For new home buyers, anything that increases the cost of the purchase (like rising mortgage interest rates) can negatively impact your ability to be able to afford your home. That is why everyone is concerned when the Federal Reserve (i.e. the FED) raises interest rates. The following chart shows how the Fed Funds Rate has performed from January 2015 through July 2019. The FED lowered the FED Funds rate to near zero in response to the market crash in 2008-2009. It kept it there until January 2016 when it began gradually raising rates. However, at their July end meeting, they decided to lower interest rates, reducing the federal funds rate target by 25 basis points, to a range of 2% to 2.25%. … [Read more...]

How “Excess Reserves” and the Money Multiplier Could Trigger Inflation

Banks have $2.5 trillion parked in "excess reserves". This is money on deposit with the FED. The FED pays a miniscule amount of interest on these reserves but the banks are willing to loan it to the FED because it is easy no risk income. But it is also the reason that the money multiplier is falling! And when the money multiplier is falling the FED has a very hard time increasing the money supply. So if the FED really wants to increase the money supply all it has to do is decrease the interest rate it pays on excess reserves and the banks will find some place else to deploy it. Which could trigger massive inflation. ~Tim McMahon,editor A Fed Policy Change That Will Increase the Gold … [Read more...]

Lessons from TARP Boss Neil Barofsky

By Bill Bonner Yesterday evening we drove down to Zombietown. A friend in Washington had promised to introduce us to Neil Barofsky, inspector general of the TARP program. You remember TARP? It was the feds' $700 billion program to rescue the US economy from a correction. Neil Barofsky was in charge of it. So we decided to go down and ask him how it turned out... Rewarding Mistakes Bill: So... where did the $700 billion go? Barofsky: "I wondered the same thing," he said (from memory). "It was amazing to me that no one knew. We gave it to the banks. But no one knew what they did with it. I proposed to Tim Geithner that we find out. He was outraged. He cursed me out, using the … [Read more...]

Inflation on a 30 Year Mortgage

I recently received the following question: In 1970 I purchased a nice house in the suburbs of Albany, New York for $54,500. Although the price of the home today is well above the inflation rate, I was wondering how the inflated dollars I'm spending on the last few payments has changed over the past 30 years. The mortgage payment has been consistent but I'm paying in inflated dollars, I just don't know how much the value of each dollar has declined in purchasing power. How would I calculate that figure?- John … [Read more...]

Deflation or Inflation: Can Helicopter Ben Come to the Rescue?

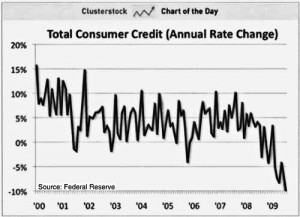

Why the Fed Cannot Stop Deflation Countless people say that deflation is impossible because the Federal Reserve Bank can just print money to stave off deflation. If the Fed’s main jobs were simply establishing new checking accounts and grinding out banknotes, that’s what it might do. But in terms of volume, that has not been the Fed’s primary function, which for 89 years has been in fact to foster the expansion of credit. Printed fiat currency depends almost entirely upon the whims of the issuer, but credit is another matter entirely. What the Fed does is to set or influence certain very short-term interbank loan rates. It sets the discount rate, which is the Fed’s nominal near-term … [Read more...]

The Smoking Ruin Solution

By David Galland, Managing Director, Casey Research Just last week, it was reported that the turnout for the Democratic primary was the lowest in 80 years. While the Republicans are clearly energized by their concerns about the direction the Democrats are taking the country in, the Democrats themselves seem to have decided to forgo the voting process, perhaps in favor of a refreshing nap. No question about it, the president is in the hot seat. While I am sure that back in 2008 Barack Obama was one happy camper about having taken the presidential prize, today one has to wonder if that victory has led him to certain bitter regrets. His problem, the problem bedeviling the government … [Read more...]

Hidden Signs of Deflation

Inflation is like a roaring lion-- pretty hard to miss. Deflation is more like a New Orleans levy holding back millions of gallons of water. You don't really know it's there until the dam breaks and unleashes its destruction. In the following article the editors of Elliott Wave International give us a look behind the curtain at all the pent up deflationary power just waiting to be unleashed.~ Tim McMahon, editor Signs of Deflation That You Might Not See Clearly By Editorial Staff, Elliott Wave International The following market analysis is courtesy of Bob Prechter's Elliott Wave International. Elliott Wave International is currently offering Bob's recent Elliott Wave Theorist, … [Read more...]