People are often confused about the difference between DEFLATION and DISINFLATION. Deflation is when prices are actually falling compared to last year, i.e., you will actually pay less for enough items to reduce your cost of living. It doesn't necessarily mean that everything costs less but enough items cost less to make the inflation rate negative. Disinflation on the other hand, simply means that the rate of inflation is slowing. This could be for as little as one month, i.e., annual inflation was 4% in May 2023 and then it was 3% in June 2023. That is a big disinflation. But it was 3.2% in July 2023. So there was no monthly disinflation but there was still disinflation over two months … [Read more...]

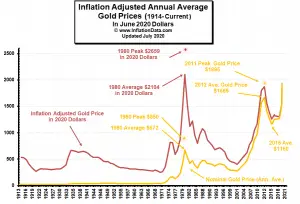

3 Factors Causing the Current Gold Rally

A variety of factors affect the price of gold. Currently, many of them are combining to drive the price of gold to all-time record highs. Let's look at a few of the factors that affect the price of gold. 1) Uncertainty- Gold is a Crisis Hedge We have said this many times over the years but it bears repeating again gold is more of a crisis hedge than an inflation hedge. When uncertainty rears its ugly head... gold does well. That uncertainty can take many forms and one of them is "monetary uncertainty". So if people don't know what the value of their money is going to be in the future (i.e. inflation) they will shift some of their assets to gold (driving up the price of gold). So as far as … [Read more...]

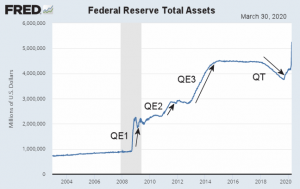

Inflation Expectations and the Massive Fed Stimulus

Inflation is loosely described as a general economic state of rising prices. In February 2020, the US inflation rate dipped from a high of 2.5% in January, to 2.3%. Assuming the standard of steadily increasing prices, driven largely by food, fuel, and living expenses, one can expect the inflation rate to tick higher. Forecasts for April 2020 are at 1.7%. Given that the major drivers of inflation are excess demand (demand-pull inflation), or cost-push inflation, current conditions based on Coronavirus quarantines have created a murky demand climate. Oil Prices and Inflationary Expectations All major US indices, including the Dow Jones Index, have plunged precipitously. Stock portfolios … [Read more...]