This is part 4 in the video series on the effects of Quantitative Easing by Chris Ciovacco the Chief Investment Officer for Ciovacco Capital Management. To see the other parts How the FED Prints Money, How the FED Prints Money – Part 2, How The FED Prints Money- Part 3 … [Read more...]

How The FED Prints Money- Part 3

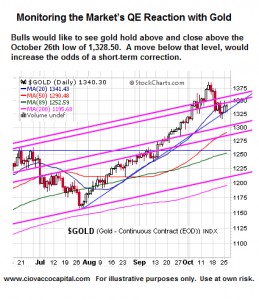

Last week we looked at who gets all the money the FED prints and before that we looked at the process the FED uses to get the money "Out of Thin Air" and into the hands of people who can spend it. Today we are going to look at what is "Quantitative Easing" well it sounds cool anyway... ~editor What is Quantitative Easing? Fed’s Perspective & Writings Part 3 in a 6 Part Video Series on Quantitative Easing A Wall Street Journal article (10/27/10) on quantitative easing (QE) hints the Fed will take a middle of the road approach in terms of the size and duration of QE2. As we would expect, the stock and commodity markets’ initial reaction is negative. A middle of the road … [Read more...]

How the FED Prints Money – Part 2

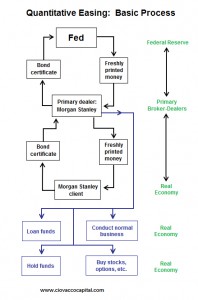

Yesterday we looked at the process the FED uses to get the money "Out of Thin Air" and into the hands of people who can spend it. In other words the "how" they do this magic. Basically, that route is through special dealers and then it goes into a few select hands. Today we are not going to look at the "how" but instead we will look at "Who" gets the money and where it is likely to go from there. Because if we know where it is likely to go we can get there first and profit from the incoming cash flow. ~Tim McMahon, editor Quantitative Easing (QE2): Who Gets the Fed’s Printed Money? Part 2 of a 6 Part Video Series on Quantitative Easing: In Part 1: How the FED Prints Money, we … [Read more...]

How the FED Prints Money

Printing Money: The process of "printing" money is always a kind of mystery to most people since only about 10% of the total money supply is actually in physical currency. Technically most of the money isn't printed so the term should be "money creation" or "money supply expansion" but "printing money" is used euphemistically to include all forms of expanding the money supply. The monetary base (or money supply) is typically controlled by adjusting monetary policy. This is usually done by the central bank (in the U.S. this is the Federal Reserve Bank or FED). The FED changes the monetary base through "open market transactions" (i.e., buying and selling of government bonds). The FED also … [Read more...]

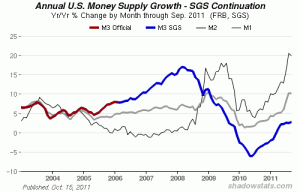

M3 Money Supply Numbers are Back- Sort Of

Back in March of 2006 I told you the U.S. Government was hiding something and that something was the growth in the money supply as measured by M3. Back then the Federal Reserve tracked and published the money supply measured three different ways-- M1, M2, and M3. Each of these three money supply measures track slightly different views of the money supply. The most restrictive, M1, only measures the most liquid forms of money; it is limited to currency actually in the hands of the public. This includes checking accounts travelers checks, and other deposits against which checks can be written. Of course the money supply is much bigger than that. What about savings accounts? M2 … [Read more...]

Understanding the FED

Protect yourself from the common and misleading myths about the U.S. Federal Reserve Over the years, occasionally I have received comments from subscribers about the SHAM of the FED and how U.S. Taxpayers are being swindled. And although I knew the truth of it, I was unable to shed any new light on the subject. Today our friends at Elliottwave have provided a new resource that will teach you everything you wanted to know – plus some things you might wish you didn't – about the U.S. Federal Reserve Bank. Since the Federal Reserve Act of 1913, the Federal Reserve Bank has been a secret, quasi-government agency. It's time to pull back the curtain on the Federal Reserve system. In … [Read more...]

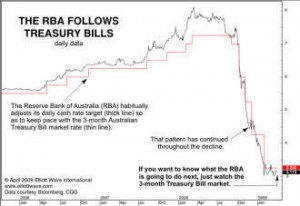

Do Central Banks Move the Markets?

Central Banks are like the giant gorilla of the investment world. Everyone thinks they can do anything they want. But can they? Or are they subject to the laws of the universe just like everyone else? They do wield a lot of clout for a day or so when a new announcement comes out but do they really have a lasting effect on the markets? In this article Mark Galasiewski of Elliott Wave International gives us a look at what the effect of the Central Banks really is. -- Editor Think That Central Banks Move the Markets? Think Again. By Mark Galasiewski The following is excerpted from Elliott Wave International’s Global Market Perspective. Conventional wisdom says that central banks can … [Read more...]