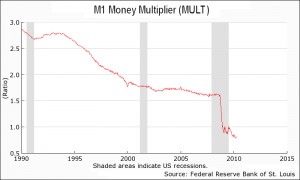

Banks have $2.5 trillion parked in "excess reserves". This is money on deposit with the FED. The FED pays a miniscule amount of interest on these reserves but the banks are willing to loan it to the FED because it is easy no risk income. But it is also the reason that the money multiplier is falling! And when the money multiplier is falling the FED has a very hard time increasing the money supply. So if the FED really wants to increase the money supply all it has to do is decrease the interest rate it pays on excess reserves and the banks will find some place else to deploy it. Which could trigger massive inflation. ~Tim McMahon,editor A Fed Policy Change That Will Increase the Gold … [Read more...]

Pushing on a String, Velocity of Money and Money Multiplier Conspire Against the FED

Under certain circumstances such as high national indebtedness, fear of bad economic times or when interest rates approach zero, monetary policy becomes ineffective in enticing consumers into spending more money. Economists refer to this as "Pushing on a String" because if the basic demand doesn't exist to induce people to spend money, it can't be forced through monetary policy. Prime examples of this are during the Great Depression in the United States and in Japan since the 1990s. And as Lacy Hunt explains we are once again facing this problem in the United States since 2008. ~Tim McMahon, editor Federal Reserve Policy Failures Are Mounting By Lacy H. Hunt, Ph.D., Economist The Fed's … [Read more...]

Money Multiplier

What is the Money Multiplier? In a fractional reserve system like we have here in the United States, money is loaned out by banks and by law they are only required to have a fraction of the amount they loan out. For example, they might be required to keep 10% in reserves. In other words, they may have $10 million dollars in deposits but because not everyone will come in to claim their dollars at once the bank may loan out $9 million dollars. But the multiplication doesn't end there. The $9 million will be deposited at another bank and that bank can loan out 90% of that or $8.1 million. And that will be deposited in another bank, who can loan out another 90% and so on. In our article, How … [Read more...]

How Wealth Can Simply Evaporate

In the following article Bob Stokes of Elliottwave explains why in times of credit expansion money is created out of thin air and in times of credit contraction money can simply disappear... no matter how much the government prints out of thin air. This results in a negative "money multiplier" as more money disappears than is created. See my article on Velocity of Money and the Money Multiplier for more information.~Tim McMahon, Editor Evaporation of Wealth on a Vast Scale How $1-million can disappear By Bob Stokes The bursting of the "debt bubble" which started in 2008 is far from over. It's the financial story of our age and it's happening before our eyes. The full scope is hard to … [Read more...]

Deflation or Inflation: Can Helicopter Ben Come to the Rescue?

Why the Fed Cannot Stop Deflation Countless people say that deflation is impossible because the Federal Reserve Bank can just print money to stave off deflation. If the Fed’s main jobs were simply establishing new checking accounts and grinding out banknotes, that’s what it might do. But in terms of volume, that has not been the Fed’s primary function, which for 89 years has been in fact to foster the expansion of credit. Printed fiat currency depends almost entirely upon the whims of the issuer, but credit is another matter entirely. What the Fed does is to set or influence certain very short-term interbank loan rates. It sets the discount rate, which is the Fed’s nominal near-term … [Read more...]

Which is Stronger- Inflation or Deflation?

By Tim McMahon, editor Why the Printing Press is No Match for Deflationary Forces- A mere two years ago (although it seems like a lifetime) in August of 2008, inflation was roaring in at 5.37% and the world was talking about hyperinflation. But then along came the housing crash which started the domino effect of deflationary forces. Housing prices, stock prices, asset prices all began falling; triggering margin calls and more liquidation until even Gold (the only investment that is not simultaneously a liability) began to feel the deflationary pressure. By July 2009 a mere 11 months later, everyone was no longer afraid of the inflation monster, but now they were fearing deflation. At … [Read more...]

Velocity of Money and Money Multiplier- Why Deflation is Possible

By Tim McMahon Back in 1924, John Maynard Keynes called gold a barbarous relic. There is a thought prevalent these days that deflation is the new barbarous relic. In a speech in November of 2002, Federal Reserve chairman Ben Bernanke said, “I believe that the chance of significant deflation in the United States in the foreseeable future is extremely small… I am confident that the Fed would take whatever means necessary to prevent significant deflation… the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities.” He went on to say, “the U.S. government has a technology, called a printing press (or, today, its … [Read more...]