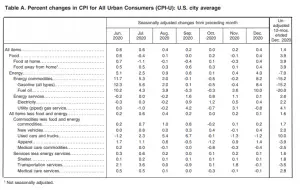

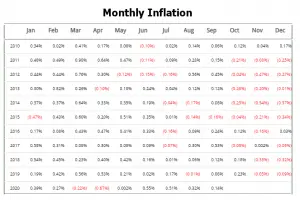

Inflation Summary: Annual Inflation up from 1.17% in November to 1.36% in December. CPI Index rose slightly from 260.229 in November to 260.474 in December. Monthly Inflation for December was 0.09%, November was -0.06%. Next release February 10th BLS Commissioner's Inflation Report: According to the BLS commissioner's report, "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in December on a seasonally adjusted basis after rising 0.2 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.4 percent before seasonal adjustment. The seasonally adjusted increase in the all … [Read more...]

Long Term Inflation Charts Updated

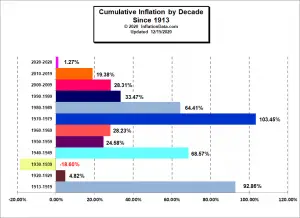

Average Inflation by Decade We've updated the long term inflation charts that appear around the site. These charts include Average Annual Inflation by decade i.e. what the average inflation rate was during the 1990s vs. the 1970s or the 2000s, etc. You can find these charts and more in-depth commentary in the following places: Average Annual Inflation Rates by Decade Total Inflation by Decade US Long Term Average Inflation Cumulative Inflation by Decade This is the amount of inflation experienced during … [Read more...]

November Inflation Virtually Flat

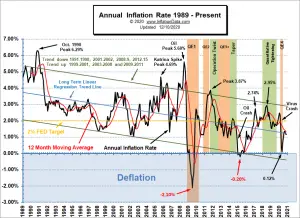

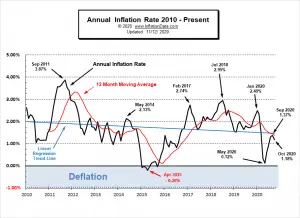

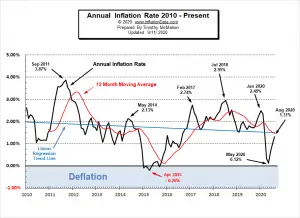

Inflation Summary: Annual Inflation was virtually unchanged from 1.18% in October to 1.17% in November. CPI Index fell slightly from 260.388 in October to 260.229 in November. Monthly Inflation for November was -0.06%, October was 0.04%, September was 0.14%, August was 0.32%, July was 0.51%, June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. Next release January 13th Annual Inflation Chart: Looking at the Annual Inflation Chart since 1989 we can see a marked downward trend. Current Inflation Situation Looking at just the most recent 10 years the trend is … [Read more...]

Annual Inflation in October is 1.18%

Inflation Summary: Annual Inflation fell from 1.37% in September to 1.18% in October. CPI Index rose slightly from 260.280 in September to 260.388 in October. Monthly Inflation for September was 0.14% and only 0.04% in October. FED Funds Rates decrease slightly while FED Assets inch up. Next release December 10th Annual Inflation Chart: Looking at the Annual Inflation Chart since 1989 we can see a marked downward trend. Current Inflation Situation Looking at just the most recent 10 years the trend is … [Read more...]

A Better Understanding of How IRS Audits Work

As an American citizen, you’re always in fear of making a mathematical error when you're filing your taxes unless you’ve got a professional doing it for you. This feeling of fear can become a lot stronger when the Internal Revenue Service (IRS) sends you a piece of mail stating that you’re going to be audited. Luckily, knowing how an audit works and the steps you need to take during the audit can help you relieve some of that fear very quickly. The Different Types of Audits While there are quite a few types of audits that the IRS conducts, the most common three that you should expect are the correspondence audit, office audit, and line-by-line audit. Correspondence Audit: This audit … [Read more...]

September Inflation Virtually Unchanged

Annual Inflation Increased Very Slightly Annual Inflation rose from 1.31% in August to 1.37% in September. CPI Index rose from 259.918 in August to 260.280 in September. Monthly Inflation for August was 0.32%, for September it was 0.14. The FED holds steady on Assets and FED Funds Rates. Next release November 12th Annual inflation for the 12 months ending in September was 1.37% The CPI index itself was up from 259.918 in August to 260.280. Resulting in a monthly inflation rate of 0.14%. Annual inflation for the 12 months ending in September was up almost imperceptibly from 1.31% to 1.37%. This is a rebound from an astonishingly … [Read more...]

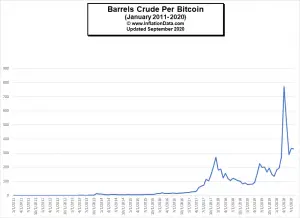

The Price of Oil Denominated in Bitcoin

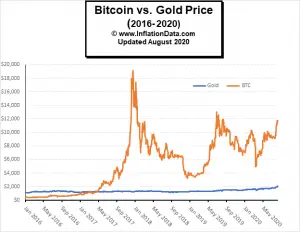

Over the years we have been saying that it is important to look at prices of various commodities in terms of other commodities. For instance, we have looked at not only the Inflation Adjusted Gasoline Prices but also the Price of Oil Compared to Gold. Because of the recent volatility of Bitcoin we thought it might be interesting to look at the price of oil denominated in Bitcoin. Back in 2016, we compared Gold vs. U.S. Dollar vs. Bitcoin and recently we published Gold vs. Dollar vs. BitCoin Revisited. Often, depending on the currency that you are accustomed to using and you earn your wages in your view of the price of a commodity can be vastly different. For instance, if your currency is … [Read more...]

How has Venezuela’s Bitcoin experiment Fared?

In early 2018, in an effort to fight a collapsing economy and hyperinflationary currency Venezuela decided to jump on the BitCoin bandwagon and create its own cryptocurrency called the Petro. On December 3rd 2017, Venezuelan president Nicolás Maduro announced the petro in a televised address, stating that it would be backed by Venezuela's reserves of oil, gasoline, gold, and diamonds. Other reports claimed that the initial issue price would be based on the price of oil i.e. 1 Petro = 1 Barrel of Venezuelan oil. On 5 January 2018, Maduro announced that Venezuela would issue 100 million tokens of the petro, for a total value of just over $6 billion. The government stated the pre-sale raised … [Read more...]

August Inflation Rises

Annual Inflation Increases to 1.31% Annual Inflation rose from 0.12% in May to 1.31% in August. CPI Index rose to 259.918 in August. Monthly Inflation for August was 0.32%, July was 0.51%, June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. The FED holds pretty steady on Assets and FED Funds Rates. Next release October 13th Annual inflation for the 12 months ending in August was 1.31%, up from July's 0.99%. Inflation is still moderate but may be picking up. The CPI index itself was up from 259.101 in July to 259.918 in August. Resulting in a monthly inflation rate of 0.32%. The Moore Inflation Predictor once again … [Read more...]

Gold vs. Dollar vs. BitCoin Revisited

Back in 2016, we compared the properties of three types of currency, i.e. Gold, Dollars (Cash), and Bitcoin. Today we'd like to look at how each has fared since then. Back then, we said that there are 10 factors that make up a good store of value. They are: 1. Scarcity- For something to be considered valuable it can’t be too readily available. 2. Fungibility- Things have to be equal. Rare paintings aren’t fungible a Picasso isn’t exactly the same as a Monet. As a matter of fact, one Picasso isn’t even the same as another Picasso. Artwork isn’t fungible. One dollar bill is pretty much the same as another, one ounce of 24 karat gold is the same as another, one bitcoin is the same as … [Read more...]