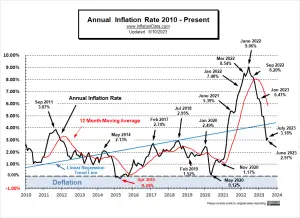

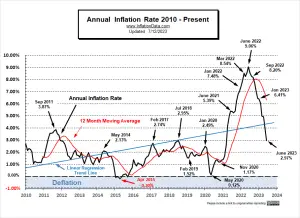

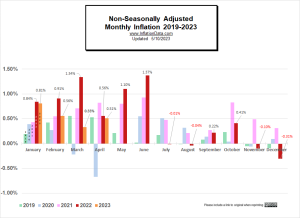

According to the Bureau of Labor Statistics CPI report released on August 10th, Annual Inflation increased from 3% in June to 3.2% in July. (but more precisely, it was from 2.97% to 3.18%.) Monthly inflation was 0.25% for May 2023, 0.32% in June, and 0.19% in July. July 2023 Inflation Summary: Annual Inflation rose from 2.97% to 3.18% CPI Index rose from 305.109 to 305.691 Monthly Inflation for July was 0.19%, down from 0.32% in June Next release is September … [Read more...]

No Surprise… FED Raised Rate by 1/4%

The market was predicting a 1/4% raise in the FED Funds rate with 99% certainty and that is exactly what they got. We were wondering if because of last month's drop in annual inflation (due primarily to a mathematical anomaly) the FED would not raise rates this month. But apparently their previous pause was sufficient under the circumstances. By applying the slight rate increase at this point, it should present the impression to the general public that they are on top of things, when the 1/3% rebound in inflation that we expect for July shows up. FED Chairman, Jerome Powell has left the door open for further increases (or not) with his comment, “Looking ahead, we will continue to take … [Read more...]

June 2023- Inflation Falls to 3%

According to the Bureau of Labor Statistics CPI report released on June 13th, Annual Inflation declined from 4.0% in May to 3% in June. (but more precisely, it was from 4.05% to 2.97%.) Monthly inflation was 0.25% for May 2023, and 0.32% in June. June 2023 Inflation Summary: Annual Inflation fell from 4.05% to 2.97% CPI Index rose from 304.127 to 305.109 Monthly Inflation for June was 0.32% Next release August 10th 2023 Jan Feb Mar Apr May June July Aug Sep Oct Nov Dec 2022 7.48% 7.87% 8.54% 8.26% 8.58% 9.06% 8.52% 8.26% 8.20% 7.75% 7.11% 6.45% 2023 6.41% 6.04% 4.98% 4.93% 4.05% 2.97% What … [Read more...]

Radical Decentralization: the Key to Wealth and Freedom

By Ryan McMaken It is not uncommon to encounter political theorists and pundits who insist that political centralization is a boon to economic growth. In both cases, it is claimed the presence of a unifying central regime—whether in Brussels or in Washington, DC, for example—is essential in ensuring the efficient and free flow of goods throughout a large jurisdiction. This, we are told, will greatly accelerate economic growth. In many ways, the model is the United States, inside of which there are virtually no barriers to trade or migration at all between member states. In the EU, barriers have been falling in recent decades. The historical evidence, however, suggests that … [Read more...]

The Effects of Raising the Debt Ceiling

In this article, Professor Daniel Lacalle examines the relationship between Federal debt and crony capitalism. ~Tim McMahon, editor. Key Facts: Congress has raised the debt ceiling 78 times since 1960 US debt to GDP is 123.4% 8% of the budget goes to pay interest Discretionary spending is around 30% of the budget Fiscal year 2023 outlays = $5.9 trillion The United States budget is unsustainable More Federal Debt Means More Taxes, Less Growth, and Weaker Real Wages By Professor Daniel Lacalle Since 1960, Congress has raised the debt ceiling 78 times, according to Bloomberg. The process of increasing the debt limit has become so regular that markets barely worry … [Read more...]

Annual Inflation Virtually Unchanged in April

According to the Bureau of Labor Statistics CPI report released on May 10th, Annual Inflation declined by 0.1%... but according to our calculations, it was even less than that. The BLS reported a decline from 5% to 4.9%, but when carried to two decimals, it was virtually a rounding error difference. Monthly inflation was 0.51% for April 2023, compared to 0.56% in April 2022. April 2023 Inflation Summary: Annual Inflation fell from 4.98% to 4.93% CPI Index rose from 301.836 to 303.363 Monthly Inflation for April was 0.51% Next release June … [Read more...]

Central Banks Respond Differently to the Banking Crisis

Central bankers don't like surprises, so they tend to communicate among themselves in order to coordinate their response to every new crisis. And this week there was a wave of responses to the combination banking crisis and still high inflation. The Cause Raising interest rates from near zero to over 4.5% in a short period of time puts stress on banks' liquidity as it causes an "inverted yield curve", i.e., short-term interest rates are higher than the locked-in long-term rates. Thus banks are paying out more (on short-term deposits) than they are receiving (on long-term mortgages). The Effect So you would think the Central Bankers would be prepared to deal with the … [Read more...]

Is The Fed Flashing Signs It’s Done Raising Rates?

The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday raised the target policy interest rate (the federal funds rate) to 4.75 percent, an increase of 25 basis points. With this latest increase, the target has increased by 4.5 percent since February 2022, although this latest increase of 25 basis points is the smallest increase since March of last year. Indeed, the FOMC has slowed its rate of increase over the past three months. After four 75 basis point increases in 2022, the committee approved a 50-point increase in December, followed by the 25-point increase this week. In other words, the FOMC has been slowed down in its monetary tightening. The committee was … [Read more...]

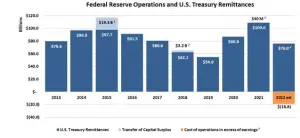

Why the Fed Is Bankrupt and Why That Means More Inflation

In 2011, the Federal Reserve invented new accounting methods for itself so that it could never legally go bankrupt. As explained by Robert Murphy, the Federal Reserve redefined its losses so as to ensure its balance sheet never shows insolvency. As Bank of America’s Priya Misra put it at the time: As a result, any future losses the Fed may incur will now show up as a negative liability (negative interest due to Treasury) as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible. That was twelve years ago, and it was all academic at the time. But in 2023, the Fed really is insolvent, although its fake post-2011 account doesn’t show this. … [Read more...]

November FED Announcement Rocks Stock Market

The FED Giveth and the FED Taketh Away On Wednesday, November 2nd, the FED held its "Federal Open Market Committee meeting" and made the announcement the market has been breathlessly awaiting. As expected, Chairman Jerome Powell announced a hike of 75 basis points in the fed funds rate. Along with the announcement, the market was hoping for some indication of a "pivot", i.e., that the FED would give some indication that it was going to be slackening off on its rapid rate increases. And in this respect, the November FED Announcement did throw the market a bone. It added the new phrase “Cumulative Tightening” to the standard announcement. So, going forward, the FED will take the fact … [Read more...]