When the government spends more money than it receives in taxes it has a “deficit” situation. In order to deal with this deficit, it engages in some fancy bookkeeping. The government is made up of a variety of agencies, so the other agencies request money from the Treasury Department. If it doesn’t have enough money the Treasury Department issues an IOU (called a Government Bond). The Treasury gives the Bond to the Federal Reserve (which is theoretically not part of the government). The FED writes a check to the Treasury for the bond. It then breaks up the bond into smaller bonds and sells them to individual banks. The banks then sell them to individual investors and groups of … [Read more...]

What Impact (if any) Does Disruption have on Inflation?

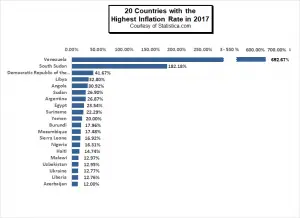

What is "Disruption"? According to Dictionary.com: forcible separation or division into parts. a disrupted condition: After the coup, the country was in disruption. Business. a radical change in an industry, business strategy, etc., especially involving the introduction of a new product or service that creates a new market: 2018 is seeing our world change rapidly in so many ways some due to various disruptions. This has caused some people to ask if disruptions cause inflation. This year U.S. inflation as of June is up from 1.63% in 2017 to 2.80% in 2018. Inflation on a global scale is a percent or two higher at 3.15% in 2017, and projected to see out the year 2018 at 3.31%. … [Read more...]

What Causes Unemployment?

I recently received the following question about unemployment from a gentleman in Tanzania and I thought it was a good question and I would share the answer with you. What Causes Unemployment? I have been thinking on that situation of unemployment. Why does the rate of unemployment increase day after day? Does it mean that people have decreased the rate of thinking on creating jobs or there is any other reason? ~ Lioba from Dar-es-Salaam Tanzania. Here is my Response: Lioba, That is a very good question. Unemployment is a function of how efficient the marketplace is. In a purely agricultural economy, there is no unemployment, everyone has to work, if they don't work they don't eat. … [Read more...]

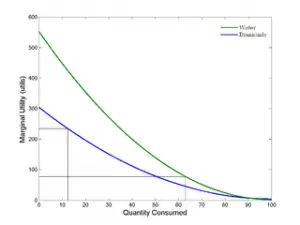

Marginal Utility

In economics, the marginal utility of a good or service is "the perceived value from an increase in the consumption of that good or service". In other words, how much benefit do you get from using or consuming one more. The concept of marginal utility grew out of attempts by economists to explain how individuals determine price. The term “marginal utility” is credited to the Austrian economist Friedrich von Wieser which was a translation of Wieser's term “Grenznutzen” (border-use). For years economists knew that there was some sort of interrelationship between utility and rarity that affects economic decisions, but were at odds to quantify it. In opposition to what Karl Marx might have … [Read more...]

What is “Leverage”?

Leverage is... The basic definition of "Leverage"is the mechanical advantage available from using a "lever"this idea has been expanded to apply to other types of advantage such as money, finance and even positional advantage. The Classic Example of Leverage... As a child I would often go to the playground and play on the "See-Saw" aka. "Teeter-Totter" it was a board fixed in the middle that allowed two kids (one on each end) to ride up and down based on their weights being equally balanced. The device didn't work all that great if one kid was considerably larger than the other one. The heavier kid would crash to the ground while the lighter kid would be launched into the air. This … [Read more...]

What is the Difference Between Micro and Macro Economics?

Microeconomics vs. Macroeconomics- Economics can be described as the social science that examines how people use limited resources to produce, distribute, and consume goods and services to satisfy their unlimited needs and desires. Although microeconomics and macroeconomics are not the only disciplines and paths of specialization to exist within the broader context of economics, these two related, tightly bound, but nonetheless disparate fields are likely the most prominent. Microeconomics and macroeconomics do exactly what their names indicate. Microeconomics focuses on close-up snapshots of people, businesses, and non-profit organizations acting within economies while macroeconomics … [Read more...]

Inflation Definitions

Inflation Adjusted Prices What is the inflation adjusted price of common commodities? Historical Oil Prices Chart - This Chart compares Monthly Average Oil Prices with their Inflation Adjusted Oil Price. Historical Crude Oil Prices (Table) - The first table shows Annual Average Crude Oil Prices from 1946 to the present. Prices are adjusted for Inflation using the Consumer Price Index (CPI-U) as presented by the Bureau of Labor Statistics Inflation Adjusted Electricity Prices - Residential electricity prices in the U.S. have risen from an average of 7.83 cents per kilowatthour in 1990 to an average of 11.44 cents per kwh in 2010. This is a 46% increase in 20 years and sounds like a … [Read more...]

What is the Fiscal Cliff and How is it Affecting the Economy

The fiscal cliff that is the current hot topic in the news is a combination of automatic spending cuts and tax hikes that are scheduled to go into effect at the end of 2012 and the beginning of 2013. The spending cuts were triggered when congress failed to reach a deficit reduction agreement during last years debt ceiling debate. The tax increases are also automatic because Congress failed to make the "Bush Tax Cuts" permanent opting instead for a more politically expedient temporary tax reduction. In other words, they "kicked the can down the road" and it landed at the end of 2012. Perhaps they were hoping the Mayans were right and the world would end before they had to deal with the … [Read more...]

Money Multiplier

What is the Money Multiplier? In a fractional reserve system like we have here in the United States, money is loaned out by banks and by law they are only required to have a fraction of the amount they loan out. For example, they might be required to keep 10% in reserves. In other words, they may have $10 million dollars in deposits but because not everyone will come in to claim their dollars at once the bank may loan out $9 million dollars. But the multiplication doesn't end there. The $9 million will be deposited at another bank and that bank can loan out 90% of that or $8.1 million. And that will be deposited in another bank, who can loan out another 90% and so on. In our article, How … [Read more...]

Velocity of Money

What is the velocity of money? Simply defined, the velocity of money is the turnover in the money supply. A shop owner can measure how fast his inventory is selling by calculating "inventory turnover." To do that, he simply calculates Total Sales ÷ Average Inventory for the period in question. See: Inventory TurnOver for more information. But if you expand the idea of turnover to the entire country, you get the "Velocity of Money". Strictly speaking all the velocity of money tells us is how long people hold onto their money. But from that we can infer their motives and perceptions of the economy in general... The Velocity of Money Calculation To Calculate the Velocity of Money, you … [Read more...]