Inflation refers to the general increase in prices of goods and services over time. It is measured by the Consumer Price Index (CPI) which tracks changes in the prices of common consumer goods and services like food, housing, transportation, medical care, recreation, etc. High inflation reduces the purchasing power of money. So, with the same amount of money, people can buy fewer goods and services. This impacts businesses and consumers in multiple ways. For marketers, inflation directly impacts marketing budgets and strategies. Here’s a look at some of the key effects. Rising Media Costs During periods of high inflation, the costs of advertising and marketing channels tend to rise. … [Read more...]

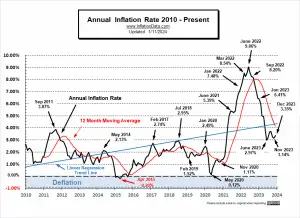

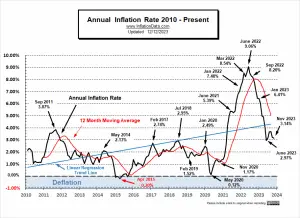

December Inflation Increases to 3.35%

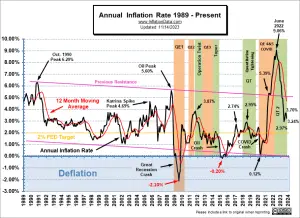

According to the Bureau of Labor Statistics CPI report released on January 11th, Annual Inflation was up to 3.4% in December from 3.1% in November. (but since we calculate it to two digits, it was actually 3.35%.) Monthly inflation was -0.04% in October, -0.20% in November, and -0.10% in December, But inflation is almost always low to negative in the fourth quarter of the year, so these numbers are not unusual. The BLS's Seasonally adjusted monthly rate for December was actually a positive 0.30% indicating that even though unadjusted was negative, it was not as negative as usual (making the adjusted numbers higher). The stock market was expecting another decline in inflation like … [Read more...]

Not All Prices Have Inflated Since 1964

Recently I came across a Newspaper ad from 1964 which coincidentally is almost exactly 60 years ago. So, I thought I would look up how much inflation we've had in the last 60 years. According to the U.S. Bureau of Labor Statistics (BLS), total inflation from November 1963 to November 2023 is 896.92%. So, $100 after adjusting for inflation is $996.92. Therefore, we would expect everything to cost about 10 times as much as it did in 1963. Note: We've used November 1963, and November 2023 because that is the most recent data from the U.S. Bureau of Labor Statistics. The advertisement that got me started on this trip down memory lane was for a 1964 RCA Color Television. In those days … [Read more...]

Worldwide Inflation by Country in 2023

Click for Larger Image Data Source Even though Argentina is in the news due to its high inflation rate it isn't the only country suffering from hyperinflation. It's not even the highest inflation... with Venezuela and Lebanon even higher. In this article, we will look at global inflation rates by country and inflation around the world as of November 2023. The World Inflation Rate The average inflation rate around the world is 11.1%. The global inflation rate surged from 4.35% in 2021, and 3.18% in 2020. Jump to: Top Hyperinflation Countries Inflation in Europe Countries with Deflation Low inflation Countries without Deflation Inflation in Asia Alphabetical … [Read more...]

November Inflation Mildly Disappoints Stock Market

According to the Bureau of Labor Statistics CPI report released on December 12th, Annual Inflation was down to 3.1% in November. (but since we calculate it to two digits, it was actually down to 3.14%.) Monthly inflation was 0.44% in August, 0.25% in September, -0.04% in October, and -0.20% in November, so it certainly looks like inflation is falling. But inflation is almost always low to negative in the fourth quarter of the year, so it could simply be an illusion. The stock market was expecting another significant drop like last month, so they were mildly disappointed, but the market was able to eke out a point or two of gains. We had been projecting a flat to slight rise for … [Read more...]

Does Inflation Increase Economic Output?

Keynesian economists would have you believe that inflation is beneficial because it encourages spending which boosts demand and consequently stimulates the economy. But "Austrian" economists disagree citing the fact that inflation deludes the public into saving less than they would have normally creating malinvestment. In today's article, we are reprinting an excellent response by Paul Vitols to a Quora question on this very topic. ~Tim McMahon, editor Does Inflation Increase Economic Output? By Paul Vitols The word inflation is used by different people to point to different things. The best definition of it, in my opinion, is “a general and continuous loss of the … [Read more...]

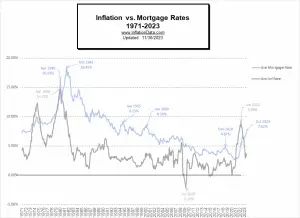

Inflation Adjusted Mortgage Rates

The interesting thing about borrowing money long-term is that inflation actually helps you repay the loan with cheaper money... At 7% inflation, prices double roughly every 10 years, which is only 1/3rd of the way through your 30-year mortgage. So, if your budget was stretched initially to make your mortgage payment, after 10 years (assuming your salary kept up with inflation) that same mortgage would only have half the impact on your budget. Thus, to get the true impact of mortgage rates, we need to adjust them for inflation. It has been a while since we addressed the issue of “Inflation Adjusted Mortgage Rates,” primarily because inflation and mortgage rates have been at historically … [Read more...]

October 2023 Inflation Shrinks

According to the Bureau of Labor Statistics CPI report released on November 14th, Annual Inflation was down to 3.2% in October. (but since we calculate it to two digits, it was actually down to 3.24%.) Monthly inflation was 0.44% in August, 0.25% in September, and -0.04% in October. So it certainly looks like inflation is falling. The stock market took this as a "positive surprise" and went on to rally. We had been projecting this decrease due to numerical anomalies for several months. Typically the 4th quarter has low or negative monthly numbers but October 2022 was very high thus the "surprise" as the new numbers were normal (i.e. much lower). Unfortunately, December holds the … [Read more...]

The Source of the Eurozone’s Economic Woes

In today's post, Daniel Lacalle looks at the problems plaguing the eurozone. He says their major problems aren't China, rate hikes, or the Ukraine war. Instead, he demonstrates that the curse of the eurozone is central planning. Subsidizing obsolete sectors and zombie firms, bloated government spending, and high taxes. ~Tim McMahon, editor The Eurozone Disaster: Between Stagnation and Stagflation The eurozone economy is more than weak. It is in deep contraction, and the data is staggering. The eurozone manufacturing purchasing managers’ index (PMI), compiled by S&P Global, fell to a three-month low of 43.1 in October, the sixteenth consecutive month of contraction. However, … [Read more...]

The Great Phony Disinflation

People are often confused about the difference between DEFLATION and DISINFLATION. Deflation is when prices are actually falling compared to last year, i.e., you will actually pay less for enough items to reduce your cost of living. It doesn't necessarily mean that everything costs less but enough items cost less to make the inflation rate negative. Disinflation on the other hand, simply means that the rate of inflation is slowing. This could be for as little as one month, i.e., annual inflation was 4% in May 2023 and then it was 3% in June 2023. That is a big disinflation. But it was 3.2% in July 2023. So there was no monthly disinflation but there was still disinflation over two months … [Read more...]