The College Degree

When we hear the term “valuable commodity” we might think about oil or gold. Yes, these are undoubtedly commodities (though their value has fluctuated over time), but many other less concrete objects are also considered commodities in our society today. A commodity is defined as “A raw material or primary agricultural product that can be bought and sold, such as copper or coffee.” But the second definition is “a useful or valuable thing, such as water or time”.

Based on the second definition, one of the most valued commodities available in modern society is a college degree. While it may sound odd to refer to a diploma as a commodity, there’s no denying that a college education is a “useful and valuable thing” in today’s society. As our economy continues to struggle and the job market is fiercer than ever, a college degree is one of the most valuable assets an individual can hold. See: How much difference does a College degree make in the unemployment level?

Based on the second definition, one of the most valued commodities available in modern society is a college degree. While it may sound odd to refer to a diploma as a commodity, there’s no denying that a college education is a “useful and valuable thing” in today’s society. As our economy continues to struggle and the job market is fiercer than ever, a college degree is one of the most valuable assets an individual can hold. See: How much difference does a College degree make in the unemployment level?

That being said, there is considerable concern over the topic of academic inflation and grade inflation in the world of higher education today. Credential Inflation: College Graduates Just Not Sizing Up

As our economy has continued to struggle, the issue of too many qualified applicants on the market has driven down the worth of a college degree. For the first time in decades (and possibly in history), a college education is no longer being looked at as an investment without risk. For years, a college degree meant a ticket to employment—not only employment, but decent employment. Sure, degree holders might have to suffer through a few entry level positions and pay might be low initially, but that college education always paid out in the end. Today, this isn’t exactly the case for every college degree holder.

Student Loan Debt

As student loan debt soars to the highest rates ever seen in history, investing in a college degree comes with risks that not all bright-eyed college hopefuls foresee. Jobs are scarce today. While numbers have been improving, there are still plenty of degree-holding college graduates struggling to find work that puts their degree to proper use. To make matter more complicated, these underemployed 20-somethings are paying exorbitant amounts in student loan debt at rates their coffee shop jobs don’t match. Not to sound like a broken record, but, to make matters even more difficult many recent graduates find themselves in a catch 22 of sorts.

With so many people young and old looking for work today, many new graduates looking for that first “real” job to propel them into the world of true adulthood are met with employers giving them the line that they “require more experience”. College graduates academically qualified for a position are told that they do not have enough professional experience. But, of course, the only way to gain experience is by landing the exact job at hand. The degree is required and necessary, while also being not quite enough. Everything else being equal, employers faced with the choice between a recent college graduate with no experience and a middle aged candidate with decades of experience in the working world will choose experience over academics.

Another element of this catch 22 is that college students spending the money on their degree to qualify them for a well-paying job are no considered “overqualified” for positions they were once perfectly suited for. Entry-level positions for first-time professionals are being filled by individuals in the job market not holding degrees (because they can be paid less). Degree holders are then forced to apply for jobs that require more experience than they have to offer. It’s a bit of an impossible situation.

College Degree No Longer a Golden Ticket

Of course, there are plenty examples of degree-holding graduates who land the decently paying job and, over the course of a decade or more, slowly dig themselves out of the student loan debt hole they find themselves in at graduation. No doubt this happens. But, with the state of the economy today and the number of open jobs several chain reactions have occurred. The college degree commodity has lost much of its value. Individuals are still better off earning a degree, but there is far more risk involved. With degrees no longer worth as much in the professional world today, more and more students are finding themselves out of work and headed back to the classroom. Many students who graduate and can’t find a job initially will head back to the only world they know and the only one they’ve found success in: the classroom. Graduate degrees hold even higher levels of risk. Your debt is even higher and you run the risk of being considered seriously “overqualified” for positions with a master’s degree.

College Tuition Inflation Plus Degree Inflation

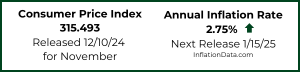

Colleges are constantly increasing their tuition rates. See: Sky Rocketing College Costs. In effect, the college degree costs more while being worth less—inflation. It’s a worrisome problem and something that takes time to resolve. In many ways, we, as a society, determine the worth of the degrees we produce. If employers continue to choose experience over academic qualifications, we can’t expect our youth to continue to value higher education. No doubt, with time, the economy will change. This is the nature of the game—value fluctuates, inflation jumps around, risk decreases, and so on. But, if we value our own educational system and our college degrees, we need to reflect that value in our economy and employment.

See Also:

- Education Inflation

- Credential Inflation: College Graduates Just Not Sizing Up

- Inflation Adjusted Education Cost Chart

- The US’s Education Bubble

- Education Inflation Way Above Consumer Price Index

Mariana Ashley writes about educational topics. She is passionate about all things education and loves using her writing to examine the state of academia today. You can reach her at mariana.ashley031@gmail.com.

Photo Credits: by CubanRefugee | College of Law Grads

Leave a Reply