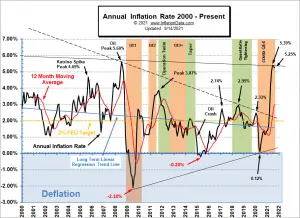

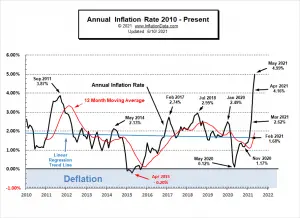

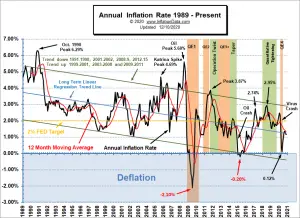

On September 14th, 2021, the Bureau of Labor Statistics said that in August 2021, the Annual Inflation Rate was down. Inflation Summary: Annual Inflation was 5.25% in August, 5.37% in July, and 5.39% in June. CPI Index rose from 273.003 in July to 273.567 in August. Monthly Inflation for July was 0.48% and 0.21% for August. Next release October 13th Inflation for the 12 months ending in August was down 0.12% from July. Since the BLS rounds to 1 decimal place, they reported June and July as 5.4% and August as 5.3%. The last time inflation was this high was the 5.6% of July 2008. Prior to that, we have to go all the way back to the 6.29% of October 1990 to find a higher … [Read more...]

BLS says July Inflation Holds Steady at 5.4%

The U.S. Bureau of Labor Statistics released their Consumer Price Index News Release for the month of July on August 11th, 2021. Inflation Summary: Annual Inflation 5.37% virtually identical to June's 5.39% CPI Index rose from 271.696 in June to 273.003 in July. Monthly Inflation for June was 0.93% and July was 0.48%. Next release September 14th Inflation for the 12 months ending in July was 5.37% identical to August 2008, July 2008 was the previous Peak at 5.60% Last month's 5.39% was the largest increase since August 2008's 5.37%. (Since the BLS rounds to 1 decimal place they reported last month, this month, and August 2008 as 5.4%). If inflation tops the 5.6% of July … [Read more...]

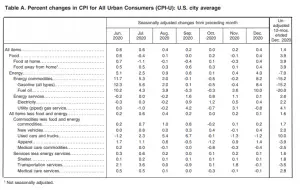

May’s Annual Inflation Soars to ~5%

Inflation Summary: Annual Inflation up sharply to ~5% (actually 4.99%) CPI Index rose from 267.054 in April to 269.195 in May. Monthly Inflation for April was 0.82% and 0.80% in May. We have to go back to the Oil Peak of 2008 to see higher inflation. Next release July 13th Annual inflation for the 12 months ending in May was 4.99% Since February, we have been predicting Annual Inflation would shoot up in March and April due to negative numbers falling out of the annual calculation. Although May 2020 was not negative it was virtually zero so replacing it with a massive 0.80% monthly inflation caused the Annual inflation rate to soar once more. Since the BLS rounds … [Read more...]

April Inflation More than Double FED Target

Inflation Summary: Annual Inflation up sharply from 2.62% in March to 4.16% in April. CPI Index rose massively from 264.877 in March to 267.054 in April. Monthly Inflation for March was 0.71% and for April was 0.82%. We have to go back to the Oil Peak of 2008 to see higher inflation. Next release June 10th Annual inflation for the 12 months ending in April was 4.16% We have been predicting Annual Inflation would shoot up in March and April due to negative numbers falling out of the annual calculation. Since the BLS rounds their numbers to 1 decimal place they reported March as 2.6% and April as 4.2% taking inflation well above the FED's 2% target rate. Due to … [Read more...]

March Inflation Skyrockets

Inflation Summary: Annual Inflation up from 1.68% in February to 2.62% in March. CPI Index rose slightly from 263.014 in February to 264.877 in March. Monthly Inflation for February was 0.55% and March was 0.71%. Next release May 12th Annual inflation for the 12 months ending in March was 2.62% We have been predicting Annual Inflation would shoot up in March due to higher gas prices and negative numbers falling out of the annual calculation. Further increases to come in April and May. Since the BLS rounds their numbers to 1 decimal place they reported February as 1.7% and March as 2.6% for a monthly increase of 9/10ths of 1% taking inflation well above the FED's 2% … [Read more...]

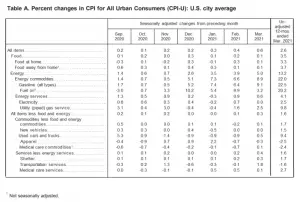

December Inflation Up Slightly

Inflation Summary: Annual Inflation up from 1.17% in November to 1.36% in December. CPI Index rose slightly from 260.229 in November to 260.474 in December. Monthly Inflation for December was 0.09%, November was -0.06%. Next release February 10th BLS Commissioner's Inflation Report: According to the BLS commissioner's report, "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in December on a seasonally adjusted basis after rising 0.2 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment. The seasonally adjusted increase in the all … [Read more...]

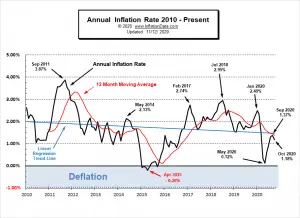

November Inflation Virtually Flat

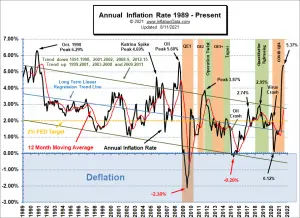

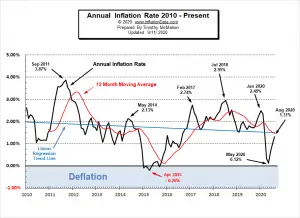

Inflation Summary: Annual Inflation was virtually unchanged from 1.18% in October to 1.17% in November. CPI Index fell slightly from 260.388 in October to 260.229 in November. Monthly Inflation for November was -0.06%, October was 0.04%, September was 0.14%, August was 0.32%, July was 0.51%, June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. Next release January 13th Annual Inflation Chart: Looking at the Annual Inflation Chart since 1989 we can see a marked downward trend. Current Inflation Situation Looking at just the most recent 10 years the trend is … [Read more...]

Annual Inflation in October is 1.18%

Inflation Summary: Annual Inflation fell from 1.37% in September to 1.18% in October. CPI Index rose slightly from 260.280 in September to 260.388 in October. Monthly Inflation for September was 0.14% and only 0.04% in October. FED Funds Rates decrease slightly while FED Assets inch up. Next release December 10th Annual Inflation Chart: Looking at the Annual Inflation Chart since 1989 we can see a marked downward trend. Current Inflation Situation Looking at just the most recent 10 years the trend is … [Read more...]

A Better Understanding of How IRS Audits Work

As an American citizen, you’re always in fear of making a mathematical error when you're filing your taxes unless you’ve got a professional doing it for you. This feeling of fear can become a lot stronger when the Internal Revenue Service (IRS) sends you a piece of mail stating that you’re going to be audited. Luckily, knowing how an audit works and the steps you need to take during the audit can help you relieve some of that fear very quickly. The Different Types of Audits While there are quite a few types of audits that the IRS conducts, the most common three that you should expect are the correspondence audit, office audit, and line-by-line audit. Correspondence Audit: This audit … [Read more...]

August Inflation Rises

Annual Inflation Increases to 1.31% Annual Inflation rose from 0.12% in May to 1.31% in August. CPI Index rose to 259.918 in August. Monthly Inflation for August was 0.32%, July was 0.51%, June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. The FED holds pretty steady on Assets and FED Funds Rates. Next release October 13th Annual inflation for the 12 months ending in August was 1.31%, up from July's 0.99%. Inflation is still moderate but may be picking up. The CPI index itself was up from 259.101 in July to 259.918 in August. Resulting in a monthly inflation rate of 0.32%. The Moore Inflation Predictor once again … [Read more...]