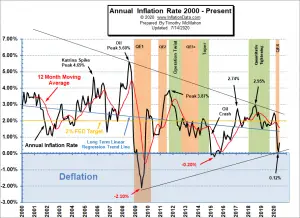

Annual Inflation Rebounds Annual Inflation rose to 0.65%. CPI Index rose from 256.394 in May to 257.797 in June. Monthly Inflation for June was 0.55%, May was 0.002%, April was -0.67%, March was -0.22%, February was 0.27%. The FED may be slowing its "Quantitative Easing" in an effort to prevent hyperinflation. FED Funds Rate up slightly but still remains near Zero. Next release August 12th The Bureau of Labor Statistics Released the Inflation Data for the 12 months ending in June on July 14th. Monthly Inflation SOARS to 0.55%. Annual inflation for the 12 months ending in June was 0.65%, May was 0.12%, April was 0.33%, March was 1.54% down sharply from February's … [Read more...]

Is the FED Tightening or Is Hyperinflation on the Horizon?

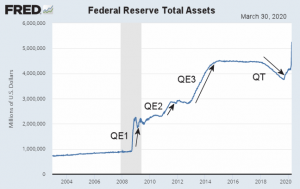

Recently a prophecy has been trending on YouTube. In it, the possibility of major upheaval in November is mentioned, combined with the possibility of hyperinflation. As I've mentioned before, beginning in March 2020, the FED created massive amounts of liquidity through Quantitative Easing in an effort to combat the monetary effects of shutting the country down due to the virus. If that is combined with a reduction in the quantity of goods and services created due to the virus or riots shutting down the means of production we could see hyperinflation. So that would play into fulfilling that prophesy. Back on April 1st, I wrote an article entitled Will the $2 Trillion Covid-19 Stimulus … [Read more...]

Will the $2 Trillion Covid-19 Stimulus Cause Inflation?

The current round of massive Corona Virus easing began Monday March 16th, 2020, with the FED buying $40 billion in Treasuries and then buying another $50 billion in Treasuries on Tuesday. By Thursday morning, it had upped the plan to $75 billion PER DAY and added $10 billion in mortgage securities. By Friday morning, the Fed had decided to buy $107 billion worth of Treasuries and mortgage-backed securities. In its first week, the FED purchased $317 billion worth of assets, which is slightly faster than the Fed balance sheet grew at the height of the 2008-2009 financial crisis. Initially, the Federal Reserve estimated purchases of $500 billion but FED chief Jerome Powell said the initial … [Read more...]

Modern Monetary Theory

Recently Freshman Congresswoman Alexandria Ocasio-Cortez (AOC) thrust Modern Monetary Theory (MMT) into the popular limelight by suggesting that MMT was how the U.S. could pay for her "Green New Deal". What is MMT and how is it different from good old "Money Printing"? History is rife with examples of countries that tried to print money without any “governor” on the quantity of money printed. Recent examples include Argentina, North Korea, Zimbabwe, and Venezuela. See: 27 examples of hyperinflation from ancient Egypt through modern-days. In today's article Charles Hugh Smith of Daily Reckoning looks at why Modern Monetary Theory Won't Work. We've reprinted the following article by … [Read more...]

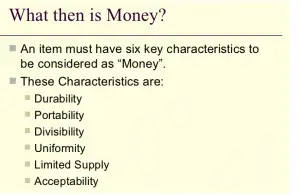

How High Inflation Drives Countries Towards Crypto

What is CryptoCurrency? A cryptocurrency (aka. Crypto), is an alternative form of payment created electronically rather than through government fiat (decree). The idea behind it is that an algorithm creates a limited amount of currency that is available to individuals to use instead of cash, checks or credit cards. The technology behind it allows you to send it directly to others without going through a 3rd party like a bank. Initially, the untraceable nature of cryptocurrency led governments to suspect that it was being used for nefarious purposes. And some notable cases of purchases on the "dark web" were prosecuted like the "Silk Road" case which operated from 2011-2013. Since then … [Read more...]

Debt and Inflationary Pressures: A Lesson in Economic Interactivity

Does debt cause inflation? If so what kind of debt? Personal debt? Government debt? Corporate debt? And what exactly is inflation? In this article, we will look at all these issues. Price Inflation occurs when the cost of a representative basket of goods and services is rising. The key factor is the general trend that takes place in an economy, it is possible that individual items such as foreign automobiles, the price of coffee, or corn could rise while other items that require a larger portion of your disposable income are falling (or vice versa). So the Bureau of Labor Statistics uses a "weighted basket of goods" i.e. they calculate what percentage of an average person's salary goes … [Read more...]

Inflation Risk

What is Inflation Risk? Inflation Risk aka. "Purchasing Power Risk" is the risk due to "a decrease in purchasing power of assets or cash flow" due to inflation. A typical example would be a bond that generates a fixed rate of return. For instance, suppose this bond is worth $1000 and generates a 5% yield i.e. $50. Suppose when you purchase the bond that $50 will buy two tanks of gas for your car. Over time inflation will reduce the purchasing power of that $50 so it only buys one tank of gas. If you are counting on using the proceeds of the bond to buy gas there is an "inflation risk" that eventually you will not be covered. The worst-case example of inflation risk is if a country … [Read more...]

Hyperinflation: 5 Currencies that Self-Destructed

Over the years we have discussed Hyperinflation a number of times. We've explained that, "Hyperinflation is an extremely rapid period of inflation, usually caused by a rapid increase in the money supply. Usually due to unrestrained printing of fiat currency." Hyperinflation has been recorded as far back as Egypt 276 AD and is usually caused due to some sort of government mismanagement issue. Typically hyperinflation gets progressively worse until the curve goes hyperbolic and then something happens to end the progression. See What is Hyperinflation? for more information. Recently Commodity.com produced an Infographic of 5 currencies that were hit by hyperinflation so with their … [Read more...]

Effects of Inflation on Businesses

When we think of inflation we usually think of how it affects us as consumers. But the effects of inflation are wide ranging, including not only individuals but also businesses and even countries. Consumers and businesses alike have to deal with the impact of inflation, both good and bad. Here are some ways in which inflation affects businesses: 1. Consumer Purchasing This is the most obvious impact to businesses. Rapidly rising prices will cause consumers to (as Samuel Goldwyn famously said) "stay away in droves". There are ways for businesses to plan for inflation to reduce the chances of revenue loss. Gradually increasing prices will prevent a sudden price hike, and if your … [Read more...]

Hyperinflation and Government Debt

By Doug Casey The over-leveraging of the U.S. federal, state, and local governments, some corporations, and consumers is well known. This has long been the case, and most people are bored by the topic. If debt is a problem, it has been manageable for so long that it no longer seems like a problem. U.S. government debt has become an abstraction; it has no more meaning to the average investor than the prospect of a comet smacking into the earth in the next hundred millennia. Many financial commentators believe that debt doesn’t matter. We still hear ridiculous sound bites, like “We owe it to ourselves,” that trivialize the topic. Actually, some people owe it to other people. There … [Read more...]