The FED's target yearly inflation rate in the U.S. is about 2%, but the long term average is more like 3% and depending on ongoing economic conditions, this rate can significantly increase, affecting the financial health of individuals across the country. Though keeping an eye on the economy can help you make decisions to brace against the impact of inflation, developing sound investments can help you protect your wealth no matter the rate. Take a look below for a few central items to consider when preserving your finances against inflation. Diversify your Portfolio Portfolio diversification is crucial for maintaining optimal financial health. Your investments should vary in asset class … [Read more...]

Navigating Economic Turbulence: How Inflationary Pressures Drive Payment Fraud Trends

This article is a bit beyond the scope of our typical article but is presented for those who want to delve into the murky waters of this issue. For a lighter look at scams and modern solutions, you might enjoy The Modern Day Wild West: Crypto Scams And Opportunities. ~Tim McMahon, editor. In an era of perpetually shifting economic landscapes, it is important for businesses and consumers alike to understand the nuances of inflationary pressures. As inflation distorts purchasing power, various vulnerabilities emerge and so fraudsters can exploit the emerging vulnerabilities, leading to sophisticated scams. Navigating these turbulent waters requires a keen understanding of the evolving … [Read more...]

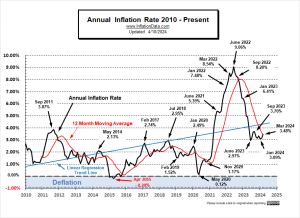

March Inflation Causes Market Concern

The U.S. Bureau of Labor Statistics CPI report released on April 10th, showed Annual Inflation was up from 3.2% in February to 3.5% in March. (but since we calculate it to two digits, it was actually 3.15% in February and 3.48% in March.) Monthly inflation was 0.62% in February and 0.65% in March. Typically inflation is highest in the first quarter of the year, so these numbers are a bit high but not that unusual. In March 2023 monthly inflation was 0.33%, so annual inflation jumped in 2024. Mr. Market didn't like the news because it drastically reduced the chances of a rate cut anytime soon. So, stocks fell on the release. The NYSE opened at 18,171.20 and that was the high for the … [Read more...]

Hyperinflation- How a Trickle Can Turn into a Flood

In 1903, a lawyer in Germany took out an insurance policy and made payments on it faithfully. When the policy came due in twenty years, he cashed it in and bought a single loaf of bread with the proceeds. He was fortunate. If he had waited a few days longer, the money he received would have bought no more than a few crumbs. Germany had been on the usual fractional reserve gold standard prior to World War I, with the Reichsbank—its central bank—expanding the money supply at a “mild” 1–2 percent inflation rate. When war broke out in 1914, the government followed the standard policy of deficit spending rather than attempting to raise taxes. The Reichsbank’s role was to monetize the … [Read more...]

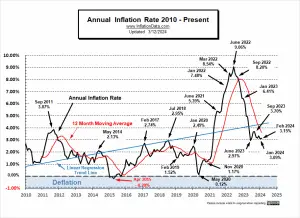

February 2024 Inflation Up Slightly

According to the Bureau of Labor Statistics CPI report released on March 12th, Annual Inflation was up from 3.1% in January 3.2% in December. (but since we calculate it to two digits, it was actually 3.09% in January and 3.15% in February.) Monthly inflation was 0.54% in January and 0.62% in February. Typically inflation is highest in the first quarter of the year, so these numbers are not that unusual. In January 2023 monthly inflation was 0.80%, so annual inflation was lower in 2024 but monthly inflation was "only" 0.56% in February 2023 so annual inflation increased in 2024. The BLS's Seasonally Adjusted Monthly rate for January was 0.3%, and 0.4% in February. As you can see … [Read more...]

Inflation, High Inflation, and Hyperinflation

The following article was written by Dr. Thorsten Polleit and was originally published in October 2022. Since then, inflation has come down significantly, but his analysis is still valid. Dr. Polleit is Chief Economist of Degussa Bank and an Honorary Professor at the University of Bayreuth. He also acts as an investment advisor. ~Tim McMahon, editor. Inflation, High Inflation, and Hyperinflation The word “inflation” is heard and read everywhere these days. However, since different people sometimes have very different understandings of inflation, here is a definition: Inflation is the sustained rise in the prices of goods across the board. This definition conveys that inflation … [Read more...]

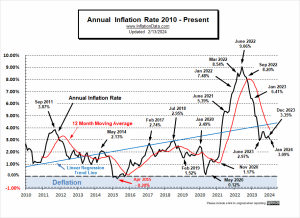

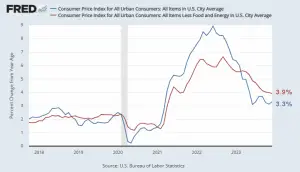

January 2024 Annual Inflation Down Despite High Monthly Inflation

According to the Bureau of Labor Statistics CPI report released on February 13th, Annual Inflation was down to 3.1% in January from 3.4% in December. (but since we calculate it to two digits, it was actually 3.09% in January and 3.35% in December.) Monthly inflation was -0.10% in December and 0.54% in January. But since inflation is highest in the first quarter of the year, these numbers are not unusual. But in January 2023 monthly inflation was 0.80%, so annual inflation is lower in 2024. The BLS's Seasonally adjusted monthly rate for January was 0.30%, the same as December 2023. As you can see from our MIP projection from last month, inflation was at the high end of our range. … [Read more...]

Industries Most Affected by Inflation: Insights from the Global Supply Chain

Inflation has rocked the world in recent years. The pandemic, global conflict, and dramatic changes in consumer spending caused inflation to spike to 11.1% worldwide before retreating. High inflation rates are, of course, bad for consumers. However, unpredictable inflationary pressures can also have a devastating effect on businesses. Entire industries suffered significant setbacks due to the supply-side issues that drove up costs and squeezed firms’ profit margins. Supply Chain and Inflation Understanding the link between the global supply chain and inflation is easy: when supply chains are distributed, supplier’s costs increase. As long as demand remains constant or grows, these … [Read more...]

Have Wages Kept Up with Inflation in 2023?

There seems to be a perennial debate about whether wages are keeping up with inflation. The media in particular loves to stoke this particular divide. We delved into this a bit in our article Not All Prices Have Inflated Since 1964 in which we showed that although wages in nominal terms haven't kept up for the "median" worker, but the "average" worker is doing better. This indicates that many workers are better off than in 1964, but not all (on a purely inflation-adjusted basis). Despite the numbers, purchasing power in many technology sectors has multiplied so many times and quality has increased so drastically that even though overall prices multiplied ten-fold, things like Televisions … [Read more...]

Inflationary Expectations Do Not Cause Inflation

Many economists believe that inflationary expectations cause general increases in prices. For instance, if there is a sharp increase in oil prices, people will form higher inflationary expectations that set in motion general increases in the prices of other goods and services. According to the former Federal Reserve chairman Ben Bernanke, “Undoubtedly, the state of inflation expectations greatly influences actual inflation and thus the central bank’s ability to achieve price stability.” Economists believe that if expectations could be made less responsive to various shocks, then over time this would mitigate the effects of these shocks on the momentum of the prices of goods and services. … [Read more...]