Biflation is a relatively new term coined by Dr. F. Osborne Brown, a Senior Financial Analyst for the Phoenix Investment Group in 2003. It is sometimes referred to as "mixed inflation" but it basically refers to a condition where both inflation and deflation occur at the same time. This seemingly contradictory situation is not a real a paradox but simply appears to be one as a result of faulty logic. The problem results from thinking that all prices rise in lock-step in times of inflation but this is clearly not the case. It is quite common for electronics to be declining in price (deflation) while oil and gas are increasing in price. Thus we have "mixed inflation" or "biflation" however … [Read more...]

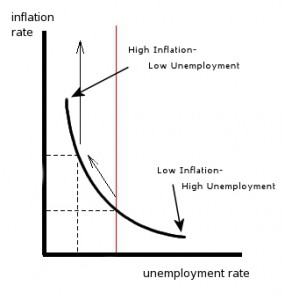

What is the Phillips Curve?

The Nature of the Phillips Curve The Phillips Curve is an economic concept was developed by Alban William Phillips and shows an integral relationship between unemployment and inflation. Phillips began his quest by examining the economic data of unemployment rates and inflation in the United Kingdom. He tracked the data over business cycles, and found wages increased at a slow rate when unemployment was high, and faster when the unemployment rate dropped. Business cycles are basically economic activity over a lengthy period of time. Originally, business cycles were thought to be predictable, but they have since proven themselves to be irregular in the areas of duration, frequency and … [Read more...]

What Does 8% Inflation Really Mean?

By Dennis Miller Eight percent is not good news. In my latest article I shared some reader feedback from our inflation survey, and in case you missed it, the Money Forever Reader Poll Inflation Rate is 8%. But what does that number really mean for us – seniors and savers trying to protect our buying power? It's time to read the tea leaves and find out. Up to Your Ass in Alligators You may remember the old poster that read, "When you are up to your ass in alligators, it's tough to remember the goal was to drain the swamp." You may have felt overwhelmed during the last few years, as the investment options for your retirement portfolio changed. You might read about the benefits of gold … [Read more...]

Could a Raise in Minimum Wage Trigger Inflation?

Here at Inflation Data we believe that all other things being equal the primary cause of inflation is an increase in the money supply, i.e. "too much money chasing too few goods." But raising the minimum wage may cause other distortions that will have an effect on the economy so that one simple stroke of a pen can still have a major impact. ~Tim McMahon, editor The Law of Unintended Consequences When the Government increases the minimum wage that employers need to pay to their employees, does it cause more problems later? The Government speaks of a raise as a good thing for the economy in order to boost sales (through more disposable income for the poor) and help low-income families pay … [Read more...]

Sequestration, Currency Wars, Inflation and Ben Bernanke

By Douglas French Laissez Faire Club Only in government speak can more = less We thought for sure the shrill cries of Sequestration hell, fire and brimstone were going to get Congress to hit the panic button and reach a deal. As such, they didn't. And while sequestration takes effect, we'll leave you with this one thought: even though $85 billion is getting "cut" from the federal budget... the government is still going to spend $15 billion more than they did last year. $85 Billion Cut = $15 Billion More Spending In the meantime, Doug French treats us to a look behind the curtain: Ben Bernanke an inflation hawk? Read on... Benny and the Monetary Jets "My inflation record is the … [Read more...]

The Impact of Inflation on Savings

The obvious impact of inflation on your savings is that the purchasing power is erroded. This means that if you stash $100 under the mattress today and inflation is 3% per year when you come back a year from now your $100 will buy 3% less stuff. Put another way you would need $103 to buy the same amount of goods a year later. When you extend this to 10 years you might think that it would mean that you would need $130 to buy the same amount of goods but because of the effects of compounding you would actually need $134.39. You can use the Retirement Planning Calculator to calculate the impact of inflation on your savings. As time goes on the impact of "only" 3% inflation compounds making … [Read more...]

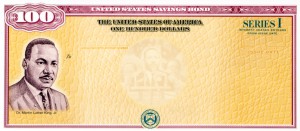

Worried About Inflation – Consider Inflation Indexed Bonds

Inflation-Indexed Bonds (aka i-Bond)- Although inflation is currently low it is still a key concern for investors, because with interest rates at record lows and the FED promising to keep them there for the foreseeable future even a small uptick in inflation can prevent an investor from achieving a real return on investment, as returns on investment fail to beat inflation rates. If a return on investment fails to beat inflation, then in real terms you have not earned any money. You may have a larger figure for your total net worth, but in terms of purchasing power this will earn you less as the costs of living increased at a higher rate. On target Inflation is currently tracking at … [Read more...]

Inflation’s Effect on Retirement Savings

Inflation and Retirement The stock market crash of 2008 may have left you feeling a little nervous about investing your money in the market. The fear of losing everything to another recession or depression has caused many people to make “safer” investment choices, and some people aren’t even investing at all, choosing to place their money in a “high yield” savings account, instead. Unfortunately, "high yield" these days is still lower than the rate of inflation, causing you to actually lose money. Inflation Worse than a Crash Losing your money to inflation is actually much scarier than losing your money to a stock market crash. Stock market crashes are rare, but inflation is inevitable. … [Read more...]

Australia- Iron Ore, Housing and Unemployment

Speculation Mounts Over RBA October Meeting As the RBA heads towards it October meeting, there are a number of important issues on the agenda. The price of iron ore which was one of the major topics of the September meeting have now seen a 26% resurgence in price and the world’s fourth biggest exporter of iron ore, Fortescu Metals, has announced that its US$4.5-billion debt deal will now enable it to refinance any outstanding deals. The central banks in Europe and the United States have announced their intentions to fight off inflation and stimulate asset prices by printing unlimited money while China will be contributing a $150-billion package to the mix. Unemployment Despite … [Read more...]

Why Gold is a Good Investment for Inflationary Times

The Impact of Inflation on Savings If you keep your money in the bank or in money market funds, inflation can eat away at their value. Inflation can be deceiving because your account balances won’t go down. However, when you take your money out to buy something, you might notice that you won’t be able to buy as much as you used to. Therefore, if you don’t put your money into something that keeps up with inflation, you’ll soon find your savings won't buy as much. As an investor, you need to be prepared for the risk of inflation. It happens when there is too much money chasing too few goods, so prices have to go up (because of an increase in the money supply). When the economy is facing … [Read more...]