Taper Caper: Conspiracy Theory Last Thursday, prior to the FOMC announcement, I was invited to come sit with another group of friends and traders everyone was sure there would be some type of tapering. That message had been clearly communicated to the markets. When the announcement came, the telephones went off and everyone erupted with various forms of surprise. I fully admit to being speechless. I kept waiting for some kind of explanation, and none came. The more we talked about it and the more I thought about it later, the more convinced I became that this was one of the more ham-handed policy announcements from the Fed in a very long time. Why would you go to the trouble of getting the … [Read more...]

How States Stack Up

If you have ever considered moving to improve your income or lifestyle the following info-graphic might help clarify your choices. It covers median household income by state ( the yellow states have the highest median income and the orange states have the lowest). It also covers Housing costs, number of millionaires, poverty rate, well being index, employment rate, tax burden, minimum wage and GDP. By clicking on an individual state you can see all its results at once in the right hand column. See also: Cost of Living, State Employment and Unemployment Rates and Minimum Wages vs Unemployment. … [Read more...]

How The Federal Reserve is Making Us Poorer

In today's article Lacy Hunt looks at the Federal Reserve's economic model and a few important questions regarding their policy, including, "How accurate have the FED's previous predictions been?" and "Has the Fed facilitated errant fiscal policies?" and "Is the Fed relying on an outdated understanding of how the macro-economy works?". He also shows how because of (not in spite of) FED actions, "real income of the vast majority of American households fell" and "worsened the income/wealth divide". In other words the FED has made us poorer. ~Tim McMahon, editor The Federal Reserve (FED) By Lacy H. Hunt, Ph.D., Economist In May 22 testimony to the Joint Economic Committee of Congress, … [Read more...]

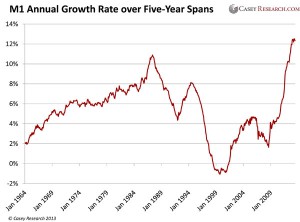

A Monetary Master Explains Inflation

Today we'd like to host a discussion between Terry Coxon, a senior editor of The Casey Report and David Galland, a partner in a research firm employing about 40 analysts. David says... Terry is my go-to guy. He cut his teeth working side by side for years with the late Harry Browne, the economist and prolific author of a number of groundbreaking books, including the 1970 classic, How You Can Profit from the Coming Devaluation. The timing of Harry's book should catch your eye, because his analysis that the dollar was headed for a big fall was spot on. Anyone paying attention made a lot of money. As coeditors of Harry Browne's Special Reports, Terry and Harry made a formidable team for … [Read more...]

Deflation Warning: Money Manager Startles Global Conference

History shows that the U.S. should pay attention to economies in Europe The economy has been sluggish for five years. There's no shortage of chatter about "why," yet few observers mention deflation. One exception is a hedge fund manager who spoke up at the recent Milken Institute Global Conference. The presentation by Dan Arbess, a partner at Perella Weinberg and chief investment officer at PWP Xerion Funds, was startling because of how deeply it broke from the standard narrative. We've been wrong to assume that the economic crisis is over, Arbess said. ... The threat of deflation is once again rearing its head. "The persistent risk in our economy is deflation not inflation," Arbess … [Read more...]

A Reader Question About IRAs and Gold Stocks

I recently got an excellent question from a longtime reader named Bob and I thought I would pass along some of what I told him. Bob has invested a good portion of his IRA in shares of Randgold Resources. The NASDAQ symbol is GOLD. Randgold Resources is a gold mining business based primarily in Mali. Its headquarters are in Jersey, the Channel Islands, it is listed on the London and the NASDAQ stock exchanges. Bob has been accumulating shares of Randgold because he feels that as a mining company it is a productive asset rather than physical gold (or paper derivatives of gold) which earns no interest (or dividends). Randgold peaked at around $127 back in October 2012 and has been trending … [Read more...]

Syria in the Throes of Hyperinflation

Living in the United States or other "stable" countries, we tend to think that Hyperinflation is a relatively uncommon event but that is far from the truth. In our post What is Hyperinflation? We list 26 instances of hyperinflation 11 of which have occurred since 1990. It seems that every couple of years there is another one. Even in the midst of deflationary pressures we have seen Zimbabwe (which ended in 2008), North Korea (2010-13) and now Syria. In Surviving a Hyperinflation we noted that "Hyperinflation only occurs in countries where the government has already broken down. Weimar Germany was mired in a social Civil War… Zimbabwe never had a working democratic government and the … [Read more...]

Inflation: America’s #1 Export

What’s America’s No. 1 Export? by Bill Bonner In 1950 the typical working man was able to support a family. Today he can barely support himself because the costs of his main expenses have gone way up. He has to work about twice as long to pay for a new car and a new house. Health care is worse. In 1950 the cost per person per year was about $100. According to the government’s numbers, prices today are about 10 times higher. So health care should cost about $1,000. Not even close. It’s $9,000. In 1950 the typical father earned about $60 a week. For a family of four, he had to work fewer than seven weeks to cover the year’s health care expenses. Today how much does he earn? We’ve … [Read more...]

The Case of the Disappearing Gold

When I was in the 6th grade (many, many years ago) my class took a field trip to New York City and visited the NY FED. The highlight of the trip for me was a ride down the elevator (or more precisely what was at the bottom. The ride took forever with dozens of kids and one security guard in that tight stuffy space. Anticipation built as we went down what seemed like miles into the earth where the vaults rested on Manhattan bedrock. And what was in those vaults? Gold! Lots of gold! Each vault had a name on it but not people's names, countries names. After all in those days people weren't allowed to own gold. For years now there has been a controversy as to whether our (the U.S.) Gold … [Read more...]

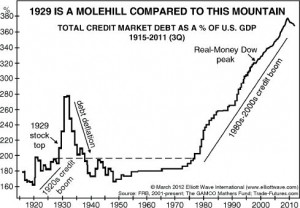

2 Types of Money

From the beginning, productivity improved with specialization. If one person can produce fruit more efficiently while the other was a better hunter, more wealth will be generated if the hunter hunts and the farmer farms. Forcing the farmer to hunt or the hunter to farm is just plain inefficient. But in order for the system to work there has to be a medium of exchange. Somehow the farmer has to be able to get the wild game in exchange for his crops. And what if the farmer wants meat but his crops aren't ripe yet? Well, that is how credit developed. In today's post Bill Bonner looks at mediums of exchange i.e. money and credit. He examines how they began and what they mean for us and our … [Read more...]