With interest rates still at record lows, many people are looking for alternatives to savings accounts. US Savings Bonds are a safe and smart investment choice. No other investment carries the full weight of the U.S. government. The U.S. Treasury Department guarantees investors will receive their full principle plus interest. Consider why purchasing savings bonds is an investment that can be made with confidence. US Savings Bonds: Conservative, but Smart Although savings bonds do not yield as much return as higher-risk investments, investors can rest easy knowing they will not loose their money. The financial downturn of the last few years has resulted in many Americans loosing large … [Read more...]

Gold and the Federal Reserve

Gold-US Dollar Link by Chris Vermeulen The $1800 per ounce level continues to be a major technical resistance area for gold. After hovering near $1800 recently, gold moved sharply away from that level last week to close at $1735 an ounce. Despite that, more fund managers and analysts continue to point to a bright long-term future for gold prices. John Hathaway of the Tocqueville Gold Fund says gold will reach new highs within a year. He based his forecast, like many others, on the fact that negative real interest rates look likely to persist as Ben Bernanke and the Federal Reserve continue to print money. Believe it or not, some mainstream analysts are also touting gold’s … [Read more...]

Civil Liberties Rest Upon Sound Money

Sound Money = Freedom Over the years I have written many times about the necessity of sound money to base our economy on and the results of wanton reckless money creation that will alway result in inflation and a worthless currency either sooner or later. I've told you about how inflation affects you, and how the Money Supply affects Inflation and Who Inflation Hurts the Most. I also spoken at length about the value of gold as the Timeless Inflation Hedge and how Gold is Still Money. Today, Wendy McElroy, author of The Art of Being Free shares a deep and fascinating research on all the main issues we face: the loss of security in the name of security, the state's role in strangling … [Read more...]

Will Greece Follow Iceland or Weimar Germany?

In Iceland the bankers were told to stuff it. In Weimar Germany they resorted to the printing press. Which model will modern day Greece follow?It seems that the words Weimar Germany and Hyperinflation are almost synonymous. The Weimar Republic (Das Weimarer Republik in German) is the name of the democratic government which was established in 1919 when Germany was defeated in WWI and Emperor Wilhelm II abdicated the throne. The problem came from the War repairations that were foisted upon Germany by the winners and the growing internal unrest which was allowing the Nazi's to gain a foothold. In an effort to pay their debts, promote full employment, and fight back against growing competitive … [Read more...]

What is the Significance of the Fiat Currency?

Last month in an article entitled What Is Fiat Currency? we told you that "Fiat currency is a term that is used to describe a currency which is created by “fiat” or “arbitrary order or decree” of the government." This month we would like to talk a little about the significance of Fiat currency. ~ Tim McMahon, editor. Fiat Currency Currency that is declared by a government to be a legal tender is referred to as a ‘Fiat Currency’. This type of currency owes its value strictly to the government’s acceptance of it for paying taxes and requiring its acceptance for "all debts public and private". It is not backed by reserves or any physical commodity and is defined as nonconvertible paper money … [Read more...]

The Biggest Commodity: The College Degree and Academic Inflation

The College Degree When we hear the term "valuable commodity" we might think about oil or gold. Yes, these are undoubtedly commodities (though their value has fluctuated over time), but many other less concrete objects are also considered commodities in our society today. A commodity is defined as "A raw material or primary agricultural product that can be bought and sold, such as copper or coffee." But the second definition is "a useful or valuable thing, such as water or time". Based on the second definition, one of the most valued commodities available in modern society is a college degree. While it may sound odd to refer to a diploma as a commodity, there's no denying that a college … [Read more...]

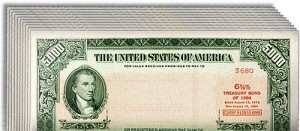

Should I Invest in Inflation Indexed Bonds?

The question of "Should You Invest in Inflation Indexed Bonds?" depends on your personal situation and the current inflationary environment. If you want to have a low risk investment that will keep up with inflation you might consider investing in inflation indexed bonds. Inflation Indexed Bonds When Inflation Rates are High, you might be worried about what's going to happen to your savings. Inflation series bonds are one option to consider. These unique investments have the ability to fight inflation and protect your savings from total devastation. Types of Inflation Indexed Bonds There are two different types of inflation indexed bonds issued by the U.S. Treasury one is called the … [Read more...]

What are T-Bills?

T-Bills Definition: Treasury bills (aka. T-Bills) are short-term debt obligations that are backed by the US government and which have less than a year’s maturity. They are sold in $1000 denominations and purchases can go up to 5 million. Commonly, T-bills come with 4-week (1 month), 13-week (3 month) or 26-week (six month) maturities. The issuing of T-bills is done by a competitive bidding process where the bids are placed on “discounts from par” which means that unlike in the case of conventional bonds with fixed interest rates, here, it is the bond appreciation that gives the holder his returns. For example, if you buy a T-bill with a 13-week maturity at $9,950. What happens here … [Read more...]

What You Need to Know About the Federal Reserve System

The Federal Reserve System If you saw the HBO movie “Too Big to Fail,” you may have the notion that the Federal Reserve System, commonly known as The Fed, deals with high level banking issues that have worldwide implications. And you would be right. But The Fed also regulates banking functions that affect individual Americans, ranging from regulating debit card overdraft fees and limiting gift card fees to issuing U.S. Treasury savings bonds. History of the Federal Reserve The Founding Fathers were cautious about establishing a central bank, thinking that it would encourage irresponsible borrowing by the government. As a result, America functioned without a central bank throughout the … [Read more...]

Beginners Guide to Gold Investing

Gold Investing 101- Precious metals, particularly gold, are a very common investment opportunity in our modern world. Gold has become extremely popular both as a hedge against inflation and currency devaluation and as a primary investment with historically solid returns over time. Many small-time or new investors are eager to invest in gold; however, the high prices and multitude of investment options can be overwhelming. Buying gold physically in the form of bullion or coins, trading for gold in the foreign exchange markets, or trading a variety of gold related stocks or mutual funds are all viable methods to invest in gold. Some of these methods can seem downright frightening for the new … [Read more...]