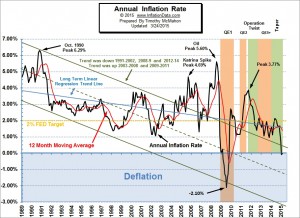

The Bureau of Labor Statistics (BLS) released the inflation statistics for the month of March on April 17th. Once again we have slight deflation on an Annual basis. The Consumer Price index (CPI-U) at the end of March 2015 was 236.119 while it was 236.293 at the end of March 2014. So overall prices are just a hair lower a full year later. That means there was -0.07% inflation and as we all know negative inflation on an annual basis is called Deflation. Because the BLS rounds all their results to one decimal place they have rounded it to -0.1% , which is what they said it was in January as well. Rounded to two places it is -0.09% for January, -0.03% for February and -0.07% for March which … [Read more...]

Deflation Watch: Key Economic Measures Turn South

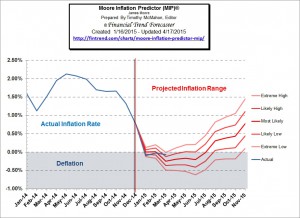

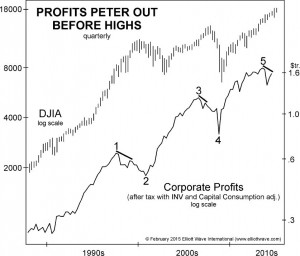

Last month (12 months ending January 2015) inflation dipped below zero resulting in an annual deflation of -0.09% rounded to -0.1% by the Bureau of Labor Statistics (BLS). The 12 months ending in February bounced up slightly to -0.03 but the BLS was able to round that up to Zero thus giving the impression that the deflation was over. But our Moore Inflation Predictor is saying otherwise. It indicates that we could be in for as much as 6 more months of deflation. And now the analysts at Elliott Wave International have found that several key economic indicators are also turning Bearish and confirming our deflation prediction. These key indicators include: Corporate profits, Retail and Food … [Read more...]

Deflation Almost Zero

The Bureau of Labor Statistics (BLS) released the inflation statistics for the month of February on March 24th. According to the official numbers there was neither inflation nor deflation for the 12 months ending in February. Technically that wasn't exactly correct. The Consumer Price index (CPI-U) in February 2014 was 234.781 and in February 2015 it was 234.722. So actually there was -0.03% inflation and as we all know negative inflation on an annual basis is called "the big D" or Deflation. However, since the BLS rounds all their results to one decimal place they have rounded it to zero, that is prices are essentially the same as one year ago. Now before you send me nasty-grams saying … [Read more...]

Deflation Days are Here Again

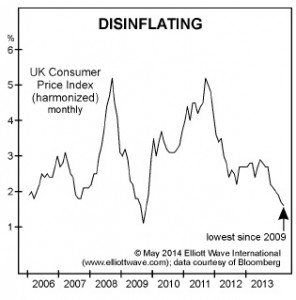

The U.S. Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI-U) data today for the month of January. The verdict was that inflation had fallen rapidly from 0.76% in December to a slightly deflationary -0.09% for the 12 months ending in January. This is the first time since 2009 that we have seen Annual deflation although there were several times during 2014 that we saw monthly deflation. Monthly deflation (annual disinflation) means that prices are slightly lower than they were last month but still higher than a year ago, which typically happens a few times every year (generally in the 4th quarter), but this year prices began falling during the summer, indicating … [Read more...]

Japanese Superman Meets Economic Kryptonite

Abenomics: From Faith to Failure Why the biggest monetary stimulus effort in the world did NOT stop deflation in its tracks By Elliott Wave International When Shinzo Abe became the Prime Minister of Japan in December 2012, he was regarded with the kind of reverence that politicians dream about. He was featured in a hit pop song ("Abeno Mix"), hailed as a "samurai warrior," and featured on the May 2013 The Economist cover as none other than Superman. But in the two short years since, Abe as Superman has been struck down by the superpower-zapping force of economic kryptonite. On November 17, government reports confirmed that Japan's brief respite from a 20-year long entrenched … [Read more...]

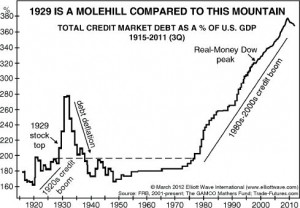

Deflation: The Last Argument of Central Banks

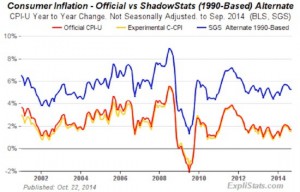

In today's article John Mauldin looks at "good" deflation vs. "bad" deflation, Austrian vs Monetarist vs Keynesian economics, causes of falling agricultural and manufactured goods prices, ShadowStats, hedonics, Asset Inflation Versus Price Inflation and more. ~Tim McMahon, editor Thoughts from the Frontline: The Last Argument of Central Banks By John Mauldin For a central banker, deflation is one of the Four Horsemen of the Apocalypse: Death, Famine, Disease, and Deflation. (We will address later in this letter why War, in the form of a currency war, is not in a central banker’s Apocalypse mix.) It is helpful to understand that, before a person is allowed to join the staff or board of a … [Read more...]

Europe is Teetering on the Edge of “Japan-Style” Deflation

Europe: The ONE Economic Comparison That Must Not Be Named... Was Just Named The Continent is now teetering on the edge of a "Japan-style" deflation. Here's our take on it. By Elliott Wave International It's happened. The one economic comparison Europe has dreaded more than any other; the name that's akin to Lord Voldemort for investors has been uttered: "deflation." And it's not just "deflation." You can still spin that term in a positive light if you get creative enough. Say, for example, "Falling prices during deflation actually encourage consumers to spend." But once you add the following two very distinct words, there's no way to turn that frown upside down. And those words … [Read more...]

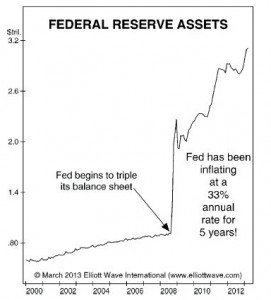

Why the Fed Does Not Control Inflation and Deflation

Although we may not always agree with Steve Hochberg's conclusions the following video contains some very thought provoking ideas accompanied by some charts that you probably haven't seen anywhere else. It's interesting to note the quadrupling of the FED's leverage over the years since 2008 and the amazing lack of inflation associated with it. Check out this excellent six-minute video clip by Elliott Wave International's Steve Hochberg... at the Orlando Money Show. Despite the Fed's leverage and its attempt to inflate throughout the economy, the deflationary pressures in the U.S. are overwhelming. Gain an Advantage Over 99% of U.S. Investors - in Just 15 MinutesYou can … [Read more...]

Deflationary Forces Overpower FED

Despite Bernanke's famous helicopter speech the FED's powers really are not unlimited. There is only so much they can do to stimulate the economy. After all they can't force people who are concerned about their future to borrow money. Just like a turtle people naturally recoil and pull back when times are uncertain. And even if they wanted to borrow bankers are reluctant to lend in uncertain times. This results in a phenomenon called Pushing on a String where no matter how hard the FED tries very little force is exerted on the economy. Robert Prechter believes that this is exactly what has been happening over the last few years where the FED has been trying to stimulate the economy but the … [Read more...]

Deflation Warning: Money Manager Startles Global Conference

History shows that the U.S. should pay attention to economies in Europe The economy has been sluggish for five years. There's no shortage of chatter about "why," yet few observers mention deflation. One exception is a hedge fund manager who spoke up at the recent Milken Institute Global Conference. The presentation by Dan Arbess, a partner at Perella Weinberg and chief investment officer at PWP Xerion Funds, was startling because of how deeply it broke from the standard narrative. We've been wrong to assume that the economic crisis is over, Arbess said. ... The threat of deflation is once again rearing its head. "The persistent risk in our economy is deflation not inflation," Arbess … [Read more...]