I came across some research on the subject of worry. Here's how it was presented: Things People Worry About: things that never happen - 40% things which did happen that worrying can't undo - 30% needless health worries - 12% petty, miscellaneous worries - 10% real, legitimate worries - 8% Of the legitimate worries, half are problems beyond our personal ability to solve. That leaves 4% in the realm of worries people can do something about. I thought about our gigantic national debt and weak economy. These seem to fit into both subcategories of "real" worries. You can't do much as an individual to solve the nation's debt and economic problems, yet you can prepare for a … [Read more...]

What Happens to Gold if We Enter a Recession or Depression?

By Jeff Clark, Casey Research Mayan prophecies aside, many of the senior Casey Research staff believe that economic, monetary, and fiscal pressures could come to a head this year. The massive buildup of global debt, continued reckless deficit spending, and the lack of sound political leadership to reverse either trend point to a potentially ugly tipping point. What happens to our investments if we enter another recession or – gulp – a depression? Here's an updated snapshot of the gold price during each recession since 1955. … [Read more...]

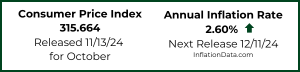

Cost of Living: How Much of Your Budget Goes to Food?

Cost of Living: Food Knowing what percentage of our cost of living is spent on food is always a good thing to know. We recently published an article by Lynn Carpenter on her Cost of Living- Real Basket of Goods in it she compares the cost of several ordinary food items over the decades. Her weekend meal basket included "one loaf of bread, one pound of coffee, one dozen eggs, three pounds of mid-price beef, one box of Corn Flakes or Cheerios, five pounds of potatoes and one Hershey bar." In this article she determined that over the years a minimum wage earner would have to work 9.25 hours in 1938 to buy this food. But by 1961 a minimum wage earner only had to work 3.75 hours to buy the same … [Read more...]

Inflation Adjusted Gold vs Stocks vs Bonds

Recently our good friends at Casey research published the following chart comparing the inflation adjusted Gold returns to stocks and bonds for the period 1971 through the present. From this chart we can see that as bonds fell during the late 1970's gold rose equivalently and stocks were basically flat. During the 1980's bonds rose and gold fell while while stocks rose slightly. During the 1990's stocks rose sharply gold fell and Bonds were volatile but basically flat to slightly up. During the 2000's gold was up sharply, stocks were volatile and bonds were pretty flat. … [Read more...]

What All Major Depressions Have in Common

Signs of deflation are visible but the public will be fooled Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). -- Conquer the Crash, 2nd edition (p. 88)Has the United States met that precondition? Well, consider that total credit market debt as a percent of U.S. gross domestic product was 280 percent in 1929 at the start of the Great Depression 380 percent in 2008 The current build-up of credit goes far beyond major -- it's unprecedented. It's been rising steadily for 60 years. The slope literally looks like the side of a steep mountain. Bank credit and Elliott wave expert Hamilton Bolton … [Read more...]

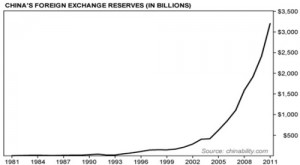

Why (and How) China is Boosting the Price of Gold

The History of Gold Prices (and How We Got Here) To get the full picture of the current price of gold we have to look back nearly 100 years. In the 1800's and early 1900's gold played a key role in international monetary transactions. The gold standard was used to back currencies. Each country determined a fixed exchange rates for its currency, i.e. how many ounces of gold each unit of currency was worth. Trade imbalances (importing more than they exported or vice versa) could rectified via the exchange of gold reserves. A country with a deficit would have to ship gold to the country with an excess. Any country experiencing inflation would lose gold and therefore would have a decrease in … [Read more...]

If the Economy’s “Recovering,” Why is the Largest-Ever U.S. City Bankruptcy on the Horizon?

What's really going on? As pundits chatter about an economic recovery, 80 miles east of San Francisco you'll find a city (pop. 292,000) facing bankruptcy: Stockton is on the verge of becoming the largest city in the United States to declare bankruptcy... San Francisco Chronicle (3/4) Bloomberg reports (2/25) that it costs the city $175,000 just to get a consulting firm's fiscal evaluation. Management Partners issued a report which said: ...the city took on a large amount of debt in anticipation of ongoing growth that now exceeds the city's ability to pay. Compensation packages exceeded sustainable levels and the city assumed a significant liability for improved retiree health … [Read more...]

Is Gold Backwardation Now Permanent?

Its Weight in Gold: The Real Prices of Things By Keith Weiner, Casey Research Worldwide, an incredible tower of debt has been under construction since President Nixon's 1971 default on the gold obligations of the US government. His decree severed the redeemability of the dollar for gold and thus eliminated the extinguisher of debt. Debt has been growing exponentially everywhere since then. Debt is backed with debt, based on debt, dependent on debt and leveraged with yet more debt. For example, today it is possible to buy a bond (i.e., lend money) on margin (i.e., with borrowed money). The time is now fast approaching when all debt will be defaulted on. In our perverse monetary system, … [Read more...]

Gasoline 20 Cents a Gallon?

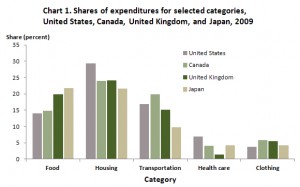

Many of us aren't old enough to remember Gasoline at 20 cents a gallon. I can remember gas during the 1960's at 29.9 cents a gallon. The last time that gasoline averaged 20 cents a gallon was in 1942. That was during WWII ! But if you know us here at InflationData.com you probably know that we usually talk in inflation adjusted prices. So adjusting for inflation, the price of gas in 1942 would have been $2.78 if you are paying in January 2012 dollars. But that is still a long way away from the average price of Gas in 2011 of $3.48. We track the inflation adjusted price of gasoline based on the annual average price using the Consumer Price Index (CPI) generated by the U.S. Bureau of Labor … [Read more...]

The Doom of Wired Telecom

Advances in technology bring many changes to the business world, and certain industries that were once considered viable are now industries that should be avoided at all costs. One industry that is expected to shrink the most dramatically is the wired telecommunications carrier industry. This industry has been rapidly shrinking in response to the increasing widespread use of cell phones and online forms of communication. The need for wired communications has become so low that 25 percent of all households do not even own a land line phone. Some even predict that by 2025, land line phones will completely disappear. … [Read more...]