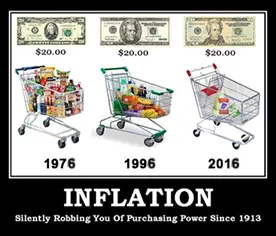

With the entire world struggling to ward off global deflation, it is prudent to understand why the current actions by the Central Banks are not heading in the correct direction. The massive amount of Quantitative Easing by the Central Banks, globally, have not been converted into inflation as was earlier anticipated. This article will shed light on various aspects leading to deflation. Investopedia defines ‘deflation’ as “a general decline in prices, often caused by a reduction in the supply of money or credit. Deflation can be caused also by a decrease in government, personal or investment spending. The opposite of inflation, deflation has the side effect of increased unemployment since … [Read more...]

The Devaluation Derby

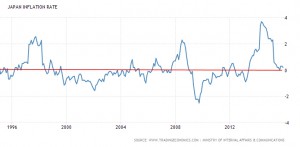

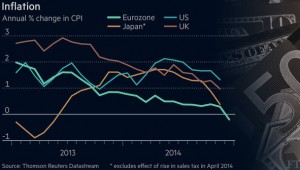

The 1930's had massive deflation on a world-wide scale. Making it the worst deflationary event in living memory. This has affected the thinking and even the language of everyone from economists, to politicians, to the media, as new words like devaluation, disinflation, low inflation, even negative inflation are created to avoid having to say what they really mean and that is the big "D"... DEFLATION. But no matter how you say it, the fact is, deflationary forces are building around the world. During the first quarter of 2015 the U.S. saw slight deflation on an annual basis. And despite historically low interest rates and high economic stimulus, in September 2015 the Financial Times posted … [Read more...]

Betting on Deflation May Be a Huge Mistake. Here’s Why…

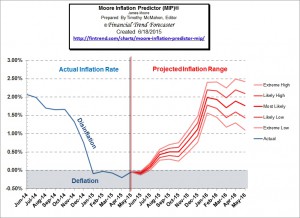

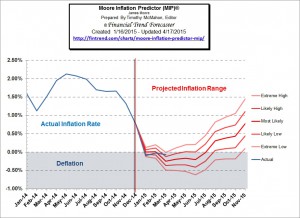

Although this site is called Inflation Data for the last several years we have been talking a lot about the big "D"... deflation. Strictly speaking, the only true deflation (inflation rates below zero) occurred in 2009 and then very briefly in 2015. See Annual Inflation Rate Chart. But as the chart shows the overall trend since the peak in 1990 has been down with the occasional spike upward. Since the peak in September 2011 however, the trend has been sharply down (falling inflation rates = disinflation) until it bottomed in April 2015. Since then inflation has turned up and has crossed above its moving average. So does this mean that we are in for a bout of inflation? Possibly. … [Read more...]

Europe in Deflation: Got (cheap) Milk?

Why falling food prices are not a boon for Europe's economy By Elliott Wave International In the early 1990s, two simple words from a genius ad campaign radically transformed the way the U.S. consumer saw it: "Got Milk?" Suddenly, the narrative changed from an obligatory drink you had to finish as a kid, along with eating your vegetables -- into a sexy, funny, and above all desirable treat for all ages. Until now. In Europe, in 2015, famous celebrities donning milk mustaches no longer light the public's passion for lactose -- as prices for milk have spoiled. Here, a September 8, 2015 CNN Money article captures the curdled state of affairs: "So much milk is sloshing around the … [Read more...]

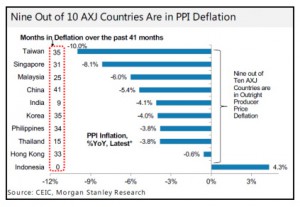

Is Global Depression and Deflation Underway?

In an article we published on August 16th, called Markets Crashing, Gold Rising the author said, "The probability of U.S. interest rate hikes this fall is now falling a rock. We are once again hearing the familiar call from Keynesian economists, including Paul Krugman, for more stimulus and debt. They acknowledge the trillions already printed and borrowed haven’t worked – but say it is only because it wasn’t nearly enough." As a matter of fact, Krugman has been beating the same drum since 1998 when he said, "The clear and present danger is, instead, that Europe will turn Japanese: that it will slip inexorably into deflation, that by the time the central bankers finally decide to loosen up … [Read more...]

BLS Releases May Inflation Stats

May's monthly prices increase 0.51% but the annual inflation rate was still -0.04%. The Bureau of Labor Statistics (BLS) released their monthly Consumer Price Index (CPI-U) and Inflation report for the year ending in May on June 18th. This resulted in the 5th deflationary month in a row. We have seen a steady decline in inflation rates over the last year. May 2014 started with an annual inflation rate of 2.13%. June saw annual inflation fall to 2.07% then July declined to 1.99%, August was 1.70%, then September and October were both 1.66%, November was 1.32%, and December was 0.76%. When January rolled around it was … [Read more...]

World War D—Deflation

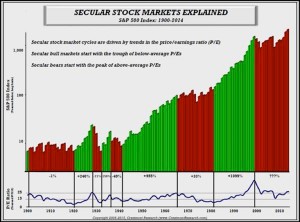

In today's article John Mauldin looks at the "Big D" deflation plus the difference between the out look and time-frame of the average investor and that of the professional money manager. He also looks at the difference between "secular" and "cyclical" bull and bear stock markets. We also have an article by Jawad Mian entitled "A Little Less Deflation, A Little More Reflation, Please". Enjoy! ~ Tim McMahon, editor Thoughts from the Frontline: World War D—Deflation By John Mauldin Everywhere I go I’m asked, “Will there be inflation or deflation? Are we in a bull or bear market? Is the bond bull market over and will interest rates rise?”The flippant answer to all those questions is “Yes.” … [Read more...]

“Glinda the Good” Deflation Isn’t Looking So… Good

Cold weather, falling wages, bizarre fluke? The real reason consumers aren't spending is... defensive, deflationary psychology By Elliott Wave International Editor's note: You'll find the text version of the story below the video. Learn What You Need to Know NOW About Deflation Get Your Free Report Now » When 2015 began, the mainstream financial experts were certain of one thing: Even if the United States economy were sliding into deflation (which, they said, was open to discussion) that particular kind of Glinda the Good deflation, characterized by plunging energy and food prices, was going to be a boon for consumer spending: "Good deflation a tax cut for … [Read more...]

Deflation Again

The Bureau of Labor Statistics (BLS) released the inflation statistics for the month of March on April 17th. Once again we have slight deflation on an Annual basis. The Consumer Price index (CPI-U) at the end of March 2015 was 236.119 while it was 236.293 at the end of March 2014. So overall prices are just a hair lower a full year later. That means there was -0.07% inflation and as we all know negative inflation on an annual basis is called Deflation. Because the BLS rounds all their results to one decimal place they have rounded it to -0.1% , which is what they said it was in January as well. Rounded to two places it is -0.09% for January, -0.03% for February and -0.07% for March which … [Read more...]

Deflation Watch: Key Economic Measures Turn South

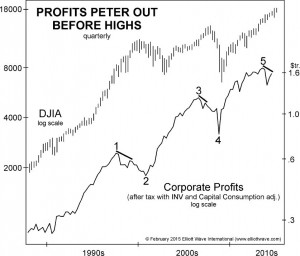

Last month (12 months ending January 2015) inflation dipped below zero resulting in an annual deflation of -0.09% rounded to -0.1% by the Bureau of Labor Statistics (BLS). The 12 months ending in February bounced up slightly to -0.03 but the BLS was able to round that up to Zero thus giving the impression that the deflation was over. But our Moore Inflation Predictor is saying otherwise. It indicates that we could be in for as much as 6 more months of deflation. And now the analysts at Elliott Wave International have found that several key economic indicators are also turning Bearish and confirming our deflation prediction. These key indicators include: Corporate profits, Retail and Food … [Read more...]