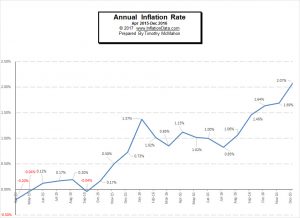

For quite some time, I've been saying, that "annual inflation throughout 2016 would remain well below the official FED target of 2% but we are getting closer and it is possible that December could tip the scale above 2%." And that is exactly what happened... annual inflation finished the year at 2.07%! The Bureau of Labor Statistics (BLS) released the data for the month of December on January 18th. They also adjusted four months of data from May through August 2016 due to some faulty data relating to Prescription drug prices but it had no visible effect on the published inflation rates and was only visible if you extended the calculation out to 3 decimal places. Annual Inflation … [Read more...]

November Inflation Up Slightly

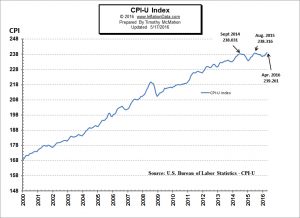

The U.S. Bureau of Labor Statistics (BLS) released the monthly and annual inflation rate data for November 2016 on December 15th. The next data release is scheduled for January 15th. The current annual inflation rate is 1.69% up from 1.64% in October. Monthly inflation was actually negative for November but "less negative" than in 2015 causing the Annual Inflation rate to rise. Inflation for the month of November 2016 was -0.16%, while November 2015 was -0.21%. The CPI index was 241.353 in November 2016 down from 241.729 in October. Current Annual Inflation Chart Annual inflation for the 12 months ending in November 2016 was 1.69% up from a cyclical low of 0.84% in July. August was … [Read more...]

Inflation Climbs Again in October

The U.S. Bureau of Labor Statistics (BLS) released the monthly and annual inflation rate data for October 2016 on November 17th. The current annual inflation rate is 1.64% up from 1.46% in September. Monthly inflation was 0.12% for the month of October 2016, while October 2015 was -0.14%. meaning that as the negative number fell out of the calculation and was replaced by a positive one, annual inflation jumped up. Historically, the 4th quarter, i.e. October, November and December have been negative inflation months i.e. disinflationary. So having positive inflation for the month of October is a bit unusual and could indicate a trend toward rising inflation or it could simply be the … [Read more...]

July Inflation Down for 3rd Consecutive Month

The U.S. Bureau of Labor Statistics (BLS) released their monthly inflation report for July on August 16th. According to the BLS Annual Inflation declined for the third consecutive month. Annual inflation was 1.13% in April, 1.02% in May, 1.01% in June and 0.84% in July. Not only did the rate of inflation fall but actual consumer prices declined as the CPI-U index declined from 241.038 to 240.647. Thus monthly inflation was -0.16%. For the year food at home was down -1.6%, energy was down -10.9%, used cars and trucks were down -3.7%, while overall transportation was down -4.9%. With all of these categories down one might wonder what actually caused the inflation rate to rise that meager … [Read more...]

May’s Low Inflation, the Price of Gold and More

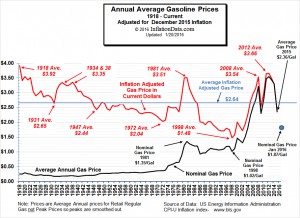

The U.S. Bureau of Labor statistics released the May inflation data on June 16th. Annual inflation fell from 1.13% in April to 1.02% in May. The Consumer Price index crept up to 240.236 from 239.261. Monthly inflation was 0.41% (40% of the total annual inflation). The primary factor in the increase was energy costs, gasoline was up 2.3% while fuel oil was up 6.2%. Many other items were actually down... airfares down -1.5%, used cars and trucks down -1.3%, food at home down -0.5%, of course physicians services and motor vehicle insurance were up 1% and 0.9% respectively, along with apparel which was up 0.8%. Current Annual Inflation Chart We’ve updated the current annual inflation chart … [Read more...]

Inflation, Economy, and the US Election

One of the major factors affecting an election's outcome is the nation’s economy during the election year. In terms of trading and from an investment standpoint, financial security is a huge issue. But unlike recent election years, forecasters predict a strong economy in 2016 during the presidential race. Economic conditions can change however, depending on which candidate wins. With the US Presidential Election still a good six months away (November 8, 2016), how will it affect inflation and the economy as a whole? Low Unemployment Rate Researchers in political science, project that unemployment will be at its lowest, since the election in 2000 (Bush versus Gore) when it was at 3.9%. … [Read more...]

CPI Reaches All-Time High

BLS Releases April Inflation Data The U.S. Bureau of Labor Statistics (BLS) released the inflation data for the year ending in April on May 17th, 2016. The Annual Inflation Rate was 1.13% up from 0.85% last month. The Consumer Price Index (CPI-U) reached an all-time high of 239.261. Normally, this wouldn't be news since for years it made a new high almost every month. But after peaking at 238.316 last August (2015) the index fell to 236.525 by December and took 8 months (until April) to climb above August's level. Interestingly, in September 2014 the index was 238.031. So it has taken 19 months for overall prices to exceed the level first attained in September 2014. This doesn't … [Read more...]

BLS Releases March CPI and Inflation

The U.S. Bureau of Labor Statistics released the March CPI and inflation numbers on April 14th. Annual Inflation fell from 1.02% for the 12 months ending in February to 0.85% for the 12 months ending in March. Interestingly, prices rose 0.43% for the month of March alone, so monthly inflation in March was almost exactly half of the total inflation for the entire year. The Consumer Price Index (CPI-U) was 238.132 up from 237.111 in February 2016 and 236.119 for March 2015. According the BLS Commissioner's report, " The food index declined in March, while the indexes for energy and for all items less food and energy rose, leading to the slight seasonally adjusted increase in the all items … [Read more...]

Inflation Picks Up in December

The U.S. Bureau of Labor Statistics (BLS) published their current inflation (CPI-U) report for the month of December on January 20th. The Consumer Price Index was 236.525 down from 237.336 in November. With the index going down you would think that we would have deflation but because when we say inflation or deflation we are talking about annual inflation/deflation we need to compare the index to the index from a year previous. Since the CPI-U for December 2014 was 234.812 and the current index is higher, we had annual inflation of 0.73%. According to the BLS, over the last 12 months Energy Prices have fallen -12.6%. Specifically, Gasoline is down -19.7%, Fuel Oil is down -31.4% and … [Read more...]

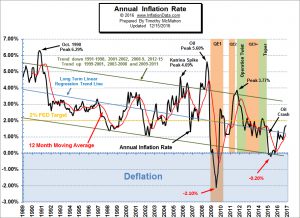

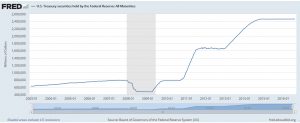

Betting on Deflation May Be a Huge Mistake. Here’s Why…

Although this site is called Inflation Data for the last several years we have been talking a lot about the big "D"... deflation. Strictly speaking, the only true deflation (inflation rates below zero) occurred in 2009 and then very briefly in 2015. See Annual Inflation Rate Chart. But as the chart shows the overall trend since the peak in 1990 has been down with the occasional spike upward. Since the peak in September 2011 however, the trend has been sharply down (falling inflation rates = disinflation) until it bottomed in April 2015. Since then inflation has turned up and has crossed above its moving average. So does this mean that we are in for a bout of inflation? Possibly. … [Read more...]