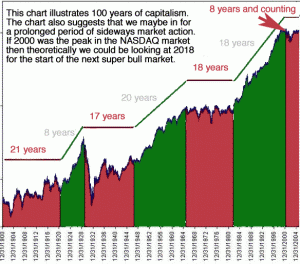

By Adam Hewison, President INO.com Regardless of what others might say, there is no quick fix for the economy. To illustrate this point, a friend of mine recently sent me a chart which I would like to share with you. This charts shows that we may be going into a prolonged period of no growth overall in the stock market. The NASDAQ peaked at 5,132.52 on March 10th, 2000. The NASDAQ market is in many ways more important than the DOW, and should be considered more of a leading indicator. If that is truly the case, then we have been in a bear market for the last eight years. … [Read more...]

Men Staring at Goats

What Hollywood can teach us about the Washington, DC establishment … and Obamanomics By Rob Carlson On November 3, 2009, a new movie opened in theatres, starring one of America’s favorite sons -- George Clooney. In the film, Men Who Stare At Goats, the government gathers and trains a group of people with “special” mental capabilities. These men of rare ability are to be trained as Top Secret… Psychic Soldiers. The film was, ostensibly, “based in a top-secret true story.” Employing their special “abilities,” these “Jedi” warrior monks would pass through walls, and see into the future. They would fight – not with guns, but with their minds. Directing their gaze at the enemy, they … [Read more...]

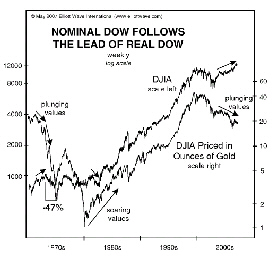

Stock Market vs. Gold

Editor's Note: Often people are skeptical about the Government's Inflation numbers and I frequently get questions like "Are they fudging the data?" And to some extent they might be. Since Gold is the original money and it is freely converted to cash, it is still a reasonable scale to gauge other prices against. If gold was a true inflation indicator, the gold price in dollars would progress steadily upward with very few downward periods and the inflation adjusted price of gold would be constant. Although this is not the case, never-the-less gold is a good scale to use for comparison purposes. So the following article on Gold vs. the Dow Jones Industrial Average is a good place to … [Read more...]

Deflation: Micro vs. Macro

Deflation By Joshua Burnett If you’re anything like me, one of the problems you run into when trying to convince someone that the hyperinflation scenario will occur is an argument that revolves around us currently being in a deflationary period. People (and those involved with the economy and stock market especially) have a hard time seeing looming hyperinflation (that might occur as soon as a year and a half away) when what they’re currently seeing is… deflation. But wait a second; how in the wide world of sports are we seeing deflation when we’ve been printing money like our lives depend on it? Let’s return to market fundamentals, and the ever-present difference between macro and … [Read more...]

What if They Stop Buying Our Debt?

By Doug Hornig, Senior Editor, Casey Research “I have always depended on the kindness of strangers,” said Blanche DuBois, in the final words of the play "A Streetcar Named Desire." Well, don’t we all. Many citizens probably still cling to the old saw that public debt doesn’t matter because “we owe it to ourselves.” Wrong. Debt always matters. And as for whom we owe it to, it is a lot of kind (or, at least, not yet unkind) strangers. As recently as 1970, foreign holders of U.S. debt were essentially non-existent. But their slice of our obligation pie has steadily increased, especially over the past two decades, until now foreign governments and international investors hold about 35% … [Read more...]

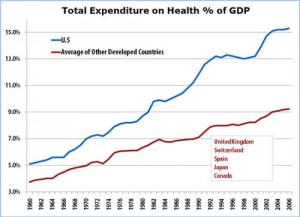

Healthcare Is Killing America

by Bud Conrad, Editor, The Casey Report Healthcare is the biggest segment of our economy. In the debate over who should pay for what or, increasingly, for whom, most people don't stop to understand just how large a portion of our society's money is dedicated to healthcare. For some perspective, as a share of GDP, the U.S. spends about twice that of other advanced nations. This is an important reason why the U.S. is increasingly uncompetitive in global manufacturing. It is, for instance, the most important factor (besides poor management) that General Motors and Chrysler are going bankrupt. Going forward, the situation is guaranteed to get worse. The Obama administration is committed … [Read more...]

How High will Gold Get?

By Jeff Clark, Editor, BIG GOLD Gold isn’t going to $2,000 an ounce. Before you gag on your coffee or suffer chest pains, allow me to explain. We’re about eight years into the bull market, and gold has breached the $1,000 level twice and has spent weeks trading above the old high of $850. Some observers are now saying that gold’s pretty much had its day and that once the recession is over, it will retreat for good. However, the four-digit gold price we’ve seen so far is with no price inflation to speak of, no effects of the atrocious increase in the money supply, and despite a rising dollar. What happens to gold when each of those pictures gets turned upside down – high … [Read more...]

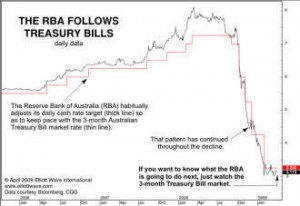

Do Central Banks Move the Markets?

Central Banks are like the giant gorilla of the investment world. Everyone thinks they can do anything they want. But can they? Or are they subject to the laws of the universe just like everyone else? They do wield a lot of clout for a day or so when a new announcement comes out but do they really have a lasting effect on the markets? In this article Mark Galasiewski of Elliott Wave International gives us a look at what the effect of the Central Banks really is. -- Editor Think That Central Banks Move the Markets? Think Again. By Mark Galasiewski The following is excerpted from Elliott Wave International’s Global Market Perspective. Conventional wisdom says that central banks can … [Read more...]

Why the Bailout Won’t Work

By Andrew Gordon The economy is now staring eyeball-to-eyeball with an activist U.S. government. It will legislate, reform, supervise, bully, give out money like cotton candy and get concessions in return. It will encourage technological development in environmental and other “future” industries. It will seek sources of energy other than the oil and gas we get from Mexico, Canada and OPEC. And it will put generous sums of money behind these initiatives. The Obama government emphatically does not want banks to sit on the money they get from the government. Nor do they want it to go to shareholders in the form of dividend payments. This is why I look for more companies to cut their … [Read more...]

The Inflation Beast is About to be let out of its Cage

By Andrew Gordon How bad is it going to get? Our reference point is the 1930’s and the Great Depression. But people in Russia and Asia only have to recall events of a little more than a decade ago. The “Asian Contagion” actually began in Russia in 1998 when the country defaulted on its national debt. The crisis then hit Thailand and within a year had spread to all of Asia with a few exceptions (Malaysia and China being the main ones). I had a front row seat. At the time, I ran a technology-transfer business in Southeast Asia and our central office was in Jakarta, Indonesia. For a while it looked like the crisis might skirt Indonesia. But it didn’t. And when it hit, it hit with a … [Read more...]