In an article we published on August 16th, called Markets Crashing, Gold Rising the author said, “The probability of U.S. interest rate hikes this fall is now falling a rock. We are once again hearing the familiar call from Keynesian economists, including Paul Krugman, for more stimulus and debt. They acknowledge the trillions already printed and borrowed haven’t worked – but say it is only because it wasn’t nearly enough.”

As a matter of fact, Krugman has been beating the same drum since 1998 when he said, “The clear and present danger is, instead, that Europe will turn Japanese: that it will slip inexorably into deflation, that by the time the central bankers finally decide to loosen up it will be too late.” Paul Krugman, “The Euro: Beware of What you Wish for”, Fortune (1998). Had the FED opened the spigots for money creation then the 2008 bubble would have been even larger and the crash even bigger (if that is possible).

In today’s article, Chris Vermeulen,the CEO of Technical Traders Ltd., looks at deflation and the possibility of global recession or even depression. ~Tim McMahon,editor

The Global Depression and Deflation Is Currently Underway!

Most central bank policy makers, investors, and analysts around the world today are gripped by the worry of declining growth rates, dwindling international commodity prices, high unemployment, and other macroeconomic figures.

However, not many have given much consideration to one economic factor that has the potential to disrupt global economies, shut down economic activities, and become a catalyst for a worldwide depression. We are talking about ‘deflation’ that if not tamed, could bring global economies to their knees creating a worldwide chaos never seen before in scale or length.

Paul Krugman, the renowned American economist and distinguished Professor of Economics at the Graduate Center of the City University of New York, had forewarned about the threat of deflation for European economies. He suggested that the European Central Bank policy makers need to look into the situation now before it’s too late for them to do anything about the situation.

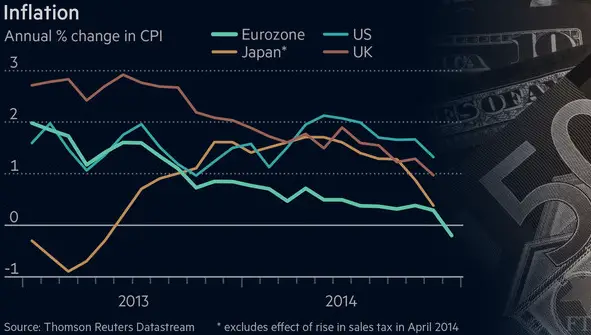

The Eurozone today has well entered into a deflationary phase with other major economies including the US, UK, and Japan slowly heading into the same direction. In Japan and many European economies such Greece, Spain, Bulgaria, Poland, and Sweden, prices have been decreasing gradually for the past decade. This has created a number of problems for the central bank policy makers as they try to find out ways to diffuse the negative effects of deflation such as a slump in economic activity, drop in corporate incomes, reduced wages, and many other problems.

What the World can Learn from Japan’s Lost Decade (1990-2000)

The impact of the ongoing global deflationary trends on economies can be gauged by what Japan had experienced during the period between 1990 – 2000, which is also known as Japan’s lost decade. The collapse of the asset bubble in 1991 heralded a new period of low growth and depressed economic activity. The factors that played a part in Japan’s lost decade include availability of credit, unsustainable level of speculation, and low rates of interest.

When the government realized the situation, it took steps that made credit much more difficult to obtain which in turn led to a halt in the economic expansion activity during the 1990s.

Japan was fortunate to come out of the situation unhurt and without experiencing a depression. However, the effects of that period are being felt even today as corporations feel another deflationary spiral could eat away at their profits. This situation, analysts feel, is about to repeat in the Western economies, and that includes the US.

Deflationary Trend Could Threaten the Fragile US Economy

Inflation rates in the US are hovering near the zero percent level for the past year. The Personal Consumption Expenditure Price Index has stayed well below the Fed’s 2% target rate since March 2012. Although, the US economy hasn’t entered into a deflationary stage at the moment, the continuous low level inflation despite the fed’s rate being at near zero levels for about a decade has increased the possibility that the US economy could also plunge into a deflationary stage similar to that of the Euro zone.

The deflationary trend could turn out to be a big concern for policy makers and investors that may well lead to a global depression. The lingering memories of the 2008 financial crises that had literally rocked the world are still fresh in the minds of most people. That is why it’s important for central banks to implement policies to fight the debilitating effects of deflation.

But, the question is how can the central banks combat the current or looming deflation trend? The Japan’s lost decade has taught us that trying to contain the possibility of deflation and its negative effects can be difficult for policy makers. Economists have suggested various ways in which the debilitating effects of deflation can be countered.

However, one policy that central banks can use to fight off deflation is what economists call a Negative Interest Rate Policy (NIRP).

NIRP simply refers to a central bank monetary measure where the interest rates are set at a negative value. The policy is implemented to encourage spending, investment, and lending as the savings in the bank incur expenses for the holders. On October 13ths I wrote in detail about NIRP. Then on October 23rd Ron Insana on CNBC talk about it here.

This unconventional policy manipulates the tradeoff between loans and reserves. The end goal of the policy is to prevent banks from leaving the reserves idle and the consumers from hoarding money, which is one of the main causes of deflation, which leads to dampened economic output, decreased demand of goods, increased unemployment, and economic slowdown.

Central banks around the world can use this expansionary policy to combat deflationary trends and boost the economy. Implementing a NIRP policy will force banks to charge their customers for holding the money, instead of paying them for depositing their money into the account. It will also encourage banks to lend money in the accounts to cover up the costs of negative rates.

Has the Negative Rates Policy Been Implemented in the Past?

Despite not being well known or publicized in the media, NIRP has been implemented successfully in the past to combat deflation. The classic example can be given of the Swiss Central Bank that implemented the policy in early 1970s to counter the effects of deflation and also increase currency value.

Most recently, central banks in Denmark and Sweden had also successfully implemented NIRP in their respective countries in 2012 and 2010 respectively. Moreover, the European Central Bank implemented the NIRP last year to curb deflationary trend in the Eurozone.

In theory, manipulating rates through NIRP reduces borrowing costs for the individuals and companies. It results in increased demand for loans that boosts consumer spending and business investment activity. Finance is all about making tradeoffs and decisions. Negative rates will make the decision to leave reserve idle less attractive for investors and financial institutions. Although, the central bank’s policy directly affects the private and commercial financial institutions, they are more likely to pass the burden to the consumers.

This cost of hoarding money will be too much for consumers so they will invest their money or increase their spending leading to circulation of money in the economy, which leads to increase in corporate profits and individual wages, and boosts employment levels. In essence, the NIRP policy will combat deflation and thereby prevent the potential of global depression knocking at the door once more.

Final Remarks

The possibility of deflation causing another global recession is very real. Central policy makers around the world should realize that deflation has become a global problem that requires instant action. In the past, even the most efficient and robust economies used to struggle in taming inflation rates. In the coming months, most economies around the world, including the US, will have difficulty curbing the effects of deflation.

The fact is that central bank policy makers have largely ignored the possibility of deflation causing havoc in the economy similar to what happened in Japan during its “lost decade”. The quantitive easing program that is being used in the US by the Feds to boost economy is not proving effective in raising the inflation rate to its targeted levels. In fact, the inflation level is drifting even lower and is hovering dangerously close to the negative territory.

Blaming the low inflation levels on the low level of oil prices is not justified. Inflation levels were hovering at low levels well before the great plunge in commodity prices. Moreover, low level inflation rates cannot be blamed on muted wage levels. The fact is that unemployment rates have decreased both in the US and the UK in the past few years, but consumer spending has largely remained unmoved.

Taming deflation is necessary if the central banks want to avoid its debilitating effects on the economy. Policies like the Quantitive Easing program used by the Feds may allow easy access to credit, dampen exchange rate, and reduce risks of financial meltdown; but it cannot prevent the possibility of another more severe situation of deflation wreaking havoc on the economy.

The concept of NIRP may seem counter intuitive at first, but it is the only effective way of combating the deflationary trend. The world economy could sink further into a deflationary hole if no action is taken to curb the trend. And the time to start thinking about it is now. Any delay could result in a global economic meltdown that may cause deep financial difficulties for millions of people around the world.

We as employees, business owners, traders and investors are about to embark on a financial journey that couple either cripple your financial future or allow to be more wealthy than you thought possible. The key is going to that your money is position in the proper assets at the right time. Being long and short various assets like stocks, bonds, precious metals, real estate etc…

Follow Chris as we move through this global economic shift here .

How can we get everyone to raise prices of everything? That’s the key maybe?

If everyone raised prices equally all consumers would suffer equally. Generally inflation is created as the government increases the money supply so each dollar is worth fractionally less but then the government spends the increase. It’s rare that I hear someone say “I want my costs to go up”. Usually people here are complaining about prices going up more than what the government is reporting. Generally, falling prices are considered a good thing. The only ones who want inflation are debtors like the government who wants to be able to rip off their creditors (Bond holders) by paying off their debts with cheaper dollars.