Under certain circumstances such as high national indebtedness, fear of bad economic times or when interest rates approach zero, monetary policy becomes ineffective in enticing consumers into spending more money. Economists refer to this as "Pushing on a String" because if the basic demand doesn't exist to induce people to spend money, it can't be forced through monetary policy. Prime examples of this are during the Great Depression in the United States and in Japan since the 1990s. And as Lacy Hunt explains we are once again facing this problem in the United States since 2008. ~Tim McMahon, editor Federal Reserve Policy Failures Are Mounting By Lacy H. Hunt, Ph.D., Economist The Fed's … [Read more...]

BLS Recovering From Shutdown

The government shutdown is over and the U.S. Bureau of Labor Statistics is recovering from their unscheduled vacation. The United States federal government shutdown of 2013, lasted from October 1 to 17, 2013. Unemployment data for the month of September was due to be released on October 4th i.e. four working days into the shutdown. So the employment data is now scheduled for release on October 22nd. And the Consumer Price Index which is used to calculate the September inflation rate, which was scheduled for release on October 16th is now scheduled for release on October 30th. Although the shutdown inconvenienced vacationers wanting to see National Monuments and the National Zoo, did it … [Read more...]

What’s So Bad about Shutting the Government Down?

It all seems a bit silly. On Monday the National Park Service declared that the open-air Veterans Memorial would be closed during the shutdown. After all they have to prove there is some "pain" involved in shutting down the government. But a bunch of 80-90 year old veterans would have none of it and they tore down the blockades. So the park service made a 180-degree turn and declared their visits now constitute protected “First Amendment activity” . Basically they had no choice, what were they going to do? Shoot the old war heroes? Put them all in jail? It's like a bit of a joke. No their backs are against the wall, somehow they must impress on us common rabble how important the … [Read more...]

Taper Caper: The Consequences of Institutionalizing Q.E.

By Ben Hunt, Ph.D. Previously, we discussed the Bureaucratic Capture of the FED and the institutionalizing of QE. QE is adrenaline delivered via IV drip ... a therapeutic, constant effort to maintain a certain quality of economic life. This may or may not be a positive development for Wall Street, depending on where you sit. I would argue that it’s a negative development for most individual and institutional investors. But it is music to the ears of every institutional political interest in Washington, regardless of party, and that’s what ultimately grants QE bureaucratic immortality. It is impossible to overestimate the political inertia that exists within and around these massive … [Read more...]

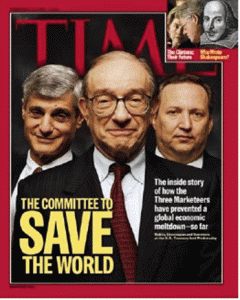

Taper Caper: Has the FED Been “Politicized” or “Captured”?

By Ben Hunt, Ph.D. Two things happened this week with the FOMC announcement and subsequent press conferences by Bernanke, Bullard, etc. – one procedural and one structural. The procedural event was the intentional injection of ambiguity into Fed communications. As I’ll describe below, this is an even greater policy mistake than the initial June FOMC meeting when “tapering” first entered our collective vocabulary. The structural event ... which is far more important, far more long-lasting, and just plain sad ... is the culmination of the bureaucratic capture of the Federal Reserve, not by the banking industry which it regulates, but by academic economists and acolytes of government … [Read more...]

The Mystery of the Missing Taper

Taper Caper: Conspiracy Theory Last Thursday, prior to the FOMC announcement, I was invited to come sit with another group of friends and traders everyone was sure there would be some type of tapering. That message had been clearly communicated to the markets. When the announcement came, the telephones went off and everyone erupted with various forms of surprise. I fully admit to being speechless. I kept waiting for some kind of explanation, and none came. The more we talked about it and the more I thought about it later, the more convinced I became that this was one of the more ham-handed policy announcements from the Fed in a very long time. Why would you go to the trouble of getting the … [Read more...]

How The Federal Reserve is Making Us Poorer

In today's article Lacy Hunt looks at the Federal Reserve's economic model and a few important questions regarding their policy, including, "How accurate have the FED's previous predictions been?" and "Has the Fed facilitated errant fiscal policies?" and "Is the Fed relying on an outdated understanding of how the macro-economy works?". He also shows how because of (not in spite of) FED actions, "real income of the vast majority of American households fell" and "worsened the income/wealth divide". In other words the FED has made us poorer. ~Tim McMahon, editor The Federal Reserve (FED) By Lacy H. Hunt, Ph.D., Economist In May 22 testimony to the Joint Economic Committee of Congress, … [Read more...]

The Case of the Disappearing Gold

When I was in the 6th grade (many, many years ago) my class took a field trip to New York City and visited the NY FED. The highlight of the trip for me was a ride down the elevator (or more precisely what was at the bottom. The ride took forever with dozens of kids and one security guard in that tight stuffy space. Anticipation built as we went down what seemed like miles into the earth where the vaults rested on Manhattan bedrock. And what was in those vaults? Gold! Lots of gold! Each vault had a name on it but not people's names, countries names. After all in those days people weren't allowed to own gold. For years now there has been a controversy as to whether our (the U.S.) Gold … [Read more...]

Rising Inflation vs. FED Tapering

Up until recently we rarely heard the word "tapering" but now it seems to be everywhere. Why? Because in June FED chairman Ben Bernanke floated a "trial balloon" and mentioned "tapering". By this he meant that he was considering slowly closing the faucet that is currently gushing easy money, i.e. $85 billion a MONTH. The stock markets promptly had a temper tantrum and Bernanke blinked and said, oh I was only kidding... I will eventually have to scale back but it won't happen any time soon... don't worry. He also said that the Fed's 6.5% target for US unemployment should be considered a "threshold, not a trigger" and that the FED would continue to support the economic recovery, "even as the … [Read more...]

The Effects of Tapering Off the FED’s Stimulus Program

Here's an economic irony for you. Less inflation means lower prices for you and I. However, to some who work for the Federal Reserve, that means things are off target and the economy still needs more work. Huh? What? It seems slightly fuzzy, but when you look at the larger macro-economic picture, things slowly start to come into focus. To a certain extent, inflation is actually good for the economy. The slow growth of inflation is one of many variables that is prompting speculation about whether or not the Federal Reserve should start tapering back its quantitative easing (stimulus) of the economy. Recent Inflation Drop Prompts Speculation In the May 2013 release of the April data, the … [Read more...]