The Fed funds rate is, effectively, the price of money. When it changes, much like dropping a rock into the water, the impact ripples out in all directions.— Greg McBride, Bankrate Chief Financial Analyst On Wednesday, September 18th, the FED reduced interest rates for the first time in four years. Mr. Market has been anticipating this cut all year and it finally happened. Last month FED Chairman Powell hinted at a rate cut at this FOMC meeting and at the time most experts believed that the cut would only be 25 basis points or ¼%. But, once lower-than-expected August inflation numbers were released on September 11th, the market began clamoring for a 50 basis point cut, or even a 75 basis … [Read more...]

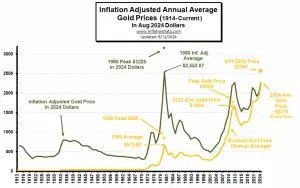

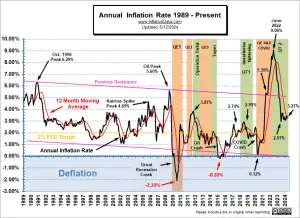

Gold Rallies on LOWER August Inflation?

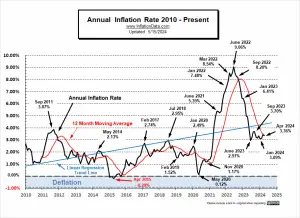

The U.S. Bureau of Labor Statistics released its August Inflation report on Wednesday September 11th showing Annual Inflation was down from 2.9% in July to 2.5% in August. (But since we calculate it to two digits, it was actually 2.89% in July and 2.53% in August.) On a non-seasonally adjusted basis, monthly inflation in July was 0.12% and 0.08% in August. Gold Prices: Contrary to what you might expect the day after the release of the lower inflation numbers Gold rallied to $2554 by mid-afternoon. I've often said, Gold is a crisis hedge NOT an inflation hedge. This is primarily because there is no "counterparty risk" i.e., it is strictly an asset not simultaneously someone else's … [Read more...]

Optimize Your Finances as Inflation Cools

The consumer price index, personal consumption expenditures, and producer price index point to cooling inflation, but no one can say for certain what the economy will do next. High inflation rates have a devastating effect on economies and the people within them, so a slower rate of inflation over the next few months and years could make everyone breathe a little easier. However, with so many factors up in the air — the U.S. presidential election and ongoing geopolitical conflicts, among others — you might not want to make any drastic moves with your personal finances. If inflation rates slow down and the economy returns to a more normal healthy state, you should adjust your financial … [Read more...]

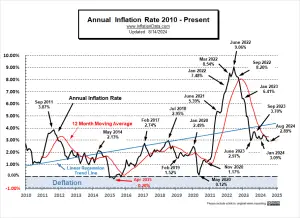

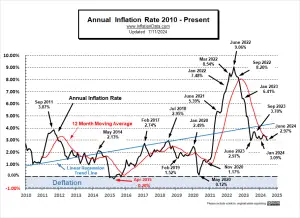

July 2024 Annual Inflation Falls Again

The U.S. Bureau of Labor Statistics released its July Inflation report on Wednesday August 14th showing Annual Inflation was down from 3% in June to 2.9%. (But since we calculate it to two digits, it was actually 2.97% in June and 2.89% in July.) On a non-seasonally adjusted basis, monthly inflation in June was 0.03% and 0.12% in July. So despite monthly inflation being slightly higher in July 2024 than in June, it was lower than July 2023 (@0.19%) so Annual Inflation fell. Economists had been predicting that the inflation rate would come in at 3.0% so inflation was lower than expectations, but Mr. Market didn't celebrate much (only increasing about 1/2%) but the rally continued upward on … [Read more...]

Annual Inflation Falls Below 3%

The U.S. Bureau of Labor Statistics released its June Inflation report on July 11th showing Annual Inflation was down from 3.3% in May to 3% in June. (But since we calculate it to two digits, it was actually 3.27% in May and 2.97% in June.) On a non-seasonally adjusted basis, monthly inflation in June was 0.03%. The Cleveland FED had been predicting that the inflation rate would come in at 3.12% so inflation was considerably lower than expectations. Markets took this as a good sign hoping for rate cuts possibly in September and rallied. The biggest beneficiaries were small cap stocks which have been beaten down by higher interest rates. The FED has been hinting that they would … [Read more...]

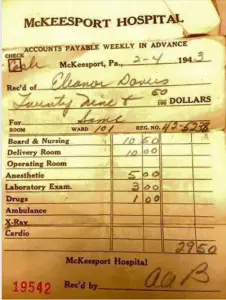

Inflation’s Hidden Impact on Healthcare: What’s Driving Costs Up?

Healthcare spending in the U.S. is higher than in any other nation. As of this writing hospital services have increased 7.2% over the last 12 months. In 2022, healthcare costs reached $4.5 trillion, with individuals spending an average of $13,493 annually. With soaring prescription drug prices, higher deductibles, and premium increases, costs are getting out of hand. According to Price Waterhouse, "The cost of treating patients is on the rise. The healthcare industry is under pressure from high inflation, rising wages, and other costs, which are only compounded by clinical workforce shortages. Health payers are negotiating pricing with hospitals while provider profit margins continue to … [Read more...]

The Death of the PetroDollar

Earlier this month, the internet was flooded with reports, stating that the “50-year petrodollar agreement” between the United States and Saudi Arabia had expired and that the petrodollar was now dead. Over the years we've written on the PetroDollar on several occasions. But this time, just as in the case of Mark Twain, "the Death of the PetroDollar has been greatly exaggerated". Ten years ago, we published an article entitled Oil, Petrodollars and Gold. In that article, I showed how the demonetizing of gold eventually led to Henry Kissinger making a deal in 1973 with Saudi Arabia to denominate all their oil sales in U.S. Dollars in exchange for the Kingdom receiving U.S. military … [Read more...]

May Inflation Surprisingly Mild

The U.S. Bureau of Labor Statistics released its May Inflation report on June 12th showing Annual Inflation was down from 3.4% in April to 3.3% in May. (But since we calculate it to two digits, it was actually 3.36% in April and 3.27% in May.) On a Seasonally adjusted basis, monthly inflation in May was ZERO. Bloomberg is making a big deal about that, but what does it really mean? As, I've been saying, beginning in the May-June timeframe inflation typically moderates for the Summer months and then gets really low (or even negative) in the 4th quarter. And that is what is happening. Double Whammy Day The overnight markets were down expecting more inflation so when the report was released … [Read more...]

Inflation Destroys More Than Money

Everyone knows that inflation hurts consumers by raising the cost of their purchases and that it hurts those on fixed incomes the most because although their costs are rising, their income isn't. In addition to impoverishing individuals, inflation has several less obvious ramifications. Perhaps the most insidious and detrimental consequence of inflation is the facilitation of more wars. How Inflation Promotes War Prior to the advent of fiat currencies, if a Monarch wanted to wage war, he had to figure out a way to pay for it. If his treasury wasn't large enough to pay for the means of war, the king would have to either raise taxes, or borrow the money, either way there were limits to how … [Read more...]

April Inflation Sparks Market

The U.S. Bureau of Labor Statistics released its April Inflation report on May 15th showing Annual Inflation was down from 3.5% in March to 3.4% in April. (but since we calculate it to two digits, it was actually 3.48% in March and 3.36% in April.) The markets took this as a good sign and the NYSE rallied 157.68 points resulting in a 0.87% gain. The NASDAQ did even better gaining 231.21 points or 1.40%. Prior to the gain, our NASDAQ ROC was flashing a warning signal. But we did say that we needed to wait for confirmation before selling. Unadjusted monthly inflation was 0.65% in March which moderated sharply to "only" 0.39% in April. Typically inflation is highest in the first … [Read more...]