaluation. The timing of Harry's book should catch your eye, because his analysis that the dollar was headed for a big fall was spot on. Anyone paying attention made a lot of money. As coeditors of Harry Browne's Special Reports, Terry and Harry made a formidable team for … [Read more...]

Inflation: America’s #1 Export

What’s America’s No. 1 Export? by Bill Bonner In 1950 the typical working man was able to support a family. Today he can barely support himself because the costs of his main expenses have gone way up. He has to work about twice as long to pay for a new car and a new house. Health care is worse. In 1950 the cost per person per year was about $100. According to the government’s numbers, prices today are about 10 times higher. So health care should cost about $1,000. Not even close. It’s $9,000. In 1950 the typical father earned about $60 a week. For a family of four, he had to work fewer than seven weeks to cover the year’s health care expenses. Today how much does he earn? We’ve … [Read more...]

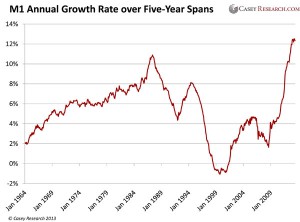

Rising Inflation vs. FED Tapering

Up until recently we rarely heard the word "tapering" but now it seems to be everywhere. Why? Because in June FED chairman Ben Bernanke floated a "trial balloon" and mentioned "tapering". By this he meant that he was considering slowly closing the faucet that is currently gushing easy money, i.e. $85 billion a MONTH. The stock markets promptly had a temper tantrum and Bernanke blinked and said, oh I was only kidding... I will eventually have to scale back but it won't happen any time soon... don't worry. He also said that the Fed's 6.5% target for US unemployment should be considered a "threshold, not a trigger" and that the FED would continue to support the economic recovery, "even as the … [Read more...]

Why Inflation is Theft

By Dr. Ron Paul When I talk to many teenagers and grade schoolers, they seem to have no problem comprehending the fact that if you just create a lot of money, it'll be like Monopoly money and it won't have value. Governments do that for all kinds of reasons, especially to enhance political power to fight wars we shouldn't be fighting or to pass welfare programs that aren't deserved. When you print that money, the value of that dollar has to go down, and then one of the consequences of inflating the money will be higher prices. But there are a lot of other problems, too, with inflating. It causes a business cycle, it causes financial bubbles and it causes a lot of … [Read more...]

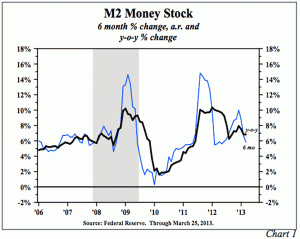

Is Ben Bernanke “Shooting Blanks”?

Summary: Lacy Hunt and Van Hoisington launch into their first-quarter "Review and Outlook," this week with a statement that some may find eye-opening: "The Federal Reserve (Fed) is not, and has not been, 'printing money'…" But given the facts of life about how money is really created (and destroyed), they are of course right: it's all about the acceleration – or deceleration – in the M2 money supply. Van and Lacy say, "A review of post-war economic history would lead to a logical assumption that the money supply (M2) would respond upward to [the Fed's] massive infusion of reserves into the banking system. Mystery Math- Monetary Base up 350%, M2 Up 35%? And yet, the Fed's 3.5x … [Read more...]

Long Term U.S. Inflation

We have updated the charts on long Term Inflation, including Average Annual Inflation by decade, Cumulative Inflation by Decade and Cumulative Inflation since 1913. The Chart below shows the Annual Inflation Rates for each decade. Each bar represents the average Annual Inflation for that decade (not the total cumulative inflation for that 10 year period but how much it increased each year on average during that decade). Do you know: 1) Average Annual Inflation since 1913: 2) That deflation in the "Roaring 20's" was almost as bad as in the "Great Depression" of the 1930's? 3) How Crop Subsidies affected farm prices in the 1920's and 30's? 4) How the proliferation of … [Read more...]