I- Bonds: A brief overview: In the current shaky economy, everyone is looking for safe and secure investments. Investors might have a chance at high rewards with stocks and corporate bonds, but there’s also a huge risk to putting money in either. The snowballing crises in Europe aren’t making foreign investments look any more tempting. Where can investors trust their finances if they want a solid risk free return on their investment? Well, for those of you who want to play it cool and safe with your investments, you might consider: I bonds. What are I-Bonds? First of all, I-Bonds are officially called Series I Savings Bonds. According to the U.S. Department of Treasury, I bonds … [Read more...]

What is the Fiscal Cliff and How is it Affecting the Economy

The fiscal cliff that is the current hot topic in the news is a combination of automatic spending cuts and tax hikes that are scheduled to go into effect at the end of 2012 and the beginning of 2013. The spending cuts were triggered when congress failed to reach a deficit reduction agreement during last years debt ceiling debate. The tax increases are also automatic because Congress failed to make the "Bush Tax Cuts" permanent opting instead for a more politically expedient temporary tax reduction. In other words, they "kicked the can down the road" and it landed at the end of 2012. Perhaps they were hoping the Mayans were right and the world would end before they had to deal with the … [Read more...]

Impact of Inflation on Bonds Part 1

Impact of Inflation on Bonds Bonds are often considered a risk-free (or nearly risk-free) investment suitable for "widows and orphans". While they are generally safe, they have several weaknesses in the modern marketplace, inflation, rising interest rates and default risk. Before buying a bond, make sure you understand how bonds work and how inflation can have an effect on bonds. The Nature of Inflation Inflation is often described as the general rise of prices in the economy. However, the increase in prices is merely the effect, called "price inflation." Monetary inflation, which is the expansion of credit in the financial markets, is what often (but not always) drives price inflation. … [Read more...]

Why Buy Gold?

Gold has been one of the best investments over the last decade going from a low of $252 to a high of $1889. If you're looking for a way to protect against the effects of inflation, currency collapse or economic instability, here are a few things to consider about why gold should be in your portfolio. Return to the Gold Standard If you've been paying attention to what is going on in the world these days, you know that the financial markets have been in turmoil. Much of this relates to the basic underpinnings of the economic system. In the United States, the Federal Reserve is in charge of the money supply and interest rates. Nothing is backing the paper money that is printed, other than the … [Read more...]

Why is the US Federal Government Afraid of Deflation?

Deflation: Harry Dent "Understanding Demographics Is Vital to Success" In this segment from one of his talks at the Casey Research Recovery Reality Check Summit, economics expert and author Harry Dent explains how shifting demographic trends lead to economic cycles and why the current US federal government is so afraid of deflation. https://youtu.be/d3EZlY-29Ss Harry's complete presentation – as well as the speeches of 30 other economic and investment luminaries from this Summit – is available to you in MP3 or CD format. Listen to experts like David Stockman, Harry Dent, Lacy Hunt, James Rickards, John Hathaway, Chuck Butler – their assessment of what investors should expect and … [Read more...]

What is Quantitative Easing?

Is Quantitative Easing Money Printing? Quantitative Easing is often referred to as "money printing" or a way for the government to increase the money supply. According to Wikipedia, quantitative easing is different from the typical method whereby governments buy treasury debt to increase the money supply. In QE1 when the market was panicked, and banks didn't want to buy government bonds, the central bank implemented "quantitative easing" by purchasing relatively worthless financial assets (like mortgage backed securities) from banks and giving them new electronically created money. So this is straight forward money printing compared to the more round about traditional method. Thus … [Read more...]

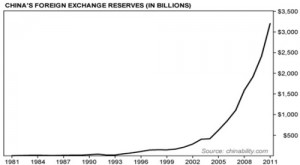

Why (and How) China is Boosting the Price of Gold

The History of Gold Prices (and How We Got Here) To get the full picture of the current price of gold we have to look back nearly 100 years. In the 1800's and early 1900's gold played a key role in international monetary transactions. The gold standard was used to back currencies. Each country determined a fixed exchange rates for its currency, i.e. how many ounces of gold each unit of currency was worth. Trade imbalances (importing more than they exported or vice versa) could rectified via the exchange of gold reserves. A country with a deficit would have to ship gold to the country with an excess. Any country experiencing inflation would lose gold and therefore would have a decrease in … [Read more...]

“No QE3″, Retracement Level Stalls Financials

Since financial stocks make up 14% of the S&P 500 Index, it is difficult to sustain a rally without strength in banks and financial services firms. With the Fed and ECB opening up the liquidity fire hydrant in late December 2011, bank stocks experienced another in a series of monster bailout rallies. As outlined below, the Financials Select Sector ETF (XLF) may be poised to give back some gains over the coming sessions based on numerous factors including reduced odds of QE3. Unfortunately in the debt-saddled world we live in, central banks may be the most important driver of asset prices. Dallas Fed President Richard Fisher told reporters after a speech Wednesday: There will be no … [Read more...]

Exploring the Not-So-Altruistic Aspects of the “Buffett Rule”

By Robert Ross, Casey Research This week, President Obama released his $3.8-trillion budget for fiscal year 2013. The plan calls for new taxes on the wealthy, a restructuring of the tax code, and short-term infrastructure spending aimed at boosting the economy (albeit artificially). Also included in the budget are limitations on subsidies for oil and gas companies, an end to the Bush tax cuts, and a proposal to raise taxes on dividends, which could be as high as 39.6% for households making over $250,000 per year. Although Senate Minority Leader Mitch McConnell (R-KY) dismissed the proposal as "a campaign document," the White House claims the measure would generate $206 billion in … [Read more...]

Fed To ‘Hold Off’ On QE 3

We noted extreme levels of optimism earlier today. What could possibly trigger a correction in stocks and commodities? If the Fed fails to signal and/or announce another round of quantitative easing (QE), it would undoubtedly leave the markets disappointed. The Fed uses the Wall Street Journal (WSJ) as a medium to communicate with the markets. It is possible someone at the Fed picked up the phone and said, “We need to temper short-term expectations for another round of QE. Can you help us out?” Friday’s WSJ has an article titled “Fed Holds Off For Now on Bond Buys”. Notice the word “may” is not included. Here is the first paragraph of the article: Federal Reserve officials are waiting … [Read more...]