By Tim McMahon

Define Inflation:

A simple way to define inflation is “an increase in the price you pay for goods” but that only tells part of the story…

It could also be seen as a “decline in the purchasing power of your money”.

But there is more to inflation than that. There are two sides to inflation “Price Inflation” and “Monetary Inflation“.

Jump to: Inflation Definition | Inflation Cause | Inflation Risk | Inflation Rate | Inflation Hedge

Price Inflation vs Monetary Inflation:

Technically, Price Inflation is when prices get higher or it takes more money to buy the same item and this is what people commonly think of when they hear the word inflation.

Technically, Price Inflation is when prices get higher or it takes more money to buy the same item and this is what people commonly think of when they hear the word inflation.

Monetary Inflation is an increase in the money supply which generally results in price inflation. This acts as a “hidden tax” on the consumers in that country and is the primary cause of price inflation.

Monetary inflation is commonly referred to as the government “printing money” although the actual process is a bit more complex than just cranking up the printing presses but the effects are essentially the same.

As the money supply increases the currency loses it’s purchasing power and the price of goods and services increases. In a large economy like that of the U.S. this process usually takes 18 months to 2 years so the government is able to spend the newly minted dollars at the old value before consumers realize that they have been cheated into accepting something that will purchase less than they originally thought it would. See How does the Money Supply affect our Inflation Rate?

Inflation is measured by the Bureau of Labor Statistics in the United States using the Consumer Price Index. See What is the Difference between Inflation and the Consumer Price Index?

What Causes Inflation?

There are a variety of different causes for inflation. The primary cause of macroeconomic inflation is an increase in the money supply. As “more money chases fewer goods” the price of the available goods is bid up. So simply increasing the money supply will increase prices. See Inflation Cause and Effect or watch the inflation and the money supply video.

A secondary cause that is generally more limited in scope and duration is a temporary shortage of goods either due to a natural disaster like Hurricane Katrina and Hurricane Sandy. In this type of situation the disaster has created a shortage of goods, but the supply of money has remained the same. And the demand for the goods is the same or even increased as rebuilding is necessary. So once again prices are bid up because there is more money than goods. But this situation is usually short lived as producers ramp up production to handle the increased demand or in the case of a localized disaster, producers may ship goods in from unaffected areas. Weather can also cause localized crop failures which can drive up prices but this has become less of a problem as food production and distribution has become more globalized.

A third cause of inflation could be the effects of an organized cartel that is purposely restricting supply and artificially raising prices. This only works as long as the cartel maintains a monopoly. Economic theory tells us that if prices are raised it will encourage competitors to enter the business and eventually drive prices back toward the cost of production. But if the producers collude together they can raise prices by restricting supply. This happened in the 1970’s as OPEC agreed to limit oil production in an effort to raise Oil Prices. The effectiveness of this type of price manipulation depends on the unity of the cartel because as prices rise there is more incentive to “cheat” on production quotas. Thus other members of the cartel bear the cost of restricting supply while the individual gets the benefit of increased sales at a higher price. Thus most cartels are generally only successful in the short run. The one notable exception is the DeBeers Diamond Cartel.

Currency exchange rates can have some effects on the price of imported goods but generally they are a function of the money supply in the country (if they are allowed to fluctuate on the open market). In other words, if a country like Zimbabwe or Venezuela prints lots of money their currency will devalue in relation to other currencies. Making their products cheaper on the world market. At first this doesn’t make sense but think of it this way: A Venezuelan produces a vase that he is willing to sell for 100 bolívar. When the exchange rate is 1 to 1 that vase will cost an American $100. But if the exchange rate drops to 100 to 1 it will only cost the American $1. The problem is that prices will probably rise in Venezuela and the next vase will have to be sold for 10,000 bolívar. Another problem arises when the government tries to set the exchange rate or institutes price controls which results in economic distortions, shortages and a rise of the “Black Market” i.e. the free market.

See:

- How International Inflation and Currency Fluctuations Affect Todays Businesses

- Venezuelan Time Capsule

So from a macroeconomic point of view the only cause of long term inflation is an increase in the money supply, since the other causes are self-limiting and of limited duration.

Inflation Risk

The primary risk in inflation is that your purchasing power will be eroded during the time that you hold the money. In other words, you will be able to buy less. If you work one hour and expect to be able to buy one toaster with the money you receive from your labors but you don’t need a toaster at the moment you expect your money to retain its value so you can buy that toaster at a later date. The primary risk of inflation is that the longer you hold those dollars the less they will buy. So after a year that money that used to buy a toaster will now only buy 90% of a toaster or 50% of a toaster. The higher the inflation rate, the faster the purchasing power decreases. And consequently the quicker people want to unload this depreciating asset. Better to buy the toaster now, even though you don’t need it at the moment, rather than wait and have to spend more money later. This causes people to spend money faster and faster the higher the inflation rate goes. The speed at which people unload their money is called the velocity of money.

Definition of Inflation in Economics

However, it appears that the meaning of the word inflation has changed over time. Let’s look at how to define inflation and how the definition has changed and what that actually means to you the consumer.

Webster’s 1983 Definition of Inflation

According to Webster’s New Universal Unabridged Dictionary published in 1983 the second definition of “inflation” after “the act of inflating or the condition of being inflated” is:

“An increase in the amount of currency in circulation, resulting in a relatively sharp and sudden fall in its value and rise in prices: it may be caused by an increase in the volume of paper money issued or of gold mined, or a relative increase in expenditures as when the supply of goods fails to meet the demand.

This definition includes some of the basic economics of inflation and would seem to indicate that inflation is not defined as the increase in prices but as the increase in the supply of money that causes the increase in prices i.e. inflation is a cause rather than an effect. But…

Webster’s 2000 Definition of Inflation

The American Heritage® Dictionary of the English Language, Fourth Edition, Copyright © 2000 Published by Houghton Mifflin Company says:

Inflation: A persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money, caused by an increase in available currency and credit beyond the proportion of available goods and services.

In this definition, inflation (rising prices) would appear to be the consequence or result, rather than the cause.

Shifty Words

So between 1983 and 2000 the definition appears to have shifted from the cause to the result. Also note that the cause could be either an increase in money supply or a decrease in available goods and services.

Other Definitions

Webster’s Revised Unabridged Dictionary, © 1996, 1998 MICRA, Inc., Relegates Price Inflation to number 3. and says:

Undue expansion or increase, from overissue; — said of currency. [U.S.]

WordNet ® 1.6, © 1997 Princeton University, has a witty definition that says:

inflation 1: a general and progressive increase in prices; “in inflation everything gets more valuable except money” [syn: rising prices] [ant: deflation, disinflation]

According to investorwords.com

The overall general upward price movement of goods and services in an economy, usually as measured by the Consumer Price Index and the Producer Price Index; opposite of deflation.

From this page we can see that even Dictionaries don’t agree on the definition of inflation and economists continue to argue over its primary cause. Although it is generally agreed that economic inflation may be caused by either an increase in the money supply or a decrease in the quantity of goods.

Therefore it should be equally obvious that falling prices will result from a decrease in the money supply or a rapid increase in the quantity of available goods. Recent years have seen a virtual explosion of inexpensive goods produced in China and other former Communist Countries. So it is no wonder that we in the United States see falling prices rather than the effects of inflating the money supply in our economy. The opposite of inflation is Deflation.

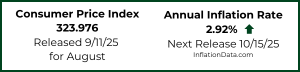

Inflation Rate

The inflation rate is generally measured on a percentage basis in annual terms. In other words, the percentage increase of prices over the previous year. So if something cost $1.00 a year ago and costs $1.10 now there has been 10% inflation. See How Do I Calculate the Inflation Rate? for more information.

You may also want to compare the Cost of Living between two cities you can use our Cost of Living Calculator.

Inflation Hedge

An inflation hedge is a method of protecting yourself against the effects of inflation. So if you would like to buy something a year from now but want to protect your purchasing power in the mean time you might purchase an “inflation hedge” commonly inflation hedges are commodities under the assumption that if paper money is depreciating then physical commodities will be appreciating. Typically precious metals like gold and silver are considered the best inflation hedges because they are easily transportable, divisible, and readily accepted. See Gold the Timeless Inflation Hedge.

Occasionally, other commodities can be used as an inflation hedge. If you are hedging large investments Oil might serve as an inflation hedge. During times of HyperInflation such as that of Weimar Germany people would buy any commodity they could get their hands on such as soap, matches, teacups, whatever… assuming that anything was better than holding on to money that would be worthless shortly. Once they had a commodity they could exchange it with someone else for what they actually needed.

Jump to: Inflation Definition | Inflation Cause | Inflation Risk | Inflation Rate | Inflation Hedge | Price vs Monetary Inflation- Top

See Also:

- Inflation Definition

- What is Core Inflation?

- What is Deflation?

- What is Disinflation?

- What is Agflation?

- What is Stagflation?

- What is Hyperinflation?

- What is Quantitative Easing?

- What is the Velocity of Money?

- Inflation Adjusted Oil Prices (Chart)

- Inflation Adjusted Oil Prices (table)

- Which is Better High or Low Inflation?

- What is the Difference between Inflation and the Consumer Price Index?

Image courtesy of sscreations / FreeDigitalPhotos.net

Inflation is simply putting too much money into circulation therefore inflating the value..

Here is an interesting exception. A rise in the price level can result from a decrease in the amount of money in circulation as well as from an increase in the amount of money in circulation. We usually think of more money causing the demand for goods — money bidding for goods — to increase raising the price, and we picture the downward sloping demand curve shifting to the right. But less money can force firms out of business increasing monopoly power, but more than that, less money in circulation means fewer sales for a firm which means that fixed costs — rent for building, debt owing, long term labor contracts — fixed costs have to be paid for out of fewer units sold, which means that the price per unit must be raised to cover costs, selling fewer at higher price. In my opinion, the low inflation of prices (actually the price level, the price indexes) is really monetary deflation causing the supply — think of the the upward sloping supply curve of goods in each market for goods — to shift to the left, which raises prices. So to answer your question I would define inflation as an increase in money in circulation which may cause either a price increase or a price decrease. Does that make sense to you?

what are the impact of inflation on economic development

Good Question! High inflation can stifle economic development because it adds uncertainty to the equation businesses don’t know how much their investment will produce. Also they will be investing valuable dollars now and getting back less valuable dollars later. This also makes banks less likely to lend money so projects only go ahead when the business has the money to do it themselves and are willing to take the risk.

Low inflation on the other hand makes people and businesses feel richer and so they may be more likely to invest in projects but this could result in uneconomical projects being undertaken and so once again money is not used in the most efficient way.

By definition, inflation is a general lowering of the value of money. Although almost never remembered, this of course means that also the price of labor goes up. (= Salaries go up.) A situation with only increased prices for goods but not for labor is not inflation but a consequence of e.g. dearer imports or lowered productivity.

Nick, You are absolutely correct. Price Inflation caused by monetary inflation should affect wages (the cost of services) as well as the cost of commodities. Unfortunately it doesn’t mean just adding a zero to the price of everything. Wages have a time lag built in i.e. you don’t get a raise until the end of the year or the next time your contract is renegotiated. So rising commodity prices have a while to take a bite out of your lifestyle before you get your raise. Wages go up in a stairstep fashion while other prices are steadily climbing so you are always a bit behind. Also your raise may depend on many factors so not everyone gets a raise equal to the inflation rate.

It is worth pointing out that not everyone is on a wage; when we teach inflation one of the first things we want students to grasp is that if, as a worker, you have leverage of your employer (e.g. skills in short supply) you will get that wage rise. If you are a pensioner, it all depends… Taking it a step further, in a “gig” economy, each contract is individually negotiated, and it may be harder for the suppliers of labour to convince the purchasers to pay more.

Inflation is a word that never should have been accepted as meaning an increase in the price level. Inflation is in increase of money and loan deposits (loans, “credit”) immediately liquid for circulation. The reason why we can’t also call a price increase “inflation” is because an decrease in money in circulation (deflation — negative inflation) can cause a INCREASE in prices as easily more money can. The tendency for a price level increase from deflation comes from two sources. 1) Less money in circulation results in less sales for producers — which means fewer units sold, which forces a cutback in output — a shift of the supply curve to the left, which raises prices. Each firm has to raise price to cover fixed costs per unit sold. Also firms are driven from business from want of sales, adding to monopoly concentration and therefore monopoly pricing power.

Question: With regards to the definition of inflation, is the population factored into this calculation? If there are more people today in the United Sates than there were in say the 1960’s, then it seems the per capita availability might be a new variable not previously considered in formulas including inflation. Is this a fair assessment or is this already accounted as a factor?

Ted,

I don’t think population has a major effect on inflation. Prices are a function of the availability goods demand for goods and the money supply. If over night half the population of the world died the demand for goods would be halved but the supply would stay the same. But as a gradual increase in the population manufacturers only produce what they know they can sell so it tends to balance out in a relatively short time.

Prices (or the ultimate cost of production) are certainly not functions of availability and demand, as ostensibly sustained by the money supply.

An implicit obligation to sustain a vital circulation of some remaining principal, from which we are artificially obliged (by an obfuscation of our promissory obligations) to pay *all* remaining principal *plus interest*, ultimately a deflationary outflux which exceeds influx to return to circulation, either by unwarranted assimilation of our production by a banking system which does not even give up commensurable consideration in a purported creation of money which obfuscates our promissory obligations to each other into falsified debts to a banking system which no more than publishes further representations of our promissory obligations to each other — or this exceeding deflationary outflux returns otherwise by re-borrowing what we are paying out of our general possession.

Thus a vital circulation sustained by the latter (with the former certainly being unjustifiable) precipitates in a perpetual escalation of falsified debt (“maldisposition”) in which principal returns to circulation as new debt, equal to the former sums of falsified debt we might otherwise presume to be resolved (thus making it mathematically impossible impossible to pay down prior sums of falsified debt); whereas unwarranted interest (on principal which isn’t even the rightful possession of such a banking system), perpetually re-borrowed to reflate a vital circulation (so long as possible), therefore perpetually increases every prior sum of falsified debt by so much as periodic interest on an ever greater sum of falsified debt, until we inevitably succumb to the present terminal sums of falsified debt.

As I explained to my high school economics instructor then, all along the way to that inevitable failure, ever more of every unit of circulation is dedicated to sustaining the escalation of falsified debt, as opposed to sustaining the industry and commerce which are artificially obliged to do so.

Furthermore, circulatory inflation (originally and traditionally defined as an increase in circulation *per* “goods and services”) is impossible, where debts are merely collateralized.

We have never suffered a circulation inflated beyond the value of monetized property. On the contrary then, circulatory inflation cannot be the cause of price inflation; rather, irreversible multiplication of falsified debt (“maldisposition”) thus remains as the only prospective cause of *price* inflation.

There has never been, nor can ever be a formal proof that prospective circulatory inflation causes price inflation — however much recent obfuscation of the traditional definition of circulatory inflation might merely claim so.

Nonetheless, however much a purported economy may be subject to such natural tendencies to balance supply and demand, actual balance is impossible under “banking’s” obfuscation of our currency — merely because maldisposition dedicates ever more of a circulation to servicing an irreversible proportional escalation of falsified debt, *until* the escalation exceeds the remaining capacity to service the escalation *and sustain* artificially obliged industry — destroying any further credit-worthiness to sustain a vital circulation in the process.

As a matter of fact, I provided the 1983 and 1984 Reagan Administrations with computer models which calculated then that this irreversible multiplication of falsified debt (“maldisposition”) would precipitate in terminal sums of falsified debt at approximately 2010 AD.

More people affect the Fisher equation MV = PQ in two immediate ways — as added producers they increase Q (if they can get hired) and as added consumers they increase P. If P and Q both rise, and if velocity is more or less locked in to institutional practices (paychecks every two weeks, tax withholding etc.) — then we see that M must have risen. But what if M is not allowed to rise — then both P and Q cannot rise together.

I’m not sure it is the Fed’s influence. Maybe it is just the dumbing down of our educational system. In the “microwave generation”- all that matters is the end result- people aren’t interested in what caused it anymore. Too much trouble to think for ones self just take the koolaide (or Ritalin) and be quiet.

Finally, someone with some common sense! I had this conversation with my father a few years ago before he passed on. He spent his entire career in the finance and banking industry. When I first told him of Irwin Schiff’s definition of inflation, my father rebuked me, saying that inflation was a rise in prices. As you mentioned, he had switched cause and effect. He finally got out one of his old college textbooks and looked up the definition from the 1940s era. He came back to me and agreed that inflation is, indeed, any increase in the money supply?

Why are today’s economists so out of touch with reality? Do you believe it is the Federal Reserve’s influence on banking that has created this imbalance? That’s my theory. Maybe you have another.